Payments

The payments tab allows you to:

- Receive payments from customers.

- Provide discounts on the invoice.

- Modify certain fees, shop supply, and tax details.

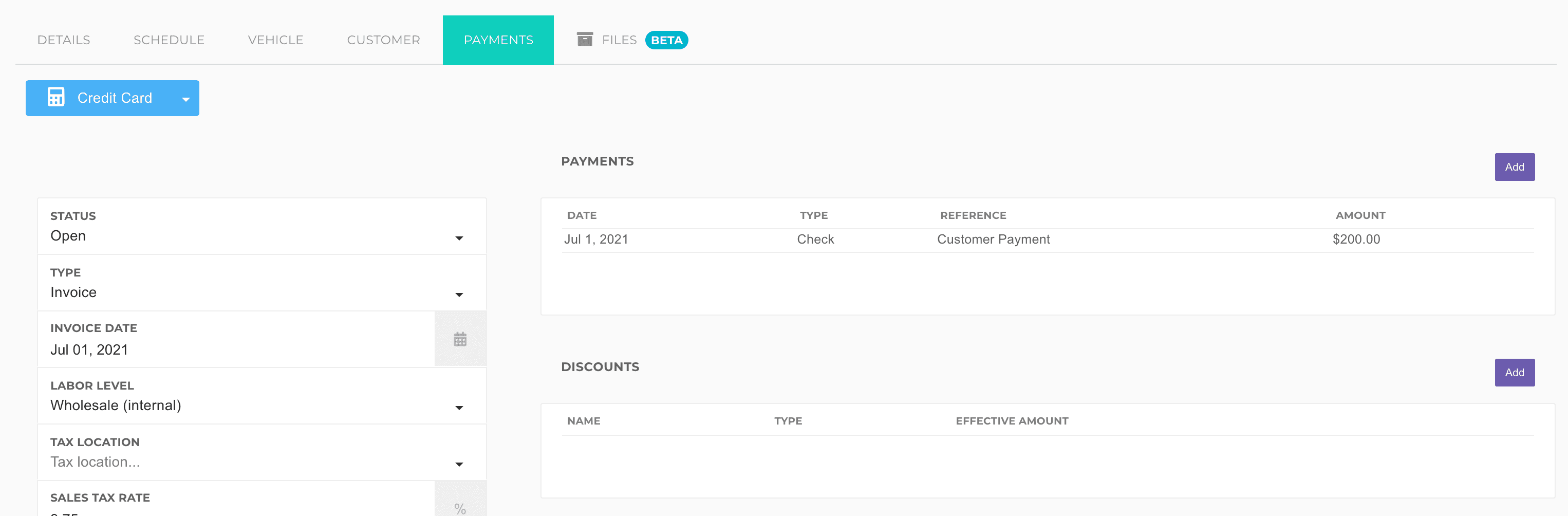

Collecting Payments

In the payments section, you can click Add to add payments.

