Finances / Payments

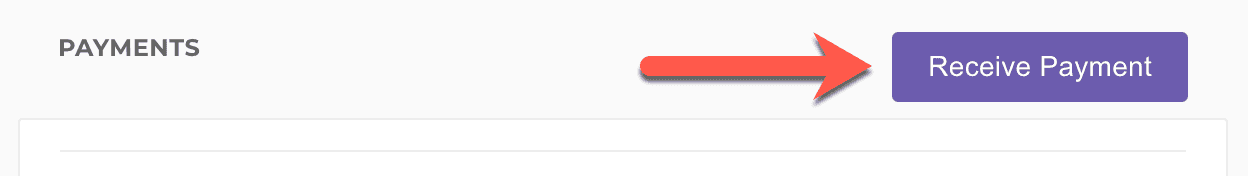

Payments

Payments are essential to tracking how much you're owed on a deal.

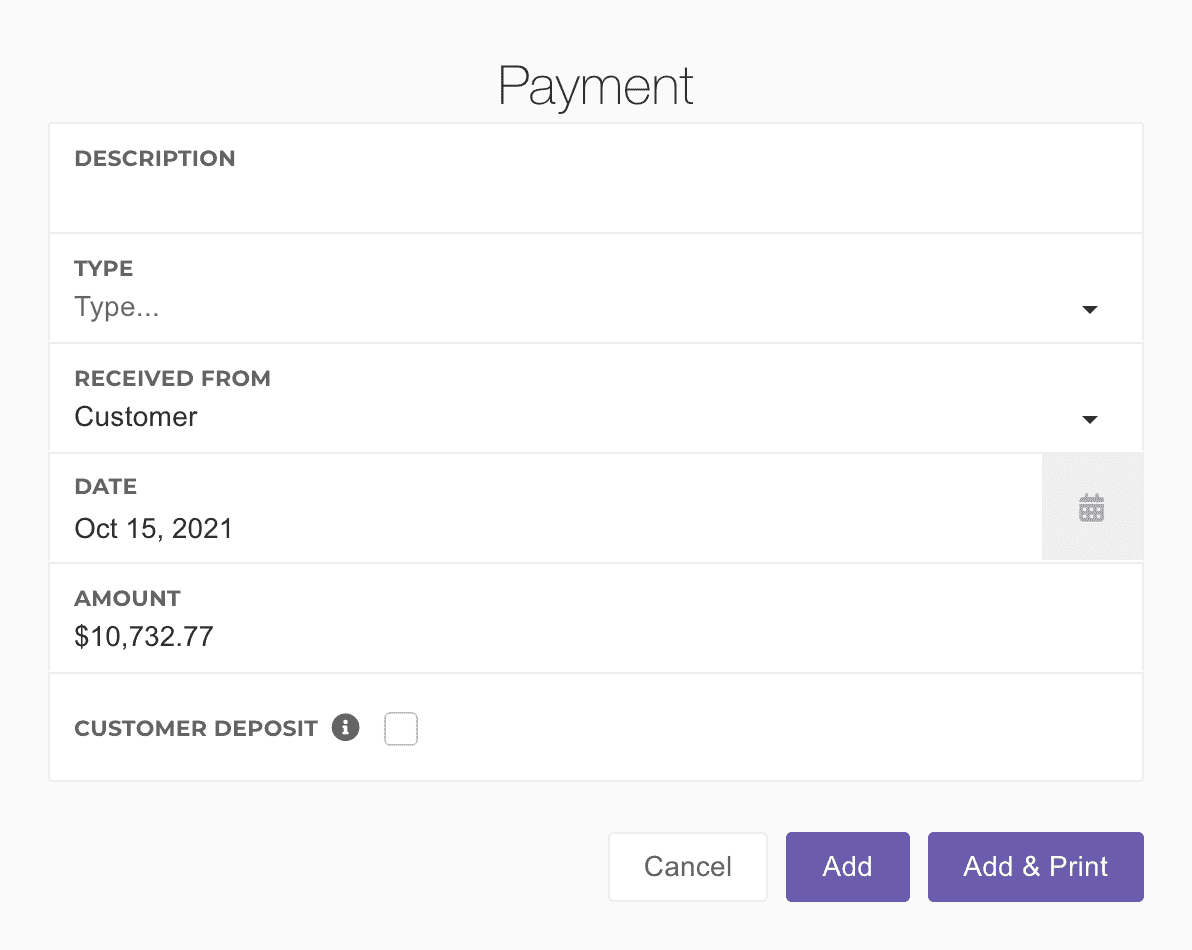

Adding Payments

Adding payments is easily done in the Payments section.

