Market Data

Market data is the magic behind the appraisals and pricing platforms. It enables you to look at real market data for vehicles similar to the one you're appraising or advertising and evaluate where you should buy and price your vehicle in order to be competitive and make money.

During your acquisition, appraisal, merchandising, and advertising processes, you should look at the market data in order to understand what the market currently looks like for your vehicle.

- What price are other vehicles advertised at?

- What price are they coming off the market at?

- How many are advertised?

- What is the supply and demand like for this vehicle? Market Days Supply

Use in Acquisition

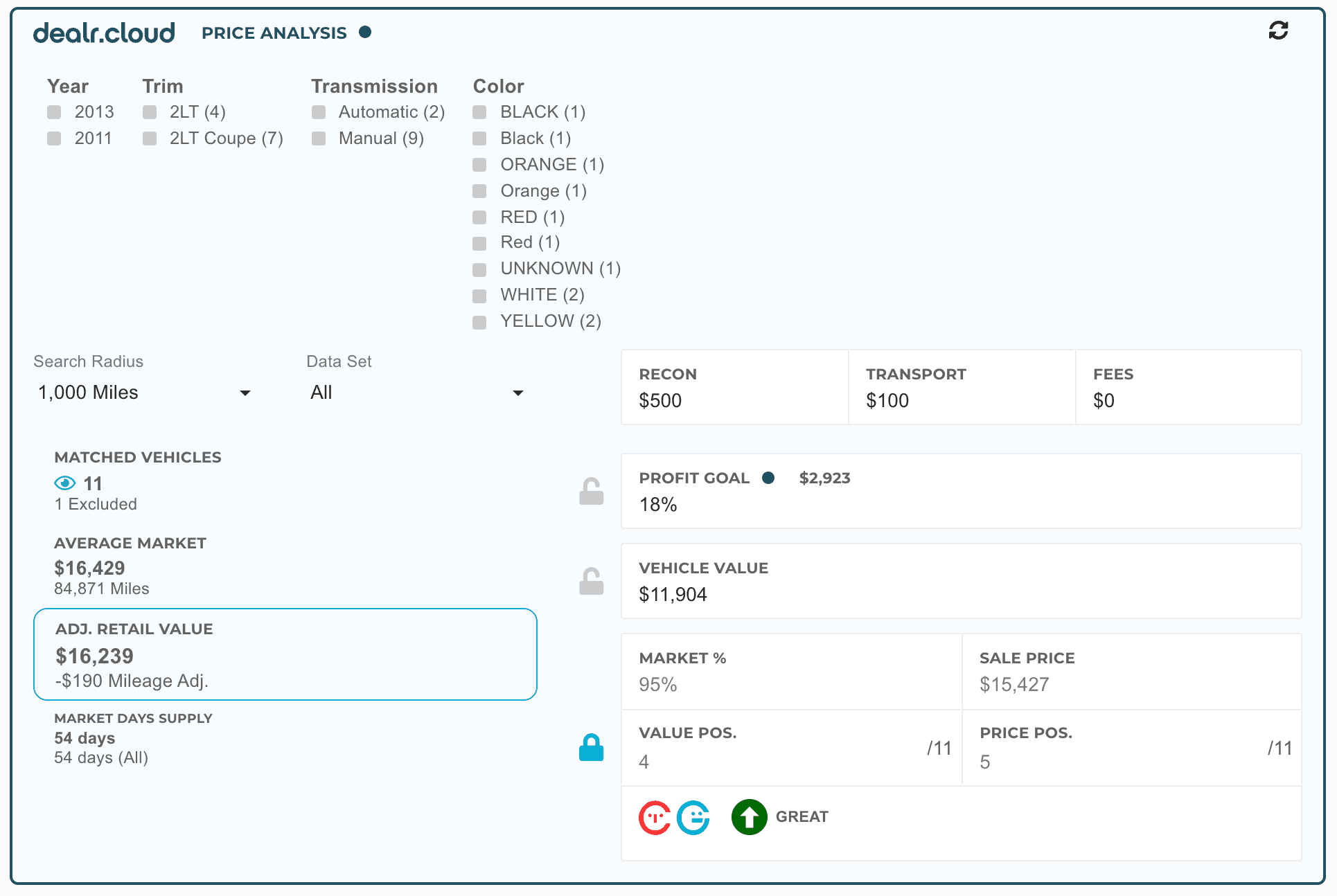

In the Price Analysis section of your appraisal, you can adjust the calculator to figure out the Vehicle Value (the price you want to buy the vehicle at).