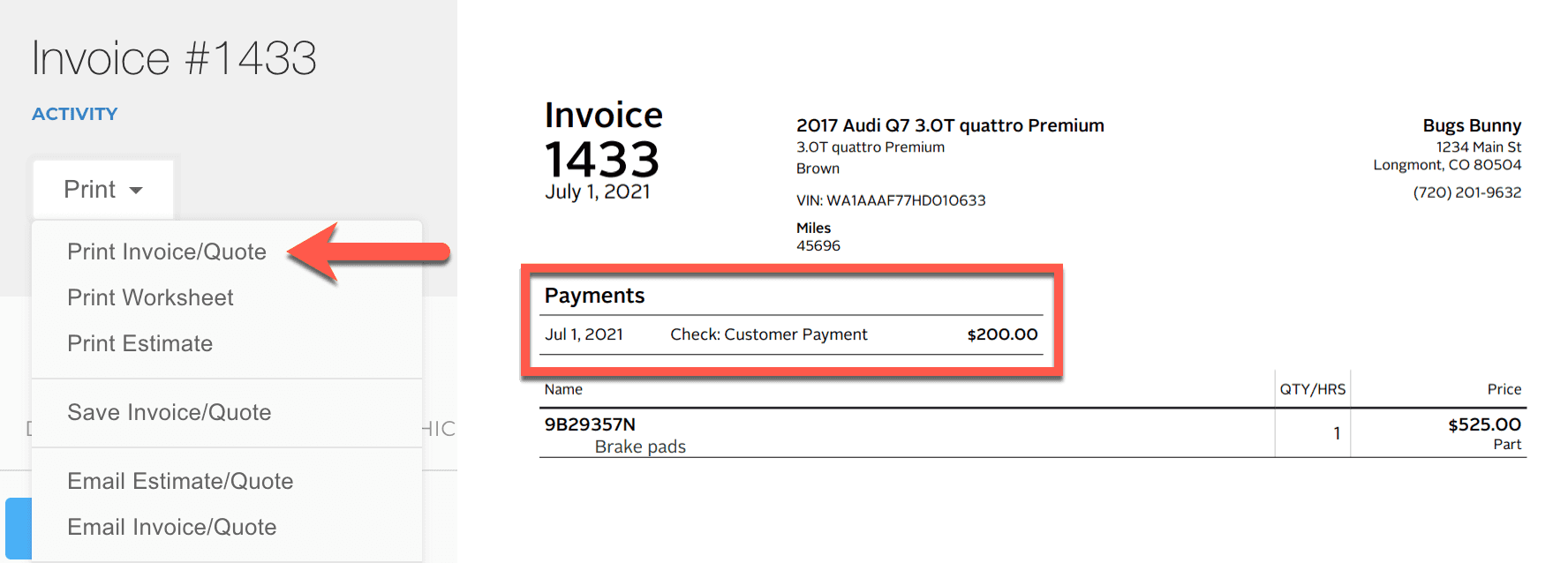

Printing Receipts

Printing receipts for service payments is done through the invoice. The printed invoice will have a record of the payments received on the invoice.