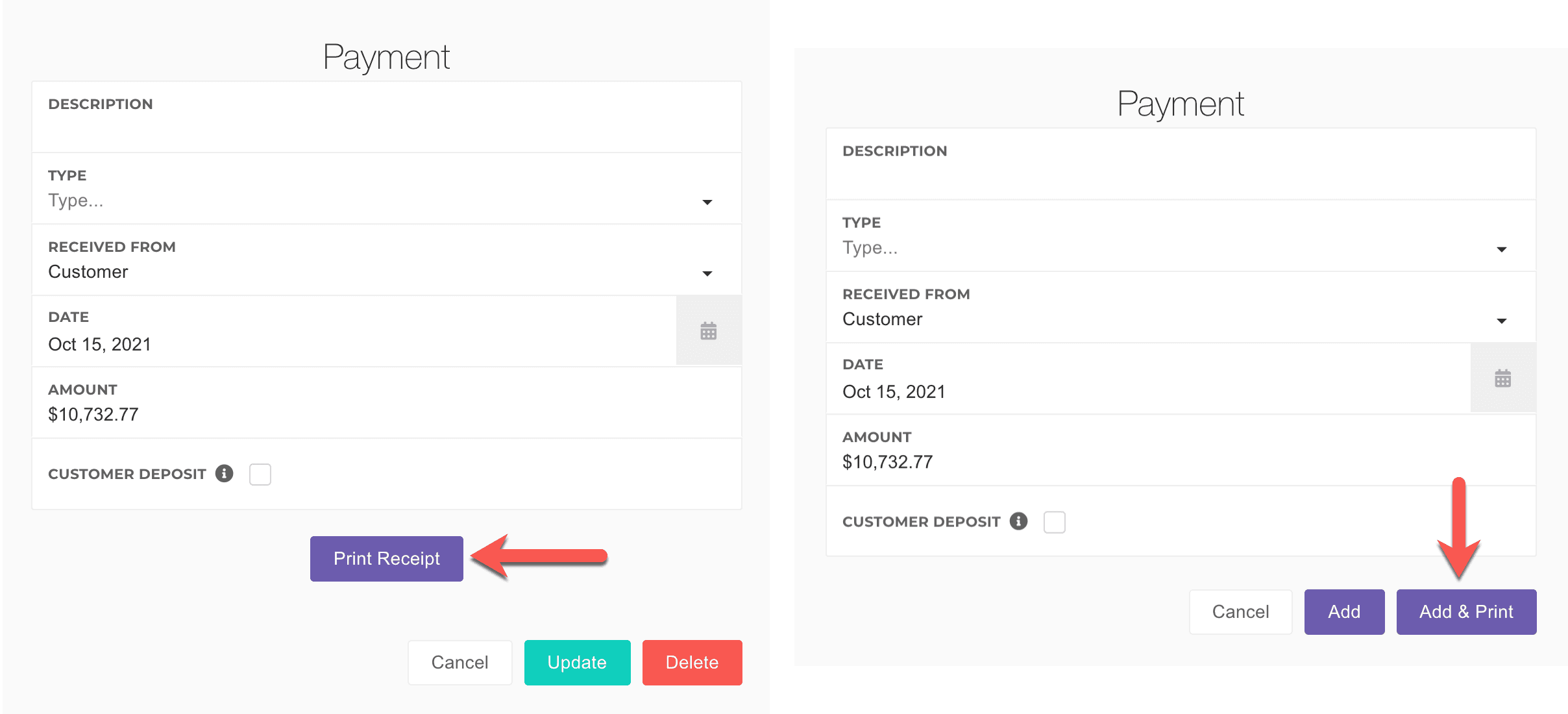

Printing Receipts

You can print a receipt for a payment by opening the payment and clicking the Print Receipt button, or by clicking the Add & Print button when adding a payment.