- Enter in recon, transport, and fees to get an accurate profit goal.

- Adjust the locks by clicking the gray unlocked icons so you can manipulate different variables in the buying process.

- Locking a value will prevent it from changing. Changing one of the other two values will trigger a recalculation of the second unlocked value.

Use in Merchandising

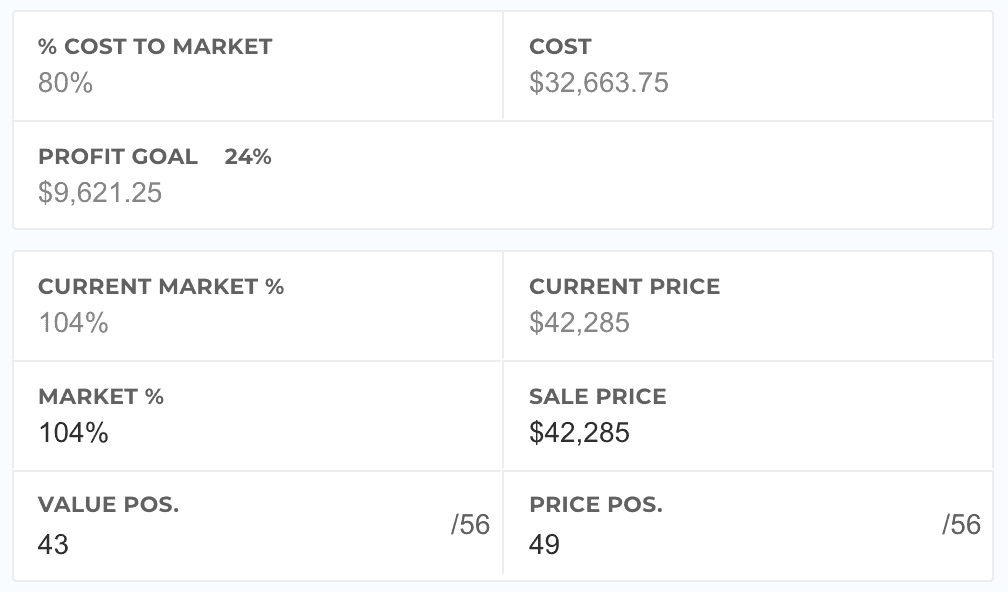

When pricing your vehicles, your costs are already locked in, meaning it's not a value you can manipulate anymore, but you can work other values:

- Profit Goal

- Market %

- Value and Price Positions

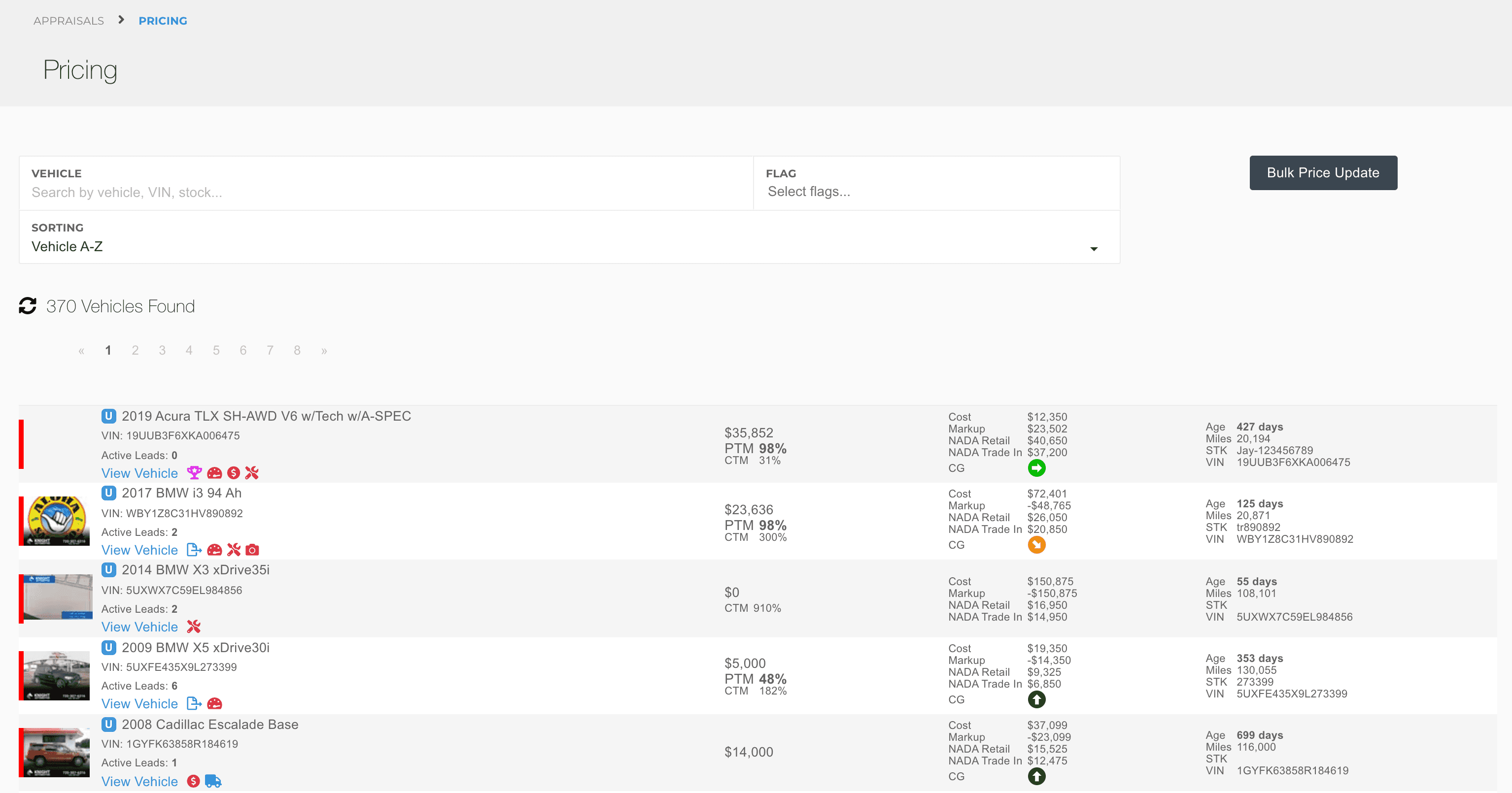

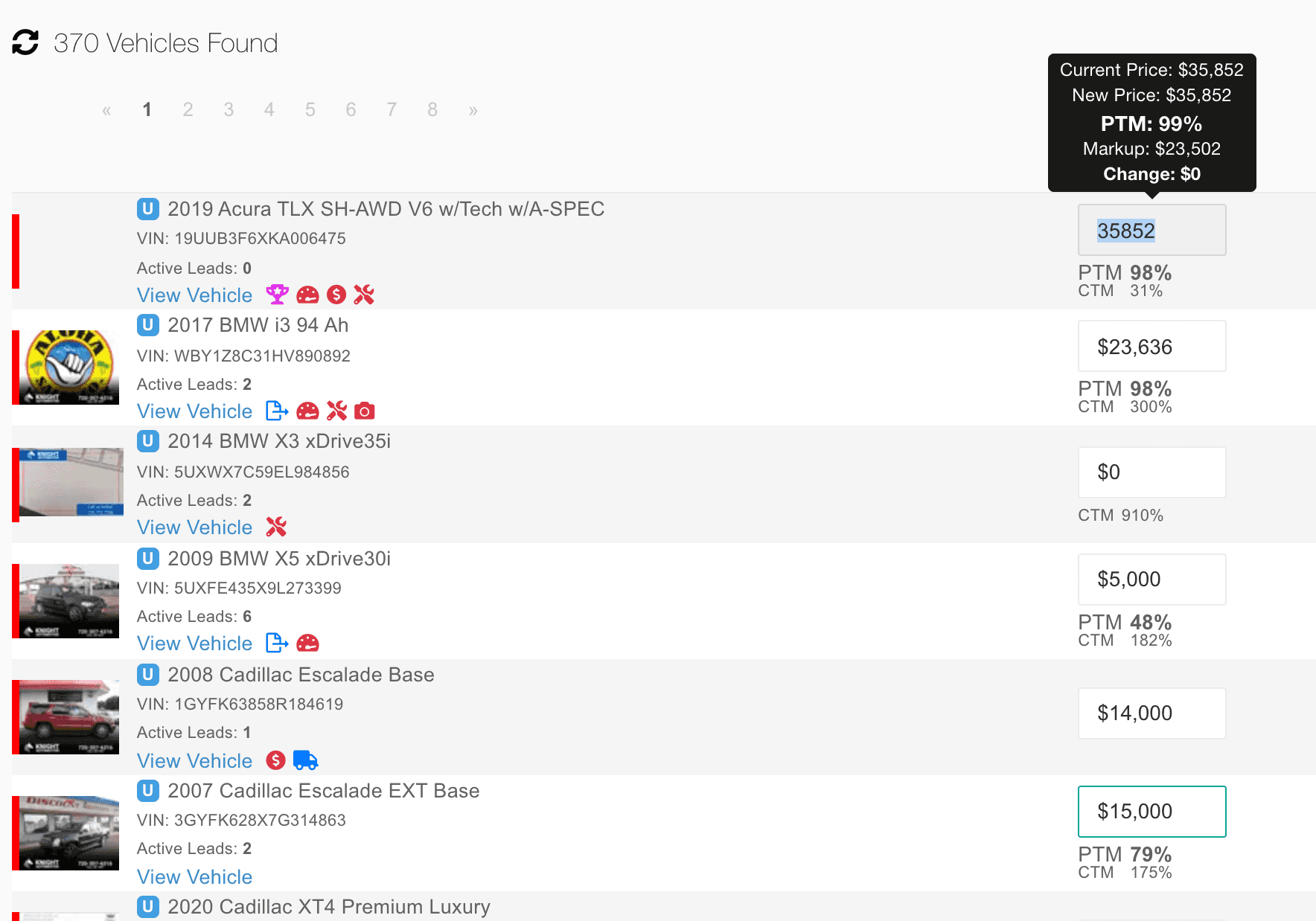

Bulk Price Updates

Bulk pricing updates allows you to re-price your inventory quickly. The Inventory > Pricing page is an invaluable way to identify:

- Old vehicles

- Overpriced or underpriced vehicles (using Price-to-Market)

- Vehicles with a high Cost-to-Market that need to get moved

It's easy to update prices in bulk on this page as well, using the Bulk Price Updates button.

You can quickly tab through pricing on all of your vehicles, get a quick view of what the cost-to-market and price-to-market are, and make your pricing adjustments. Vehicles with unsaved price changes are shown in green, so it's easy to identify which prices you've already changed at a glance.

