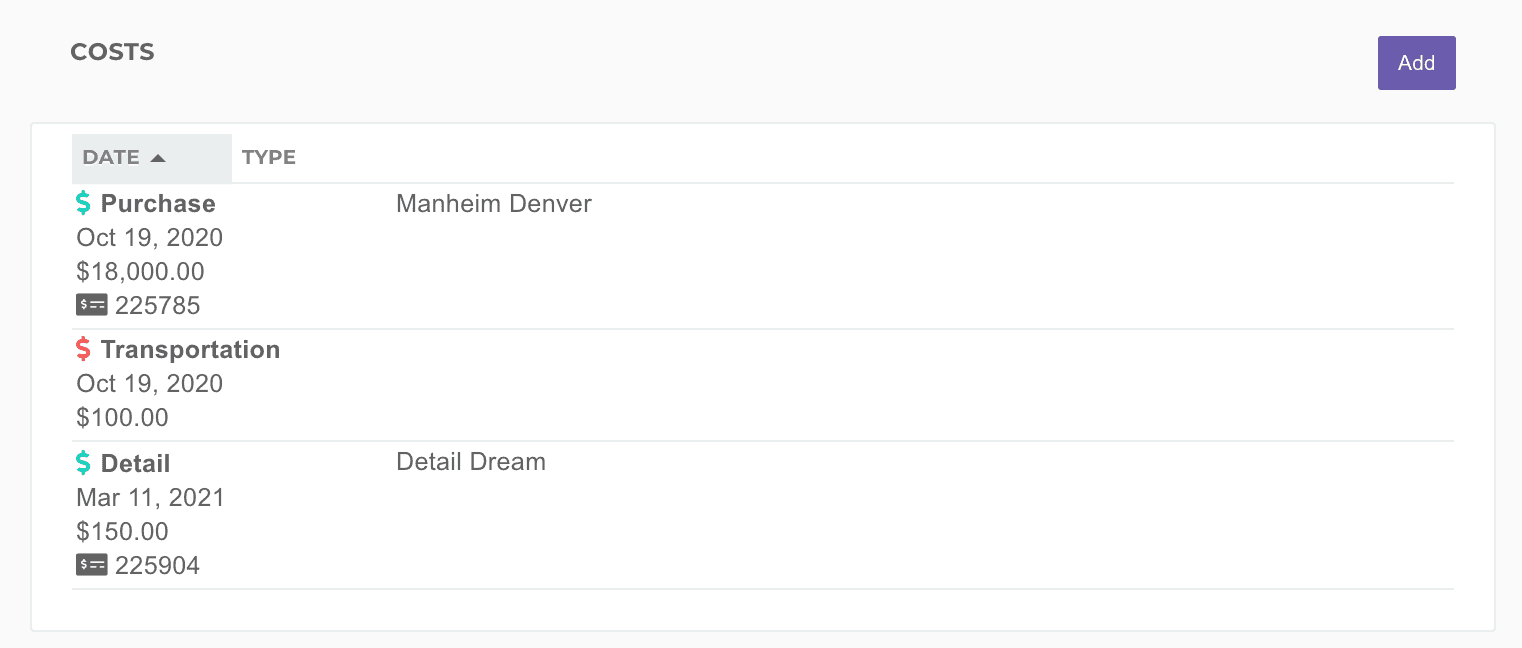

Costs

Costs are where you can track all the money you've spent on a particular vehicle.

Working with Costs

Adding Costs

You can add new costs using the Add button at the top right of the costs section.

Default Costs

When creating a vehicle, you can add default costs in settings that will automatically be created on each vehicle. These costs will be dated on the In Date when they are created. Changing the In Date later will not modify the cost dates.