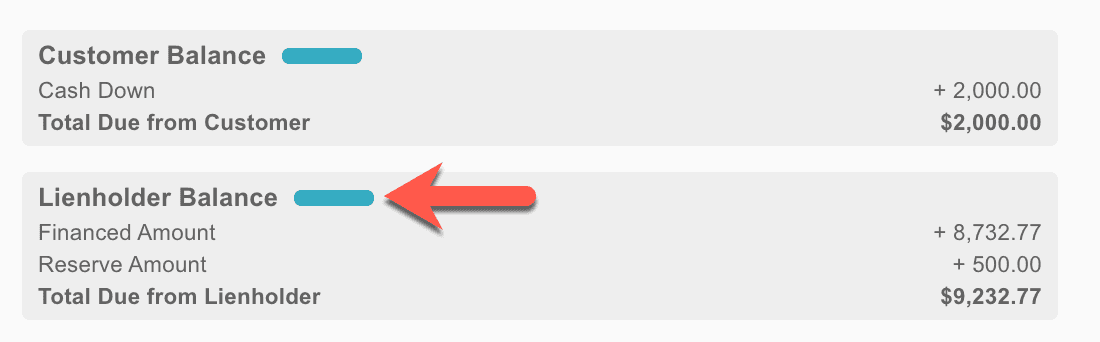

Balances

Balances are shown for the deal for the customer, lienholder, and lessor based on the deal structure.

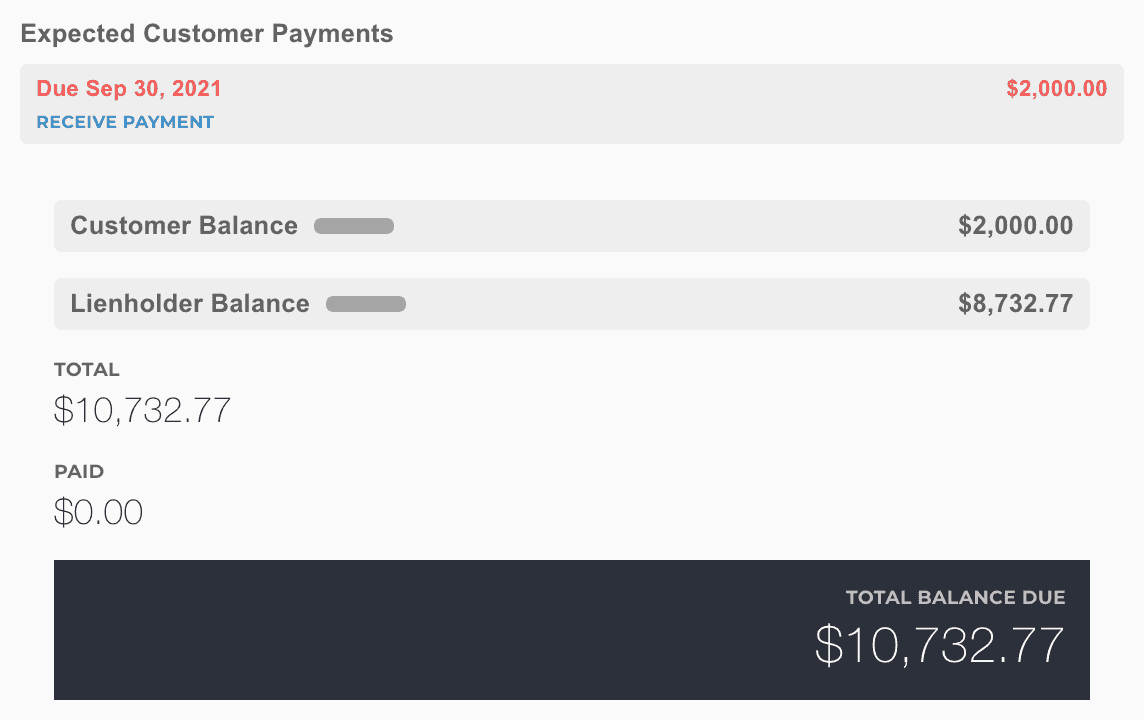

Expected Payments

The Expected Payments section shows payments that should be received from the customer, along with the date. This is useful for down payments and deferred down payments.

