Payment Types

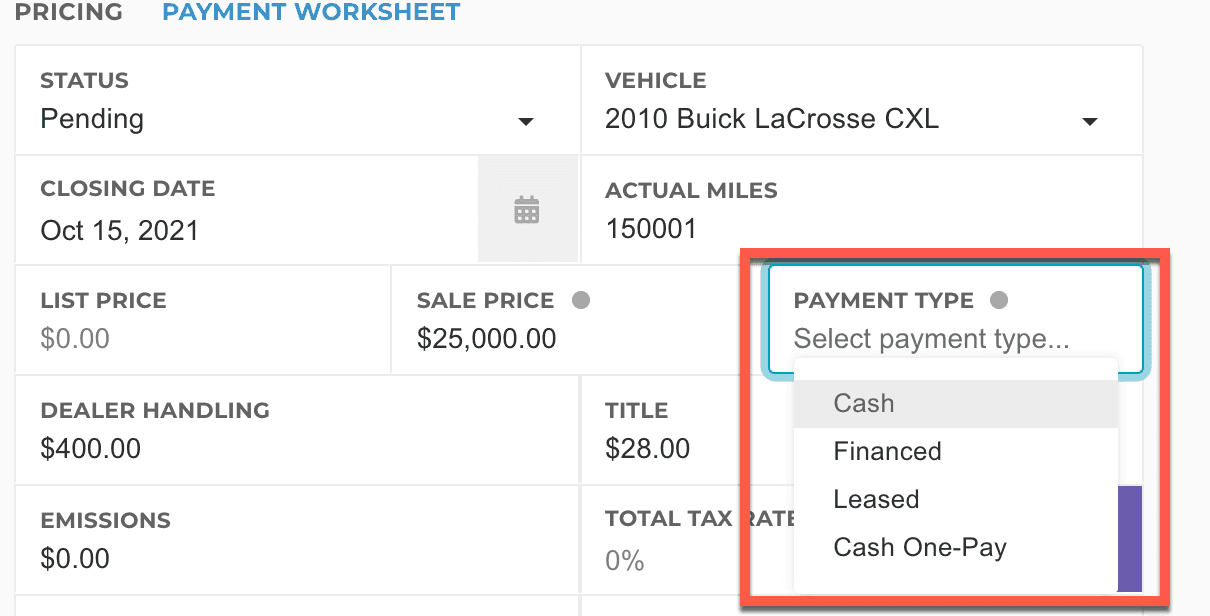

The payment type for a deal can be changed using the Payment Type dropdown on the deal.

Some common fields:

- List Price

- Sale Price

- Documentation Fee / Dealer Handling

- Tax Rate

- Vehicle Plans

- Accessories

- Due Bill

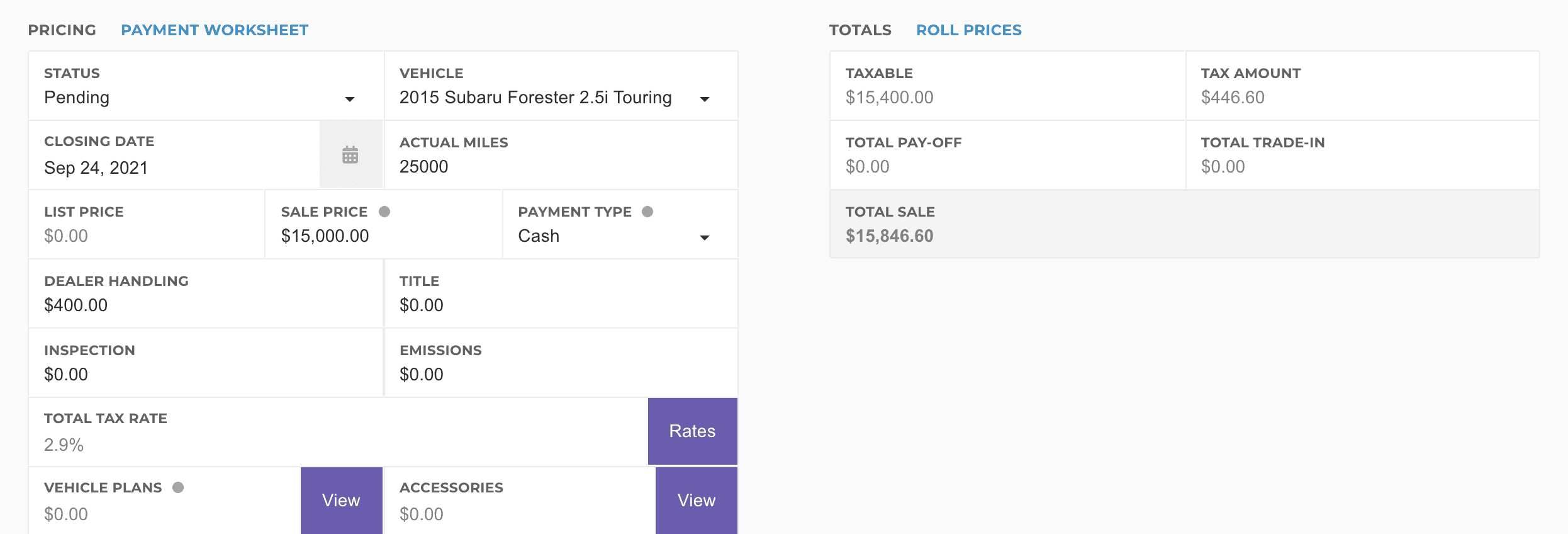

Cash Deals

Cash deals are easy to structure, and have no payment terms. The customer is expected to pay the full balance in cash or using a trade-in.

Outside Financing

Some cash deals are performed with the customer arranging financing for themselves, such as their local credit union providing a "check" for them to pay the dealership with. These local banks and credit unions will often require a buyer's order detailing how much they need to pay and how much the customer is paying, specifically in relation to the cash down.

- Cash Down - Only affects what is shown on the buyer's order/purchase agreement. Allows us to calculate what the amount financed is.

- Lien Provider - The third party bank or credit union the customer is using.

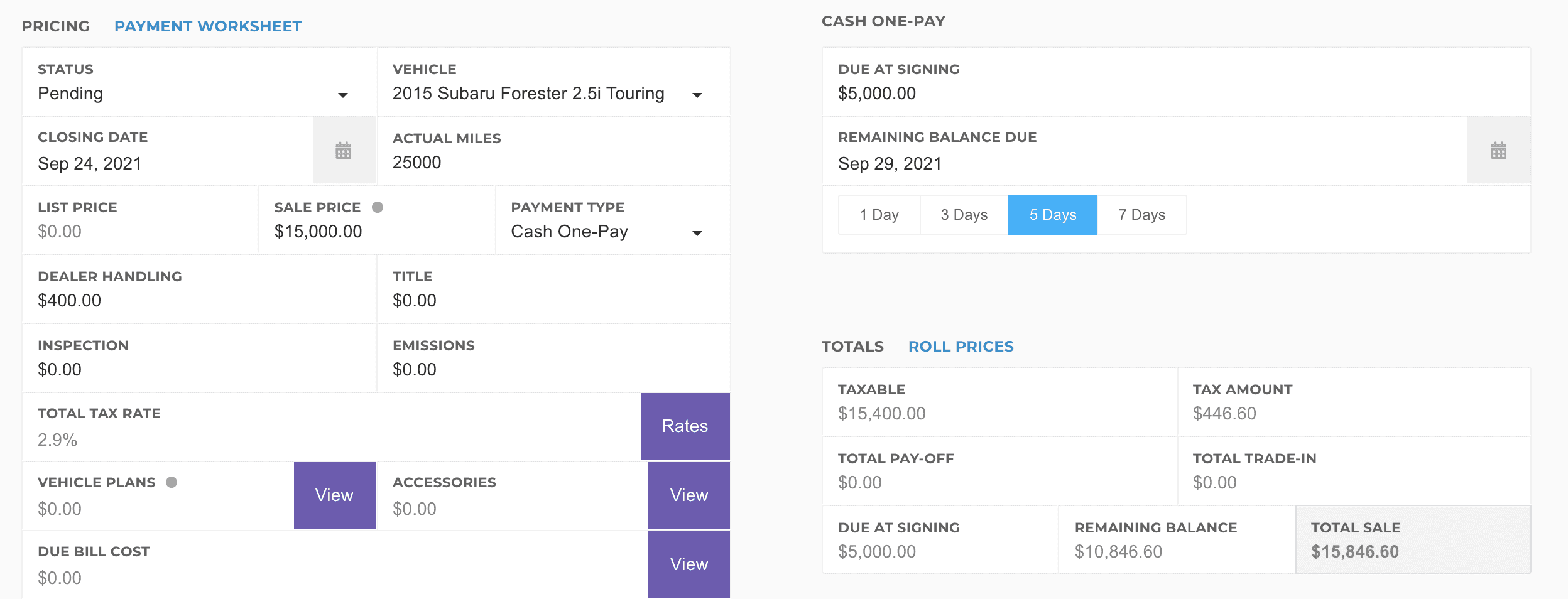

Cash One-Pay

If a customer is paying part of the sale now, and part of it later, then you can use a Cash One-Pay payment type. This is generally used if you want to lock the customer to a kind of "loan" agreement where they are agreeing, on terms of an installment contract, to pay on a certain schedule.