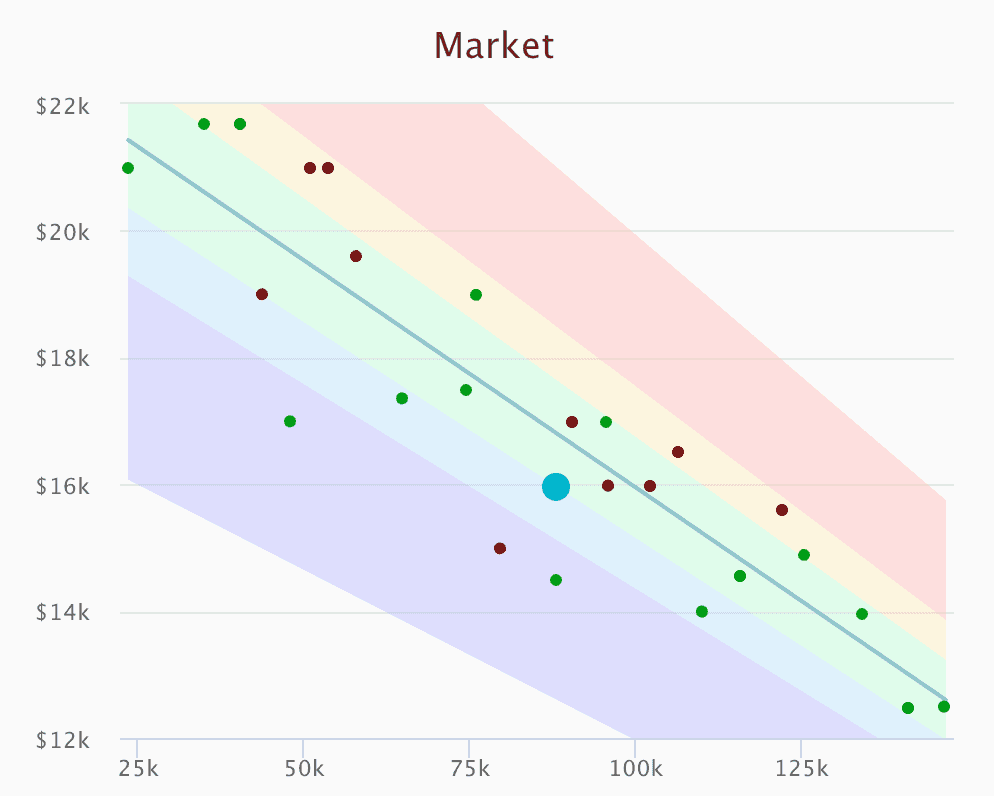

Market Graph

The Market Graph is an extremely valuable tool to help you get a visual of what the market looks like.

At a glance, you can see the distribution of price against miles, you can see where your vehicle is priced at (big teal dot), and you can see vehicles that are still active on the market (green dots) versus ones that have been taken off the market in the last 45 days (red dots). The background colors represent different market percentages, shown below, and allow you to see vehicles that are overpriced, priced right, or priced to sell.

Clicking on a green dot will take you to the vehicle's advertised page, which is a great tool to use when talking to customers and selling your vehicle.

Hovering over the dots will also give you details on distance, odometer, price, age, dealership, and more.

Color Guide

The color guide shows the following market percentage ranges. You can see that the guide is bigger at the start and smaller at the end, because as our miles and price adjusts our dollar range price spread decreases.