Calculation

If you want to see how the due amounts get calculated, look at the breakdown by clicking on the pill icon.

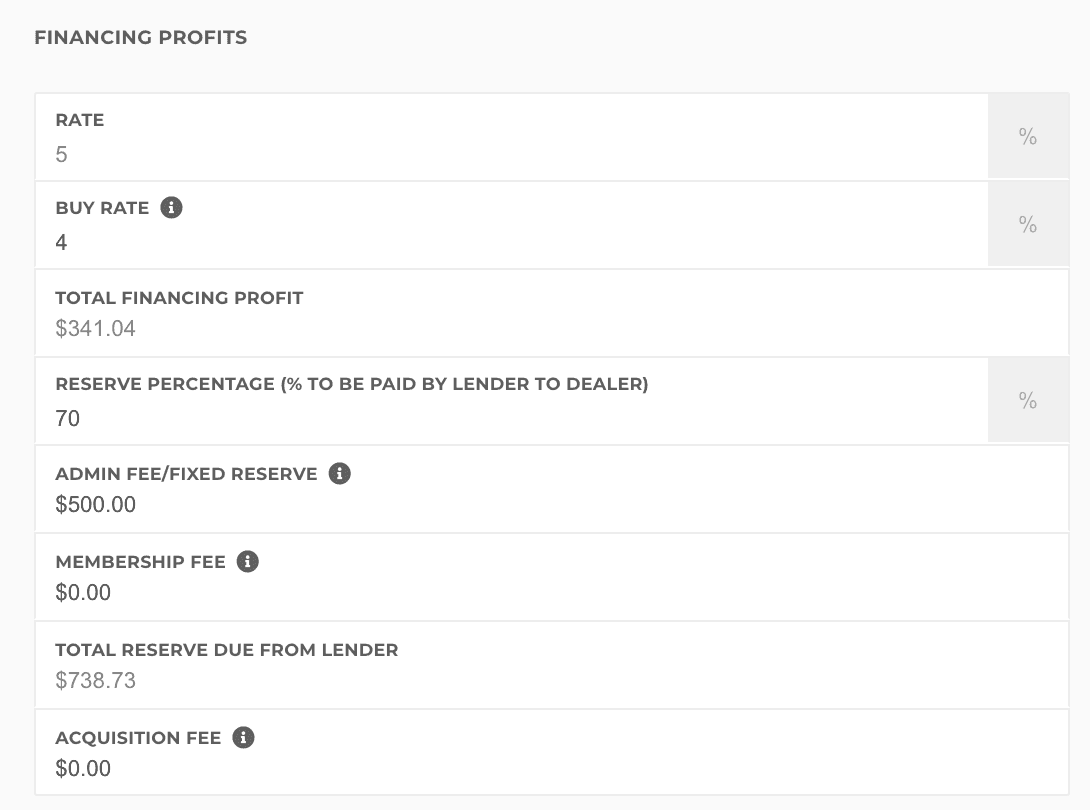

Finance Income

The finance income section lets you change the finance income details on the deal.

- Buy Rate If you're performing a rate markup, change this value from 0 to the buy rate from the bank.

- Total Financing Profit - Shown only when the Buy Rate is set. This is a calculated field comparing the buy rate to the sell rate (rate field). It calculates the total profit from the markup.

- Reserve Percentage - This indicates how much of the Total Financing Profit will be paid to the dealership.

- Admin Fee/Fixed Reserve - This is a flat dollar amount to be paid to the dealership from the lender.

- Membership Fee - This amount will be short-funded from the lender and should be paid by the customer.

- Collect Membership Fee from Customer - If checked, this amount will be added to the receivable amounts for the customer and will not be considered a cost to the dealership.

- Total Reserve Due From Lender - The total amount the lender will pay for the financing income on this deal.