- Due at Signing - Amount to be paid by the customer on the date of the sale.

- Remaining Balance Due - The date by which the customer is required to pay the remaining balance on the loan. Generally it's less than 7 days.

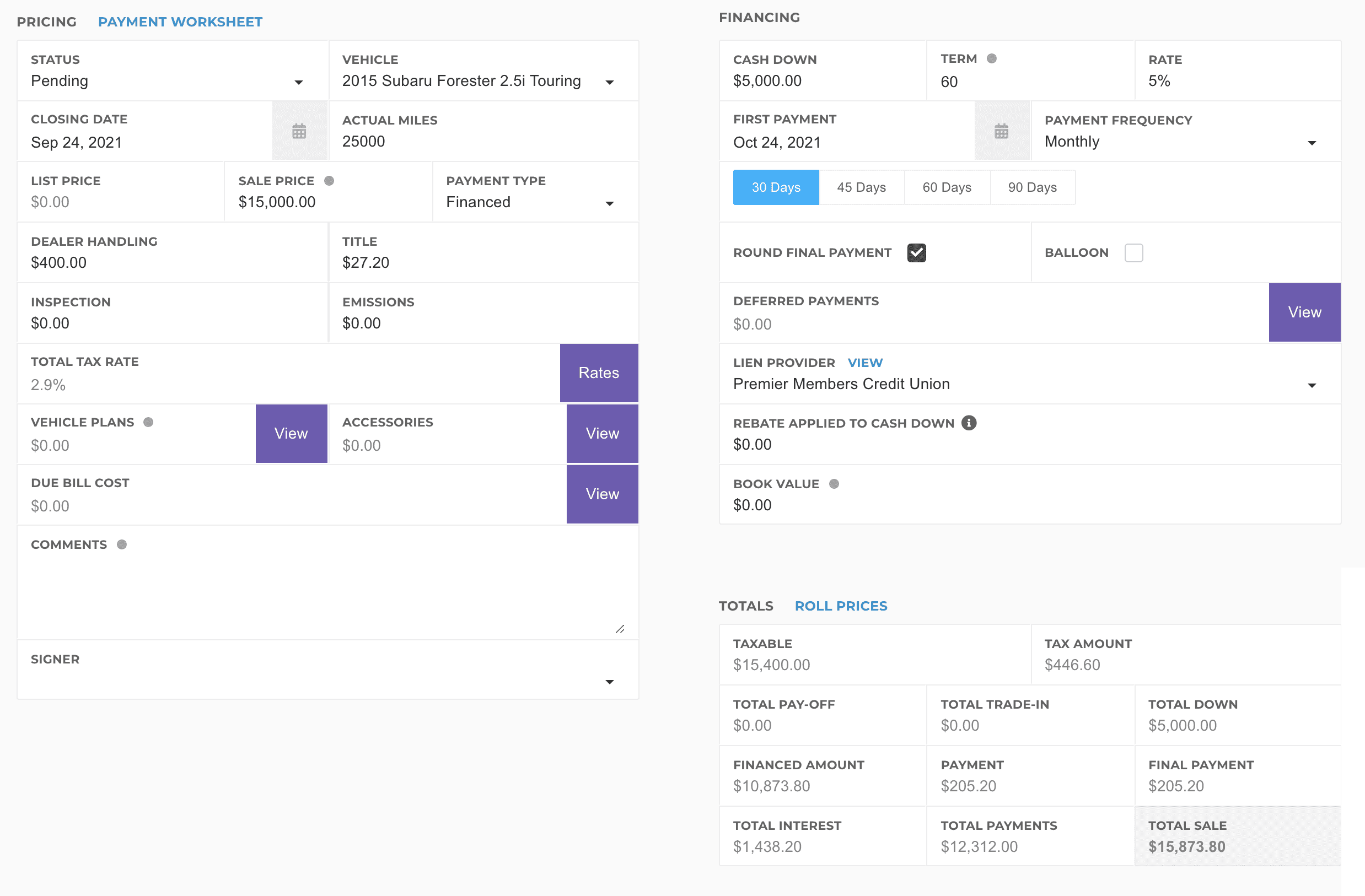

Financed Deals

- Cash Down - Amount to be paid by the customer at signing, reducing the financed amount of the loan.