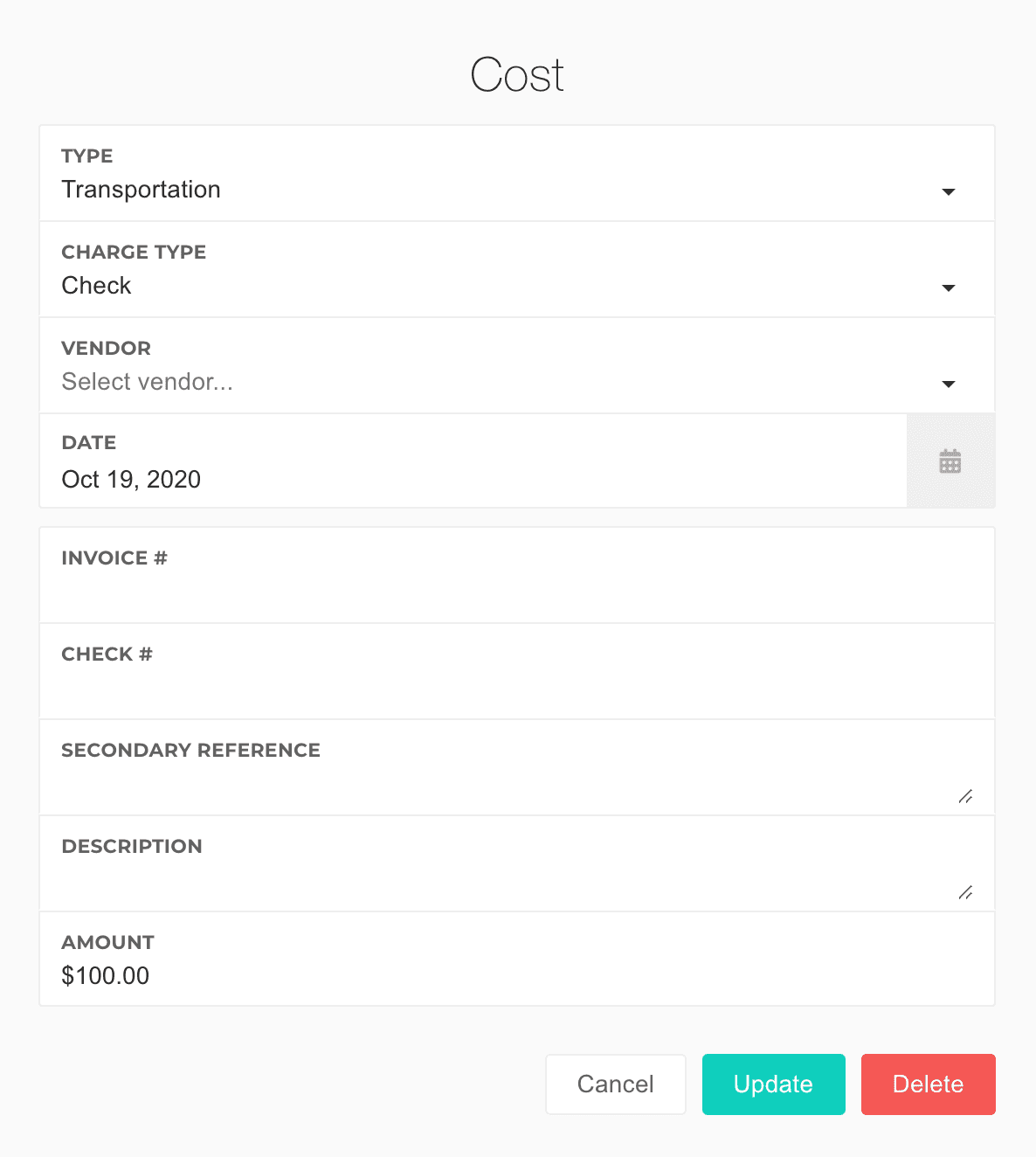

Editing Costs

You can edit a cost by clicking the cost and modifying any details needed. The only required fields are the Type, Date, and Amount.

- Type - The type of the cost. The options in this dropdown are customizable in settings.