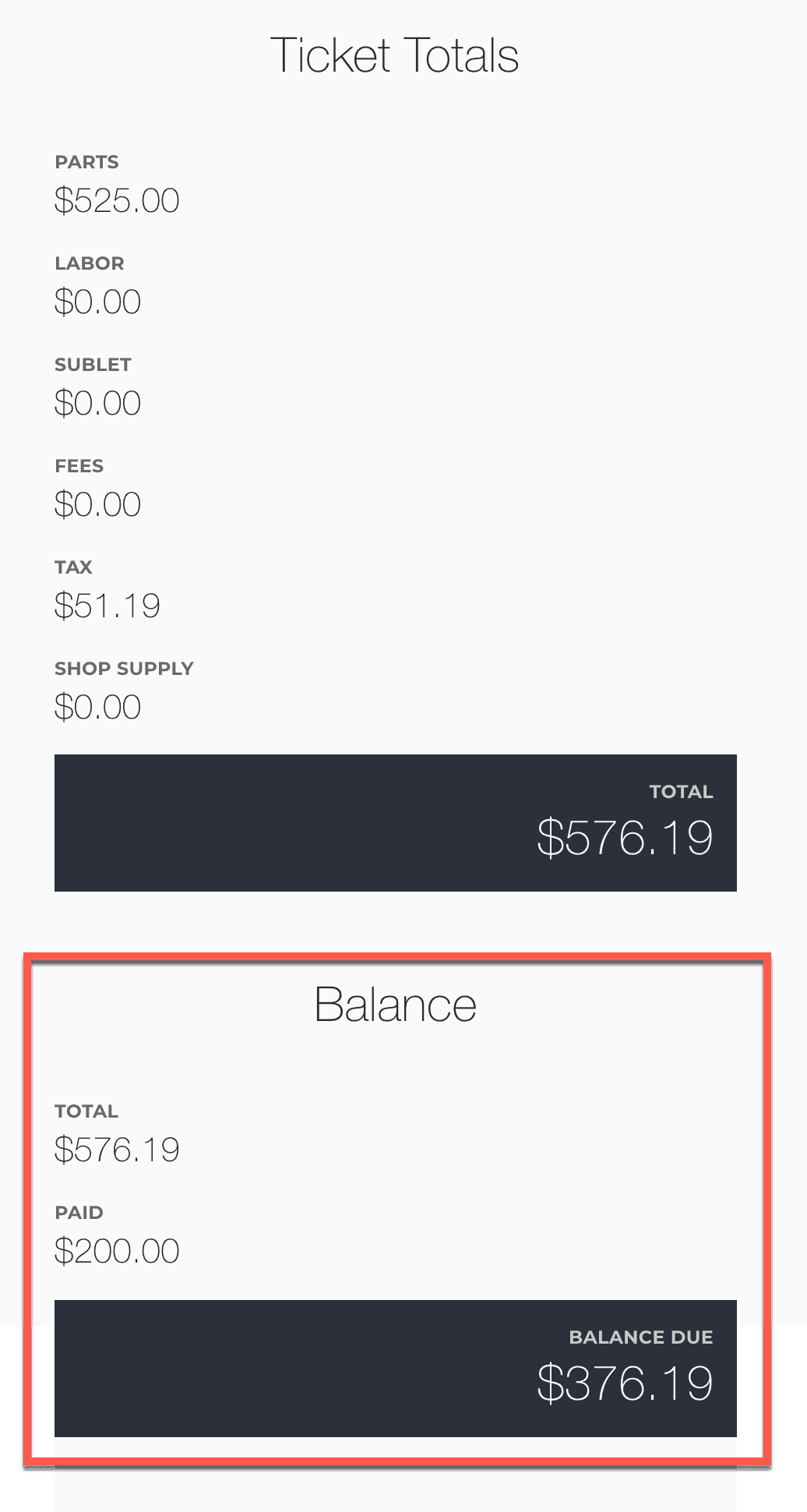

Balances

The invoice balance can be seen below the invoice totals.

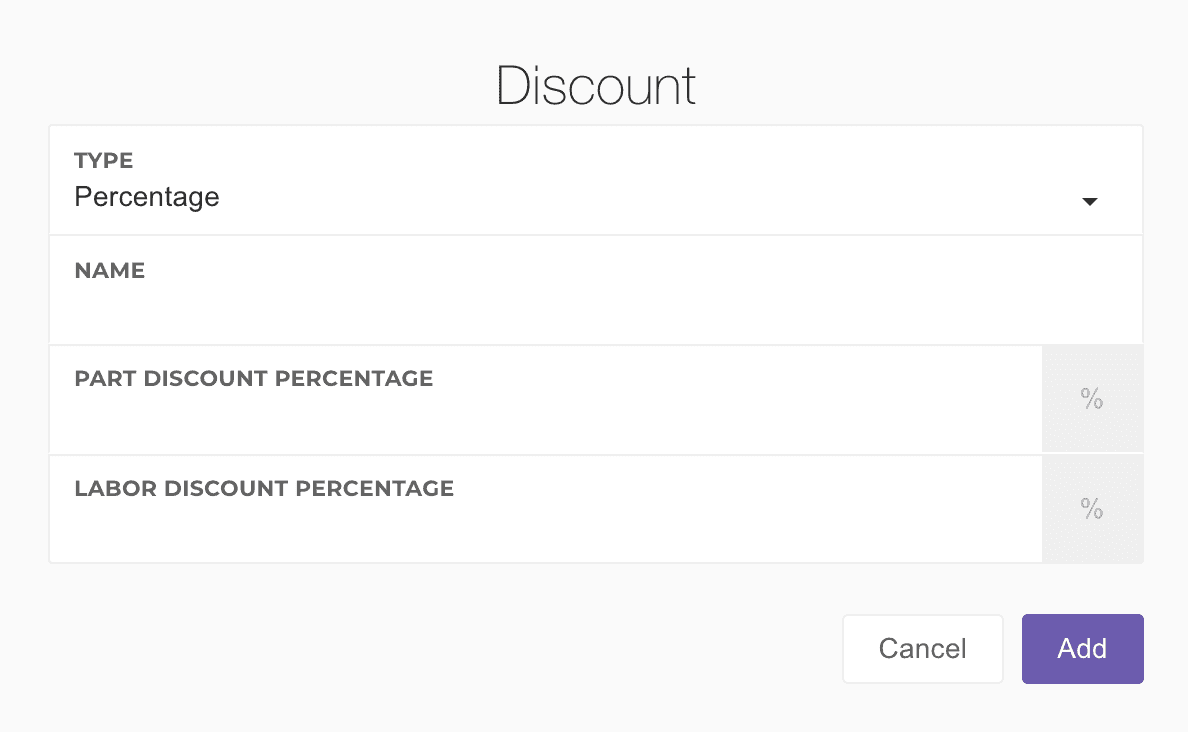

Discounts

Discounts can be added as dollar amounts or percentage amounts, and assigned to parts, labor, or both.

Discounts are applied before tax and shop supply calculations.

Shop Supply

Shop Supply is a fee charged to customers that account for overhead costs of material or services not typically itemized as line items on an invoice. This could refer, but is not limited to, costs of fluids, cleaning supplies, shop towels, etc. The Shop Supply fee is intended to help cover the costs of these items.

Shop Supply Rate

The Shop Supply Rate is the percentage that will be applied against the selected amount to determine the Shop Supply Amount.

Shop Supply Taxable

The Shop Supply is taxable depending on the state. Here is where you can toggle if you want the Shop Supply to be taxable.

Shop Supply Type

The Shop Supply Type allows you to determine on which amount you want your Shop Supply Rate to apply. Your options are:

- Labor

- Parts

- Parts and Labor

Max Shop Supply

Max Shop Supply enables you to set a hard limit on how much Shop Supply can be applied to a ticket.