- Term - The number of scheduled payments on the loan. Used in conjunction with the Payment Frequency.

- The secret circle allows you to set a specific monthly payment, for example, $200.00/mo. This is useful for BHPH loans.

- Rate - The interest rate for the loan.

- A secret circle will be shown if the APR (annual percentage rate) is more than .125% (1/8th of a percent) more than the interest rate.

- First Payment - The date for the first payment.

- Payment Frequency - Monthly, Weekly, Bi-Weekly, or Semi-Monthly

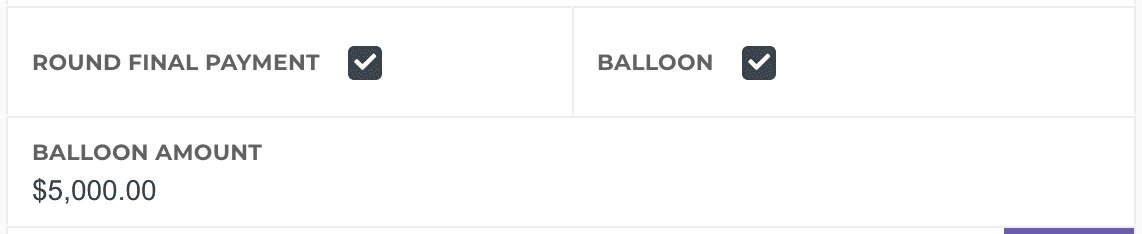

- Round Final Payment - Make the final payment equal to the normal monthly payment.

- Balloon - For a loan with a "balloon" at the end of it. See Balloon Loans for more information.

- Deferred Payments - Cash down payments that are deferred from the date of the sale. This can be used to collect payment from customers over a series of weeks or months from the loan signing in case they don't have the cash to pay the down payment immediately. Interest is not accrued against deferred down payment amounts.

- Lien Provider - The lienholder for this deal.

- Rebate Applied to Cash Down - Applies a rebate to the cash down portion of the deal, reducing how much the customer has to pay.

- If a customer isn't paying any cash down, but gets a 2,500 into both the Cash Down field and the Rebate field.

- Book Value - Not used in any deal structure calculations, but can provide you the LTV on the loan and will sometimes autofill into third-party financing sites.

Balloon Loans

Balloon payments are set up so that there's a "balloon" final payment at the end of the loan. Essentially, it forces the "final payment" of the loan to be large so that the monthly payment can be reduced. This is commonly used in shorter term loans as an alternative to leases. Customers will normally refinance the loan rather than actually paying the amount of the balloon.

Finance Calculations

If the days to first payment aren't equal to the days in a normal period, the monthly payment would also need to change to accommodate the additional interest.

