Statuses

Deals follow a lifecycle of statuses as they move through the closing process. It's important to know what each of these statuses mean and how they affect your dealership.

Sale Statuses

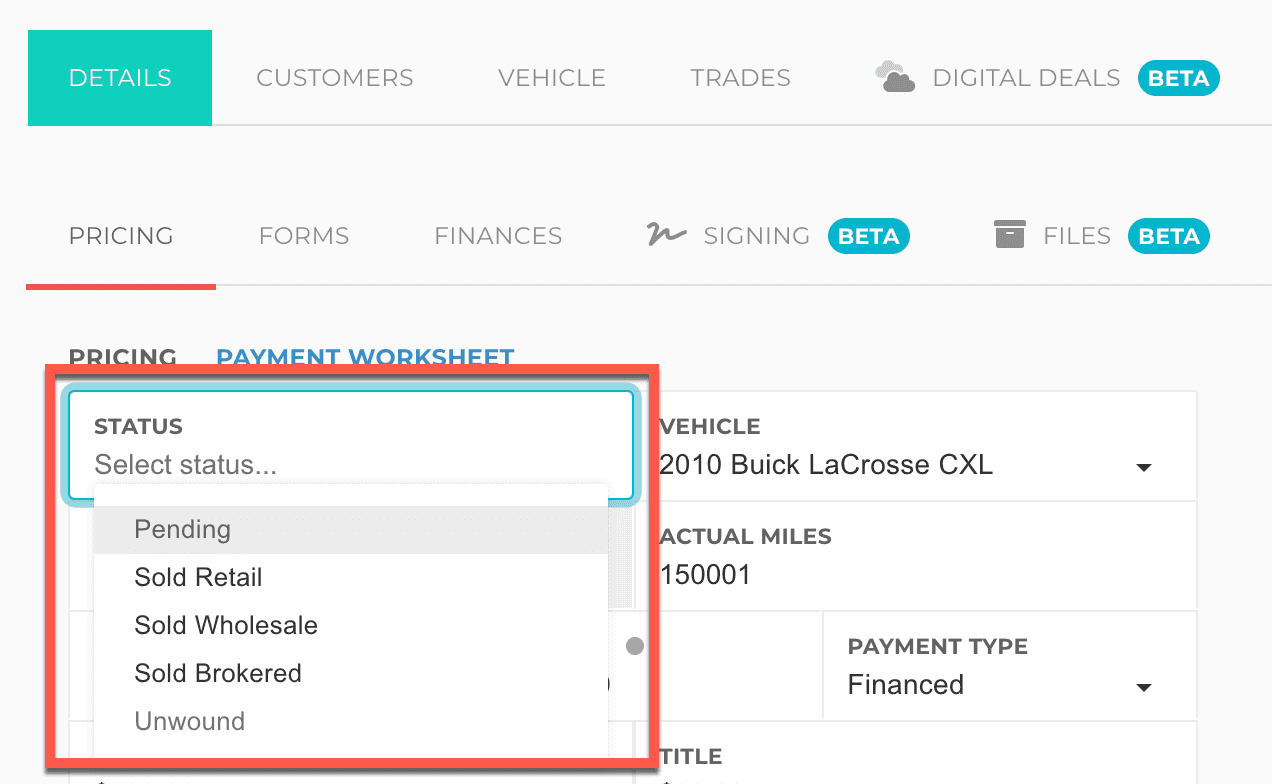

The current deal status can be found in the Status dropdown on the deal Details tab.

The deal status normally affects sales tax reports and how totals get calculated.

Pending

Deals in a "Pending" status haven't yet been closed or sold. Generally, these deals are waiting on something, like customer or lender approval. Oftentimes it's better to keep these types of deals as a Lead Worksheet.

Sold Retail

The most common sale type, deals marked "Sold Retail" categorizes deals that have been closed with a retail customer.

Sold Wholesale

"Sold Wholesale" indicates deals that have been sold to another dealer, auction, or wholesaler. These deals are generally categorized differently on sales tax reports in a "for resale" section, so it's important to mark wholesale deals this way.

Sold Brokered

"Sold Brokered" is used for deals that are brokered through another dealership.