- Acquisition Fee - This amount is short-funded from the lender and is considered a cost of getting the customer financed, reducing deal profit.

Reserve Percentage

If you are marking up a buy rate on your loan, then you generally get to share a percentage of the total financing charge increase (interest) that will be collected over the course of the loan. A common percentage is something like 70%.

In the Deals system, you'll enter your sell rate as the rate the customer is going to be contracted for. Then, enter your Buy Rate in the financing profits section. You'll see a Total Financing Profit number show. This number is calculated by the following method:

- Calculate the Total of Payments for the Rate that was sold to the customer.

- Calculate the Total of Payments for the Buy Rate that you are getting the loan from the lender for.

- Total Financing Profit = #1 - #2

Then, you'll need to add a percentage into the Reserve Percentage field. Let's say our Total Financing Profit was 700 of the financing profit included there.

Total Reserve Due from Lender

Total Reserve Due from Lender is calculated using all the other values in the Financing Profits section. This amount will be added (whether positive or negative) to the receivable amount from your lender.

While not included in the below calculation, the Acquisition Fee will also be deducted from the receivable amount from your lender.

Lease Income

The lease income section lets you change the finance income details on the deal.

- Buy Rate If you're performing a money factor markup, change this value from 0 to the buy rate from the bank.

- Total Leasing Profit - Shown only when the Buy Rate is set. This is a calculated field comparing the buy rate to the sell rate (money factor field). It calculates the total profit from the markup.

- Reserve Percentage - This indicates how much of the Total Leasing Profit will be paid to the dealership.

- Fixed Reserve - This is a flat dollar amount to be paid to the dealership from the lessor.

- Membership Fee - This amount will be short-funded from the lessor and should be paid by the customer.

- Collect Membership Fee from Customer - If checked, this amount will be added to the receivable amounts for the customer and will not be considered a cost to the dealership.

- Total Reserve Due From Lessor - The total amount the lender will pay for the leasing income on this deal.

Reserve Percentage

If you are marking up a money factor on your lease, then you generally get to share a percentage of the total rent charge increase that will be collected over the course of the lease.

In the Deals system, you'll enter your sell rate as the money factor the customer is going to be contracted for. Then, enter your Buy Rate in the lease profits section. You'll see a Total Leasing Profit number show. This number is calculated by the following method:

- Calculate the Total of Payments for the Money Factor that was sold to the customer.

- Calculate the Total of Payments for the Buy Rate that you are getting the lease from the lessor for.

- Total Leasing Profit = #1 - #2

Then, you'll need to add a percentage into the Reserve Percentage field. Let's say our Total Leasing Profit was 700 of the leasing profit included there.

Total Reserve Due from Lessor

Total Reserve Due from Lender is calculated using all the other values in the Financing Profits section. This amount will be added (whether positive or negative) to the receivable amount from your lender.