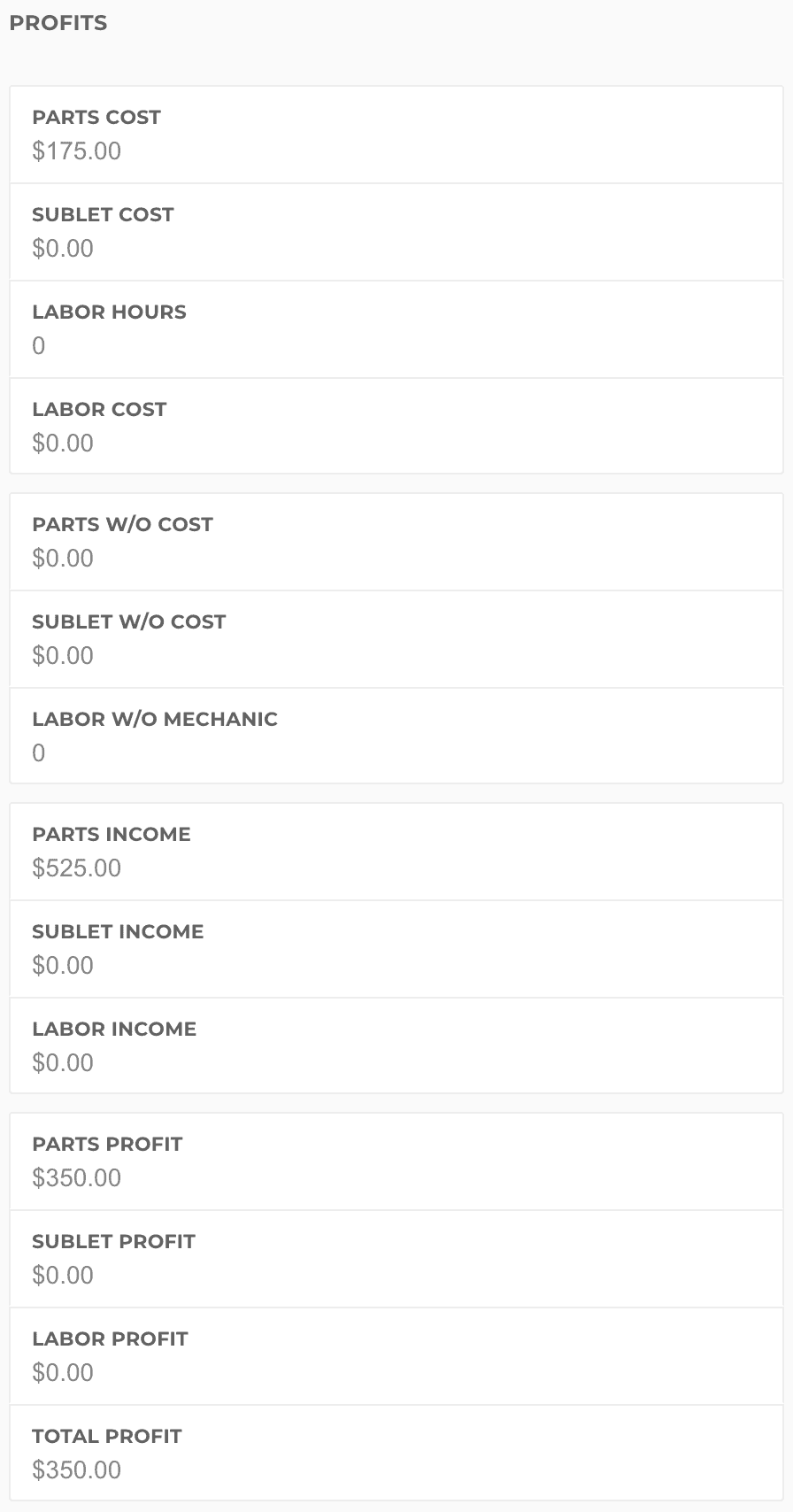

Profits

Profits can be found at the bottom of the payments tab.

- Costs - The cost for each sellable category.

- Parts Cost

- Sublet Cost

- Labor Hours - The labor hours with assigned costs.

- Labor Cost

- Missing Costs - Sellable sale price totals that are missing costs.

- Parts w/o Cost

- Sublet w/o Cost

- Labor w/o Mechanic - Labor hours without an assigned mechanic.

- Income - Sale price totals for sellables, cost to customer.

- Parts Income

- Sublet Income

- Labor Income

- Profits

- Parts Profit

- Sublet Profit

- Labor Profit

- Total Profit