- Red: Over 110%

- Yellow: 105% - 110%

- Green: 95% - 105%

- Blue: 90% - 95%

- Purple: Under 90%

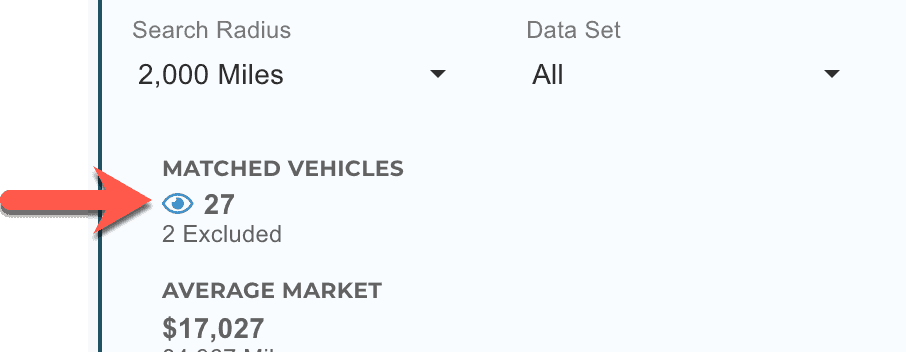

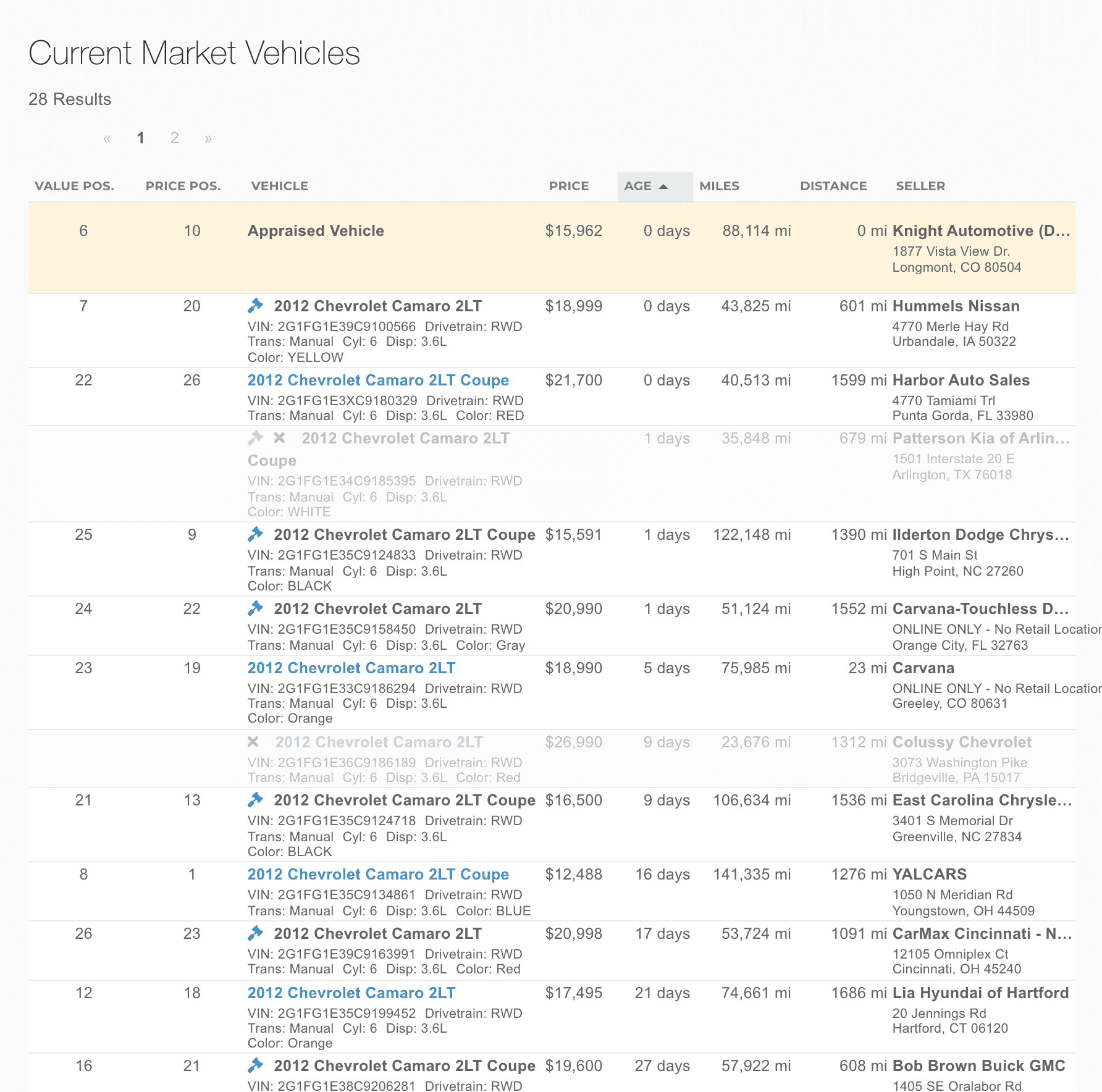

Matched Vehicles

If you want to see a detailed list of the vehicles shown in the Market Graph, you can click the eye next to the Matched Vehicles display.

This will give you a detailed list of the vehicles on the market and allow you to sort through the various factors that might affect your pricing decisions:

- Value and Price Position

- Price

- Age

- Miles

- Distance

A couple of things to note:

- The gavel indicates a vehicle that was removed from the market (likely sold) in the last 45 days

- Vehicles with grayed out rows:

- Are missing price or miles.

- Have a price or miles that is considered an outlier in the dataset (beyond 2 standard deviations of the mean).

Strategy

Market Days Supply

Market Days Supply (MDS) is a way for you to gauge retail demand and available supply for the vehicle you're appraising or selling. It's very useful when trying to evaluate whether to buy a vehicle, and how much to pay for it. A vehicle with a high MDS doesn't necessarily indicate a risky purchase; instead, it means you need to advertise it for less than market value and be competitive.

- Low MDS - Less than 30 days

- This is a hot vehicle and will sell quickly.

- Higher profit: price from 100-110%

- Faster sale: price from 95-105%

- You can probably price from 100-110% of market because demand is high and consumers are probably buying within a wider range of Market Value, or you can price it low to move it faster.