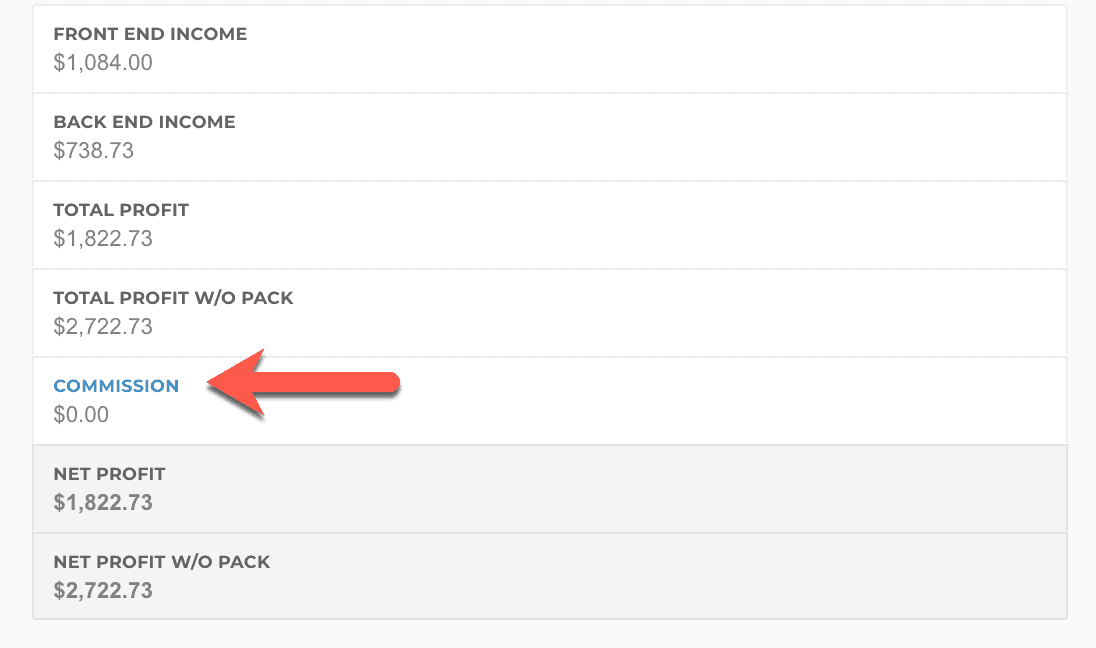

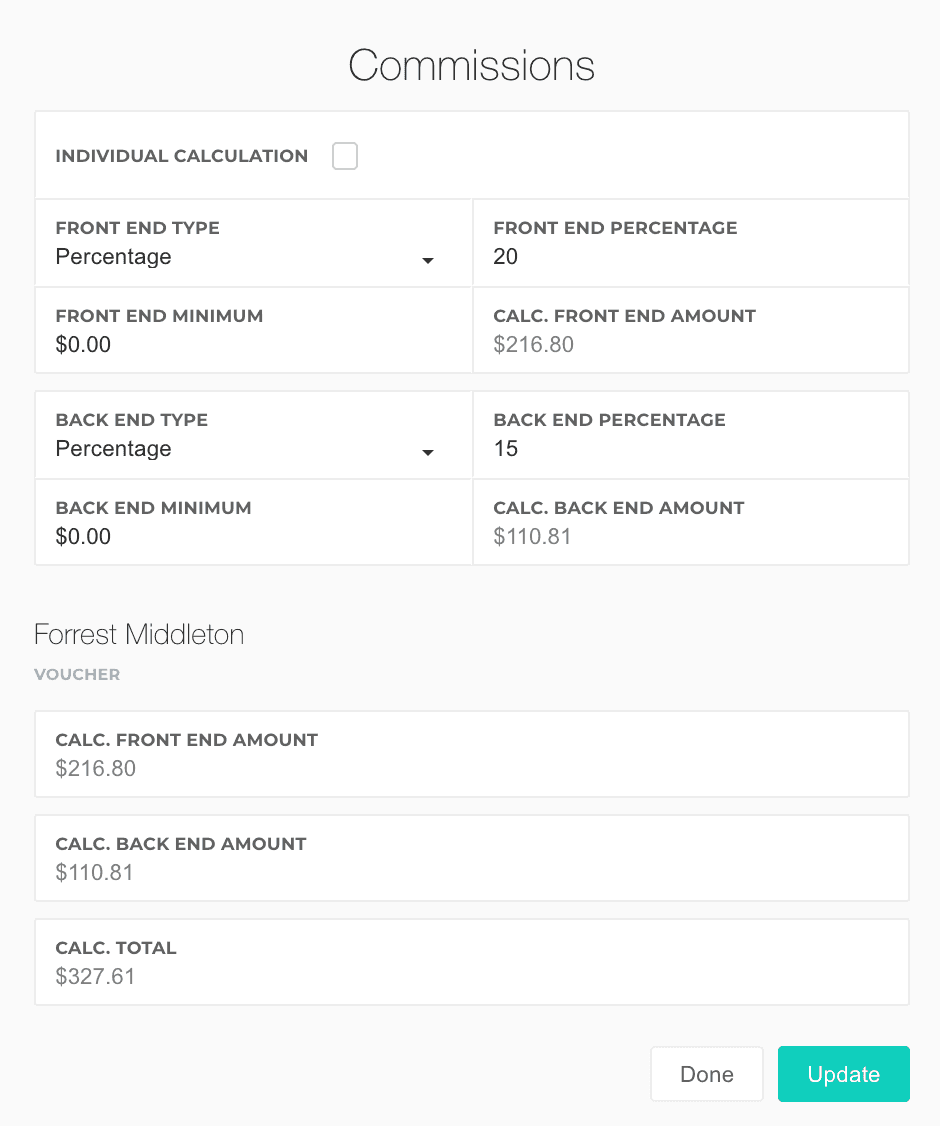

Commissions

Commissions are accessed from the Profits section on the Finances tab.

Once the dialog has been opened, you can calculate commissions using a fixed or percentage based amount.

Make sure you've added salespeople on the Details tab of the deal. If you haven't, no salespeople will show up in the commissions section.

Fixed

Fixed requires that you type in the exact dollar amount to pay the salesperson. The Minimum fields still apply to fixed commissions.

Percentage

Percentage calculations are based on the front end or back end profits and can be used with the Minimum fields to ensure that a salesperson always gets paid a minimum amount on a deal.

If you want to set a negative commissions on a deal (where the salesperson essentially has to "pay" you, or get paid less on their total commission check), you have to change the Front End Minimum or Back End Minimum to a negative value.

Splits

If you have multiple salespeople on deal, any calculated commissions will automatically be split evenly among all salespeople.

If you want to override calculations for each salesperson, you can check the Individual Calculation checkbox near the top of the dialog and calculate percentage-based or fixed commissions for each salesperson. This can be useful if you have a finance manager and salesperson involved in a deal.

Chargebacks

Chargebacks are recorded by simply changing the commission amount on the deal. There is no way to run a "report" on chargebacks, it will simply modify the total commission on the deal and on the commission report for that deal.

If you use the accounting system and an accounting lock is active on the deal, then the system will prompt you to make an adjustment. Making the adjustment will show a separate chargeback amount in the accounting system. This makes it easy to track what commissions and chargebacks have been paid.

Commission Voucher

Once you've added commissions to the deal, you can click the Voucher link below the salesperson's name in order to provide them a printed document with their commissions for this particular deal.

More often, a Commissions report is used to give the salesperson a single page with all their deals.