- Charge Type - How the cost was paid.

- Vendor - The vendor being paid. Note: for floored vehicles, this should be set to the company selling the vehicle, not the floorplan company.

- Date - The date the cost was incurred.

- Invoice # - Invoice number provided by the vendor for this cost.

- Check # - The check number that paid for this cost.

- If the cost was paid via a check in accounting, this field will automatically show the check number and isn't editable.

- Secondary Reference - Another reference number field that will show in the Identifier field in accounting.

- Description - A multiline text field for the description of the cost.

- Amount - The total amount of the cost.

Deleting Costs

When you're in the cost dialog, you can easily delete the cost using the Delete button on the bottom.

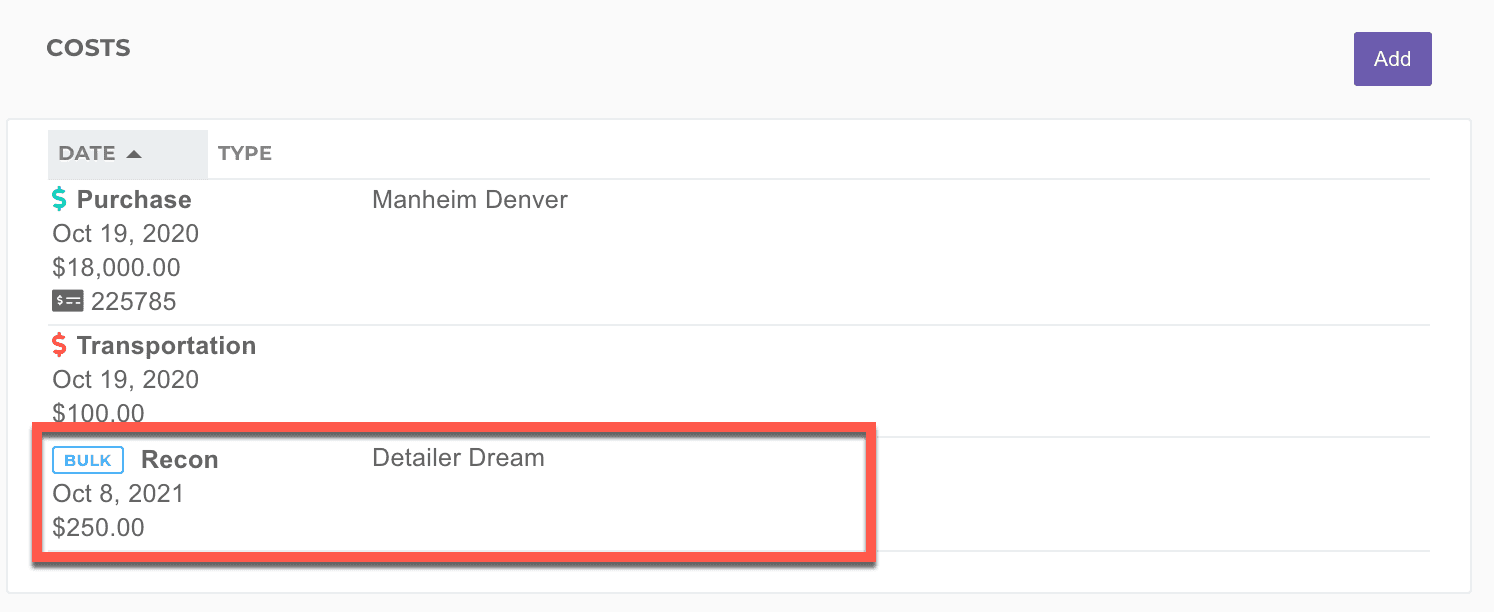

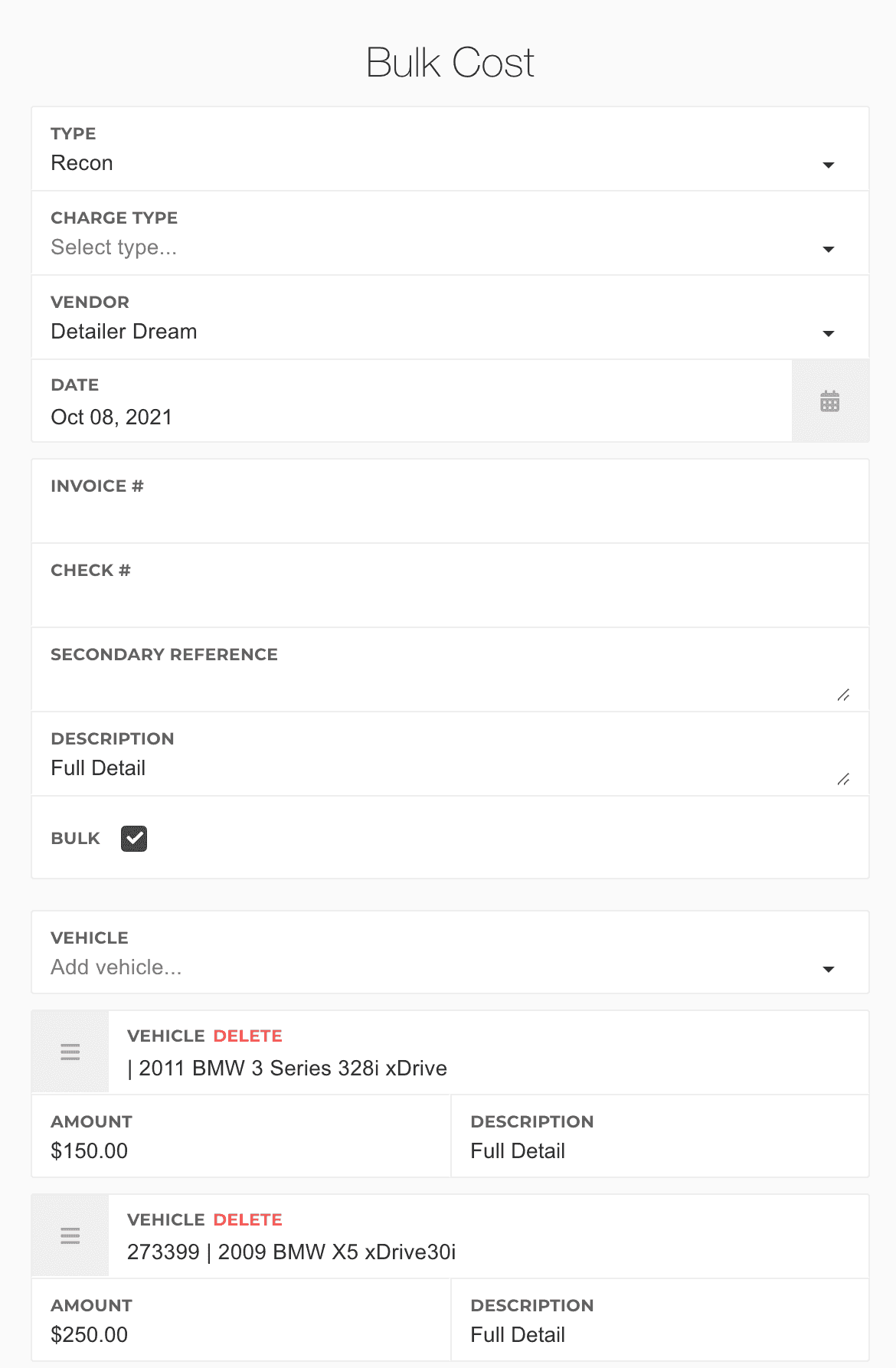

Bulk Costs

Bulk Costs allow you to create a single cost with shared information across separate vehicles.