For example, if you work with a local franchise store to get a new car for your customer, this would be considered a brokered sale.

Sold Brokered deals also don't show up on sales tax reports because the dealership providing the vehicle is generally paying taxes on behalf of the customer. You are operating more as a "bank" in this context.

To show the "Sold Brokered" option, check the Show 'Sold Brokered' Option in settings.

Your Financing

If you're arranging financing for the vehicle sale, generally you need to build out the whole deal structure. This works similarly to a bank arranging financing for the customer, and is often done by dealerships so they can get finance income or sell VSC/GAP to their customers.

Sold Brokered deals categorize all amounts received on the deal as profit (taxes, fees, etc.) and expect that you put the full cost paid to the other dealership (including purchase cost, taxes, fees, etc.) on the inventory.

Dealer Paper

If the franchise store is managing the entire sale, and simply pays you a "broker fee", then you would simply enter the flat broker fee into the sale price field on the deal. Since there are no costs, your profit should be accurate.

Unwound

"Unwound" indicates deals that have been Unwound, meaning you've taken back the vehicle and are unwinding the deal. Once a deal has been marked as "Unwound", you can't switch it back to being sold. You can, however, Duplicate the Deal Structure to restructure a new deal.

See Unwinding below.

Processing as Sold

Processing as Sold is an essential step to closing out the deal. It performs a series of tasks to help automate processes:

- Marks the vehicle as sold

- Marks the lead as sold (if applicable)

- Adds the trade(s) to inventory

- Changes the sold gavel icon to green on deals list and deal view

- Locks down certain fields on the deal (everything can still be edited using Forced Edits)

- Generates the accounting transactions for the deal

Processing as Sold should be done as soon as the deal paperwork gets signed. This helps ensure that all the deal information is accurate and starts other essential processes.

When you mark a deal as "Sold Retail", "Sold Wholesale", or "Sold Brokered" it will ask you if you want to Process as Sold.

Forced Edits

Forced Edits allows you to edit any part of the deal after it's been Processed as Sold. Generally, it's considered bad practice to modify deal financials after having signed the paperwork, but sometimes there's something that calls for it.

Forced Edits is its own permission, so you can and should control who has access to modify deals after the fact.

Accounting Implications

When Forcing Edits on a deal, any changes you make to the deal will adjust the original accounting transactions, meaning that there won't be a bunch of added unwind and rewind transactions in accounting. Instead, we just modify the original transaction to keep the books uncluttered.

If you have an accounting lock in place for the date of the deal, then a lock dialog will appear which would allow you to create an adjusting journal for just the changes.

Open/Closed

Open/Closed is automatically managed based on the balance of the deal. If the overall balance of the deal is 0.00, then the deal is Open. This helps you find deals that need your attention in the context of the balance.

Unwinding

Unwinding a Deal is done when a sale is being reversed or undone. This normally means that the vehicle is being returned to the dealership. A few steps take place here:

- The sold vehicle is added back into inventory and re-activated

- Trade-ins are deleted from inventory

- If they've already been sold, you'll have to create a new piece of inventory and switch the vehicle on that sold deal. This allows you to keep track of how you compensated the customer after the original deal got unwound.

- Accounting generates a reverse transaction for all the amounts to ensure accounting balances go back to normal

Unwind Charge

The Unwind Charge can be used to still make profit on a deal even after unwinding. It reduces the amount of money owed back to the customer after unwinding, and categorizes that money as income.

A common use case is when performing a subprime loan that the customer defaults on, and the bank requires you to buy it back from them. Once you repossess the vehicle, you oftentimes don't have to reimburse the customer for their down payment and can keep that money as profit.

Duplicate Structure

Sometimes you need to unwind a deal because the original structure was incorrect, such as bad trade or payoff information, and need to re-contract. Once a deal has been unwound, the Duplicate Structure button will be shown and will copy the full deal structure into a new deal for you to work and close.

Buy Back Loan

When working with indirect lenders, some of them require that you assign loans to them with recourse, meaning they can cancel their obligations of the loan and "send" them back to you. In these cases, the dealership can "Buy Back" the loan and take over payments. This button will:

- Create a payable back to the original lender for the amount they paid you

- Create a loan in the loans platform for you to manage payment collection