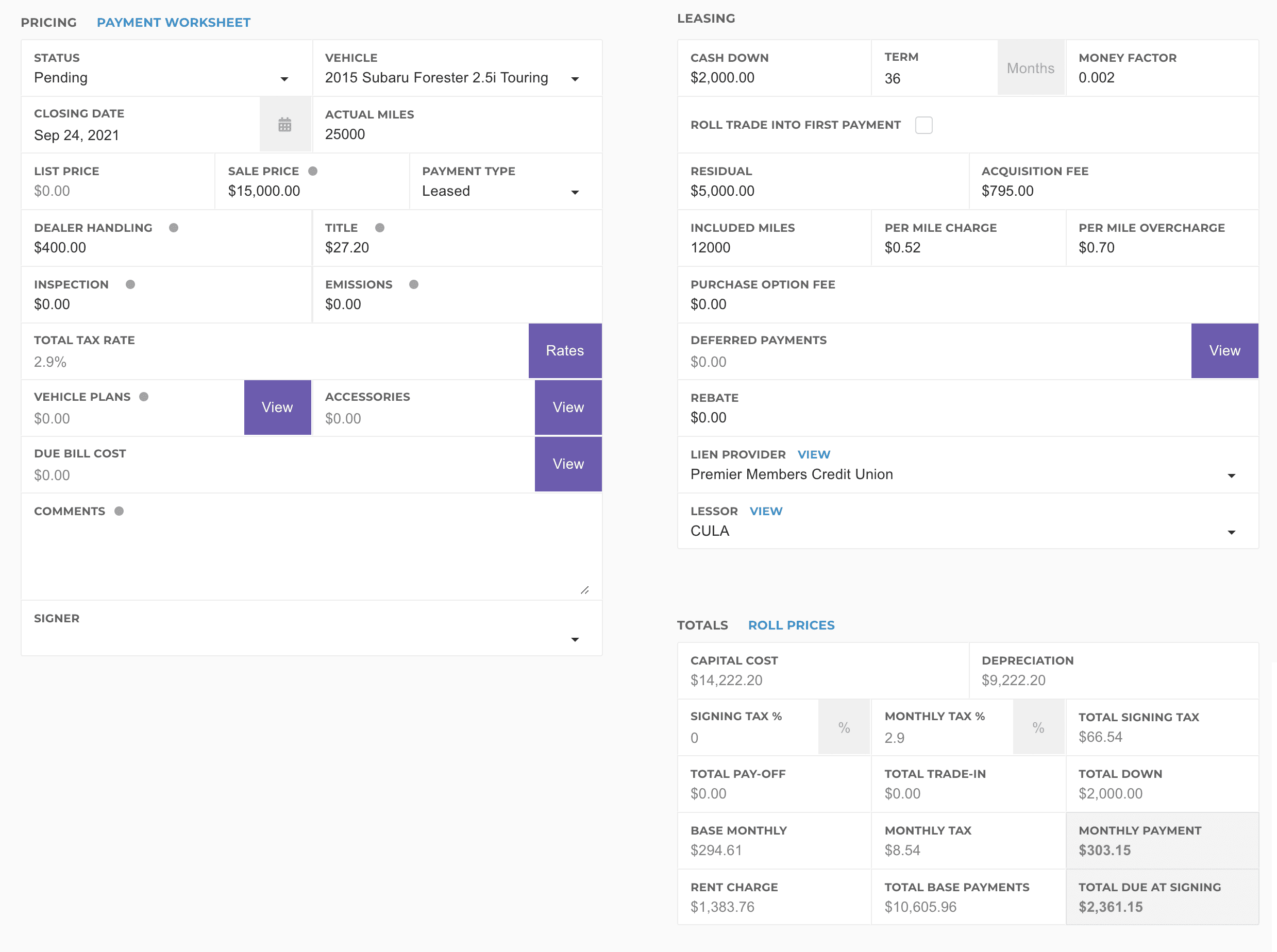

Leased Deals

- Cash Down - Used to reduce the capital cost, paid at signing. The customer will have to also pay taxes on the cash down amount at signing.

- Term - Term, in months, of the lease.

- Money Factor - Used to calculate the "rent charge" on the lease.

- Roll Trade into First Payment - If a customer has a trade-in and wants to use the value of the trade to pay for the first payment due at signing, check this box.

- Residual - The value of the trade at the end of the lease. Used to calculate the depreciation that the customer is paying for over the term of the lease.

- Acquisition Fee - A fee paid by the customer for getting the lease. This is rolled into the capital cost of the lease.

- Included Miles, Per Mile Charge, Per Mile Overcharge, Purchase Option Fee - Used only on some printed lease agreements. Has no effect on calculations.

- Deferred Payments - Cash down payments that are deferred from the date of the sale. This can be used to collect payment from customers over a series of weeks or months from the lease signing in case they don't have the cash to pay the down payment immediately. Interest is not accrued against deferred down payment amounts.

- Rebate - Reduces the amount owed by the customer at signing.

- If a customer isn't paying any cash down, but gets a 2,500 into both the Cash Down field and the Rebate field. This means the customer would still need to pay taxes on the rebate amount.

Capitalizing Fees

Everything that can be capitalized on a lease is capitalized by default, however there are secret circles on most of the fees, vehicle plans, and accessories that allows you to choose whether you want to capitalize that fee or collect it upfront at signing.

Due at Signing

The due at signing amount includes the following:

- The first monthly payment

- Cash Down

- Taxes on capital cost reduction (cash down, trades)

- Taxes on total of payments, if applicable

Capital Cost

The Capital Cost shown in the deal totals is technically the Adjusted Capital Cost. This is normally what gets used on the lease to calculate monthly payments. This is also what is used to calculate the total depreciation on the lease, which gets utilized in the lease calculation. Practically everything gets added into the Capital Cost, similarly to the Total Sale on a cash or financed deal.

Lease Calculations

Monthly payments on a lease aren't calculated the same way as monthly payments on a financed loan, so we wanted to document the method below.

The first, critical, step is to calculate the capital cost of the lease as that's the most important factor here. Then, you can calculate the base monthly payment.

Taxes are generally collected over the term of the lease with each monthly payment, so be sure to add that in if it applies to your lease.