Bulk Costs can be identified by the Bulk tag next to the cost type. Clicking into the cost on any vehicle will open up the Bulk Cost.

Creating a Bulk Cost

Creating a bulk cost can be done from any cost creation dialog. When creating the cost, check the Bulk checkbox. Then, add any vehicles and their respective cost amounts. All the fields are shared except for the amount, and the description can also be overridden on specific vehicles if needed.

You can also create a Bulk Cost from the sidebar using Inventory > Create Cost.

Accounting Implications

Bulk Costs always create a single payable and that payable is associated with the Bulk Cost, not the vehicle. The Accounting Panel for Bulk Costs can be found by opening the Bulk Cost on any vehicle, or can be paid directly from accounting.

To reiterate: you will not see the payable for the Bulk Cost on the Inventory, only the inventory asset.

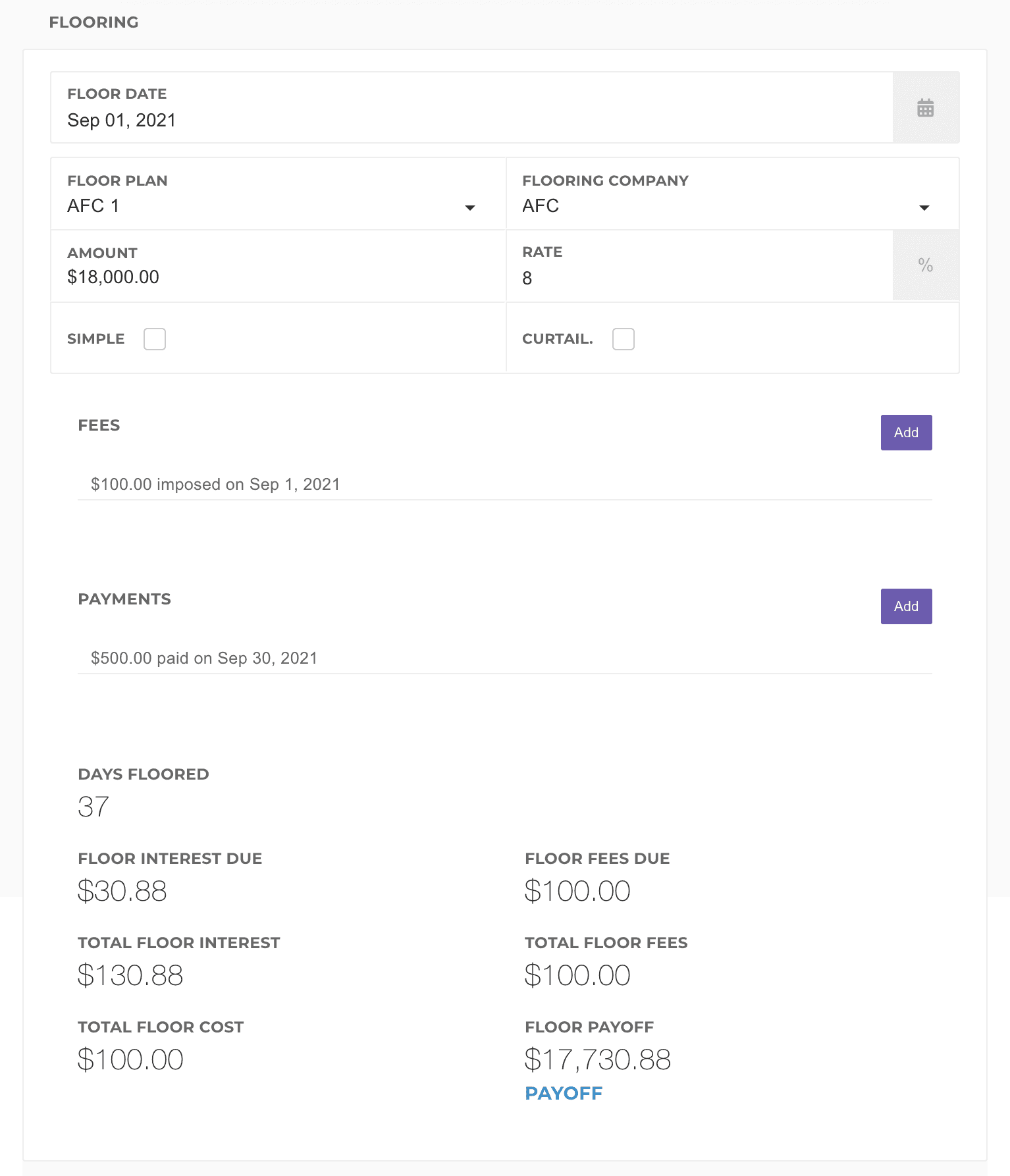

Flooring

Flooring is the process a dealership can use to purchase vehicles on credit. Essentially, it's a short term loan that enables a dealership to buy a vehicle they may not otherwise have the ability to buy. Floorplan companies will then charge fees and interest to the dealership for lending them the money.

In dealr.cloud, flooring can be tracked against the inventory in the Flooring section.

- Floor Date - The date the vehicle was floored. This is when interest starts accruing.

- Floor Plan - You can set up default floorplans in settings so that the same vendor, interest, and fee structure is used each time you floor a vehicle.

- Floor Company - The company flooring the vehicle. Some popular ones are NextGear, Floorplan Express, and AFC.

- Amount - The amount floored. Generally, this is the same as the purchase cost of the vehicle.

- Rate - The flooring interest rate. Sometimes this can be challenging to find with your floorplan logins, so reaching out to them directly can be helpful here.

- If the rate isn't precise, that's completely fine. Check Estimated Costs below for more information.

- Simple - If the flooring should be calculated using simple interest, use this. Simple interest flooring is very uncommon.

- Curtail. - If the floorplan has a curtailment schedule, you can check this checkbox. Generally this isn't used, even if you have curtailment payments, as the values have to get calculated from the floorplan company regardless.

- Fees - This section shows any fees on the floorplan, as well as the date they were imposed. If you set up a default floorplan, you can set up a fee schedule so that fees automatically apply at certain dates.

- Payments - This is where all of your payments, curtailments or payoffs, will be shown. See Payments for more details.