- Medium MDS - 30-60 days

- This vehicle isn't in high demand, but it's also still in demand.

- Higher profit: 95-105%

- Faster Sale: 90-100%

- You probably can't ask more than market for this vehicle because there's enough supply to satisfy consumer demand.

- High MDS - 60+ days

- This vehicle is in low demand with a high supply.

- Higher Profit: 90-100% (not recommended because it will take a while to sell.)

- Faster Sale: 85%-95%

As you can see, getting a vehicle with a high MDS can really cause problems in getting it to move quickly. If you want to get inventory turn on your lot down to less than 45 days, it's essential that you purchase vehicles with low MDS, or price your medium and high MDS vehicles very competitively.

MDS Calculation

Market Days Supply is calculated by looking at average daily sale rate over the last 45 days and multiplying it by the number of available vehicles on the market

Technically, the Market Day Supply value means that if you removed all added supply (no new vehicles on the market), the remaining supply would be gone with that number of days.

Profit vs Volume

This is an issue that has plagued dealerships for a long time - the balancing act between selling cars at higher prices and keeping a low volume versus low prices and high volume. The overall objective is clear: making more money. But, balancing this strategy is difficult.

The most profitable dealerships are the ones that turn and burn. Get vehicle time on lot to less than 45 days, and then auction the vehicle if you can't sell it. When acquiring inventory is challenging, you don't have that luxury. But when you can increase your dealership volume, you're in a much better financial situation.

Let's look at some examples:

Example 1 - Numbers Game

If you can sell 10 cars for $2,000 profit each or sell 25 cars for $1,000 profit each, most people would choose the latter option. $20,000 profit versus $25,000, no question.

Now, you might say that there's more work involved with selling 25 cars, and you'd be right, but if you tack on F&I (service contracts, GAP, financing), you can easily increase that average another $500-$700 and now you're looking at $25,000 versus $37,500.

You might also say that it takes 2.5x more money to sell 25 cars, and you're probably mistaken there too.

Example 2 - Volume

Let's look at the same numbers but add in an average sales cycle and vehicle cost:

- 10 cars, 10k cost, 75-day average turn

- 25 cars, 10k cost, 30-day average turn

By acquiring inventory and selling it more quickly, we can use the same financial investment. Using the numbers above, over 75 days, I have the same dollars in inventory the whole time, regardless of the two options - always 10 cars on my lot, $100k inventory asset. As I sell my cars, I buy new ones.

Application

Now, of course it's not as simple as we made it out to be above. To name a few other factors:

- Recon times

- Inventory supply

- Financial capital

You have to figure out the strategy that works for you. But, the essential part of this cycle is that you can use market data to choose your own adventure and not be tied to vehicles that are dragging down your bottom line. For example, you can choose high volume, or high individual profits. Depending on the market and supply, one may be better for you now, and one better for you later.

Market Percentage

There are other considerations to take into account when determining where you should advertise your vehicle against the market (percent of market). Just a few:

- Special vehicle upgrades

- Color combinations

- Low miles

- Physical damage/problems

Each of these things also needs to be considered in your pricing strategy, and your own experience is essential in doing that. The market data is an invaluable tool, but your expertise is also necessary to get vehicles priced right and moved quickly.

Value Position

The Value Position shows you, based on price and miles, where you rank in the market. If your value position is 1, then there aren't any vehicles out there that have a better value than yours. They may have a better price, but taking into account the mileage adjustment, you have the best valued vehicle.

Price Position

The Price Position shows you, just based on price, where you rank in the market. If you're priced in position 1, that means that there's not a single competitor out there with a better price. Because this doesn't consider mileage, we recommend using the Value Position if you price by market position.

Exit Strategy

It's important to know when to get out of a vehicle. We talk about this being your exit strategy, and we normally discuss it in the context of your cost-to-market. If your cost-to-market is too high, then you're going to lose money on the vehicle. But, as inventory ages and depreciates, your cost-to-market will keep increasing. That's why we recommend that, if a vehicle just isn't moving, keep an eye on your cost-to-market to make sure you don't get too far upside down.

Define a market percentage you need to price cars at to get them off your lot if they've sat there for too long. Getting rid of stale inventory is an essential component of reducing your average vehicle turn time, and making your dealership more profitable.