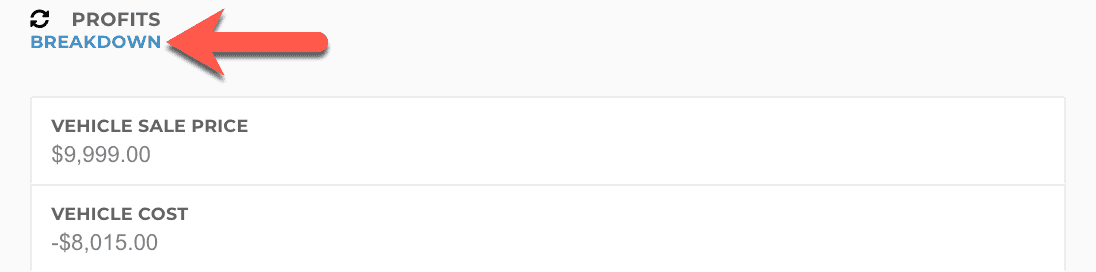

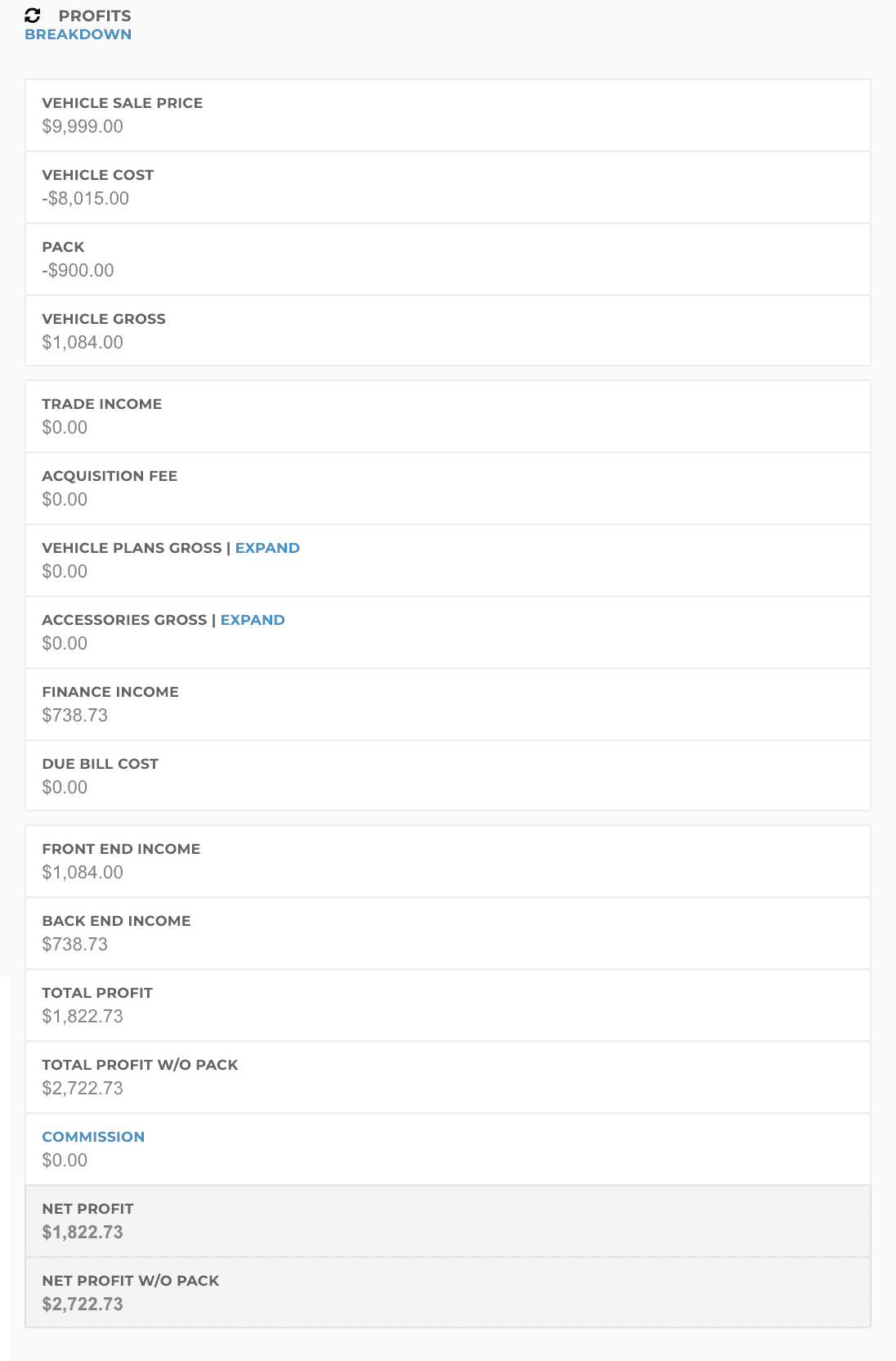

Profits

The Profits section shows you a breakdown of the profit calculations on the deal.

Accounting Profit

The accounting profit field is displayed to dealerships w/ accounting enabled based on whether pack is included as a cost. This allows us to have a value to compare and confirm that accounting profits are aligned with deal profits.

Pack

Pack profit is sometimes broken out into different totals, depending on whether Count Pack as Cost is checked on the inventory. If it is not checked, then you'll see four totals.

- Total Profit - The total deal profit with pack being considered a cost and reducing profit.

- Total Profit w/o Pack - The total deal profit excluding pack as a cost. Meaning, "Pack" in this case is now considered profit.

- Net Profit - The total deal profit after commissions with pack being considered a cost and reducing profit.

- Net Profit w/o Pack - The total deal profit after commissions excluding pack as a cost. Meaning, "Pack" in this case is now considered profit.

Deal Breakdown

The Deal Profit Breakdown is a useful download if you want a recap of the deal to get printed.