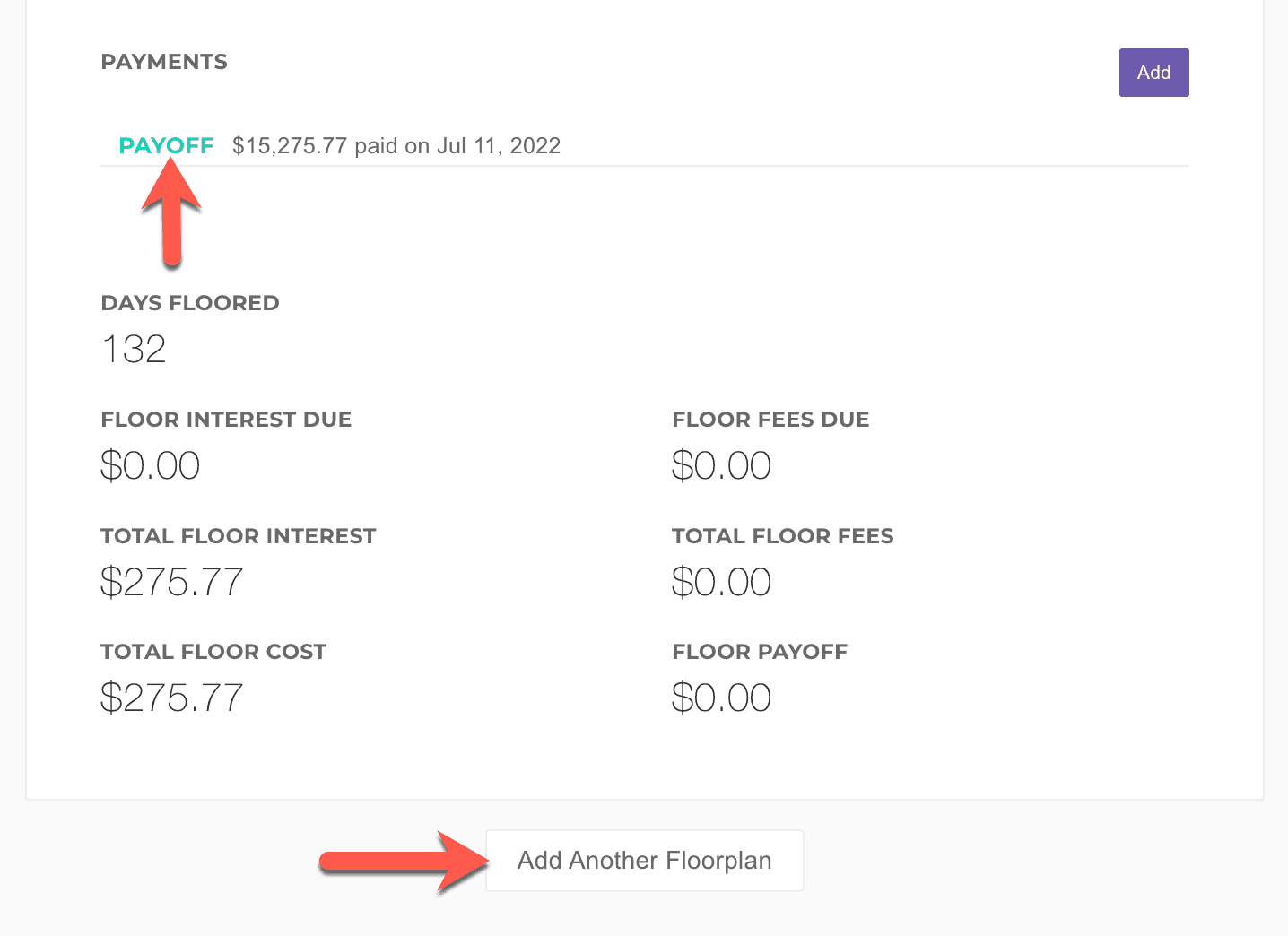

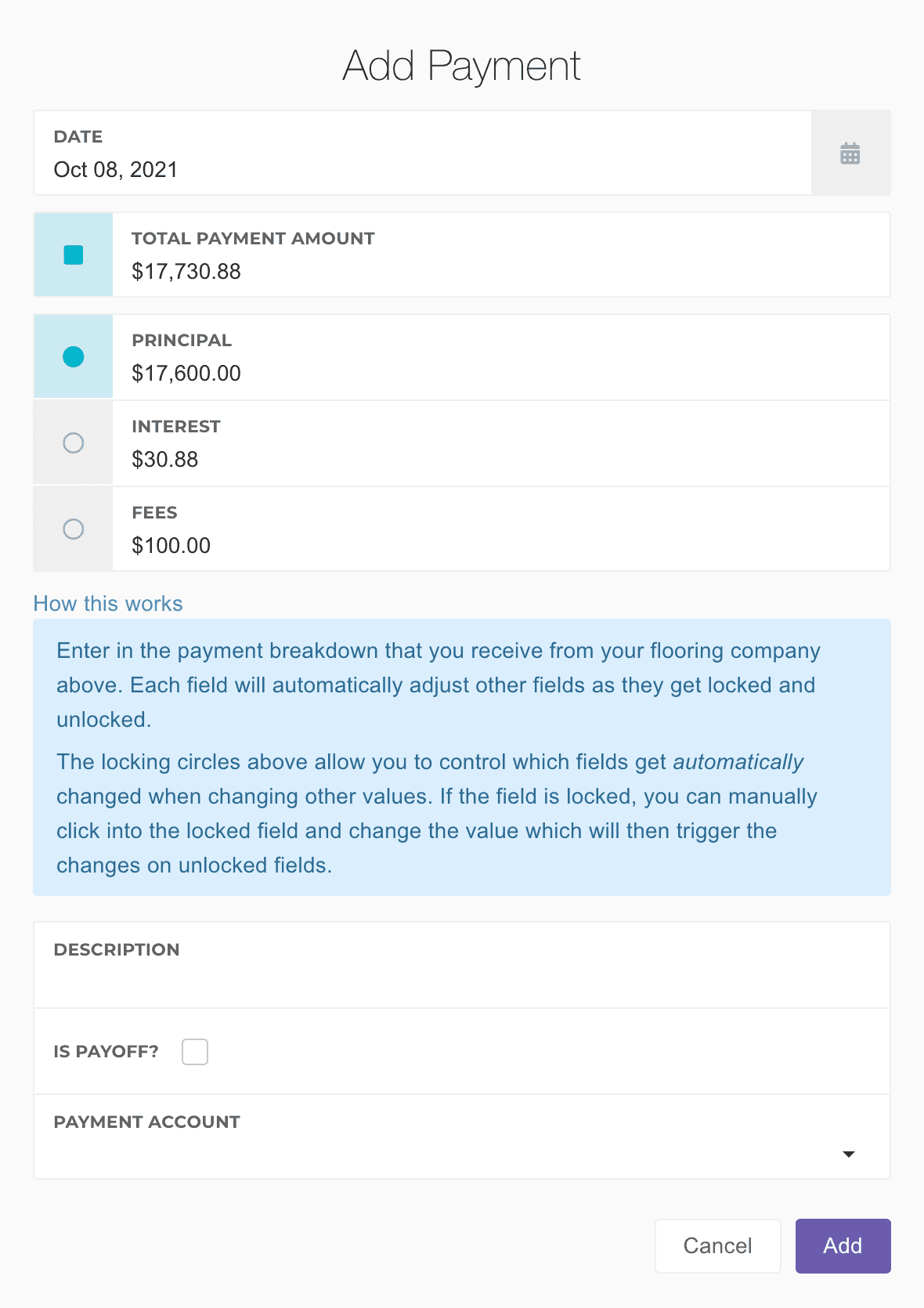

Payments

Payments are either curtailments or payoffs on a floorplan. You'll add a payment in the flooring section anytime you make a payment to your floorplan company on a vehicle.

Each time you make a payment, you'll want to enter the payment breakdown that you receive from your floorplan company. It's very important these values come directly from your floorplan company, as the values that will prefill are simply estimates based on the interest rate and principal balance. See Estimated Costs for more details.

- Date - The date the payment was made.

- Total Payment Amount - The total amount paid, including principal, fees, and interest.

- Principal - The principal balance paid.

- Interest - The total interest paid.

- Fees - The total fees paid.

- Description - An option description.

- Is Payoff - Checking this box on a payment will tell the flooring estimator to stop accruing interest, and will force the totals calculations to only use values you entered in payments.

Estimated Costs

The flooring section is a great way to keep track of estimated flooring costs, but it's important to note that the interest estimates are just that - estimates. This allows you to keep track of just how much money a vehicle is going to cost you, but it also isn't a precise calculation. Different flooring companies calculate interest in different ways, and the way the flooring section calculates interest is very straightforward, as seen below.

The important component about the flooring section, however, is that it's specifically built to take your input and treat that as the source of truth. Meaning, it doesn't matter what estimates get calculated, your payment breakdown numbers are what will be used.

Compound Interest (default method)

The below equation is used for each section of the flooring period, based on the principal balance for each day. Because the interest is compounding, the interest has to calculate on the accumulated amount, rather than just the amount.

Simple Interest

The below equation is used for each section of the flooring period, based on the principal balance for each day.