Working with Accounting

The Accounting platform allows you to pay and receive money, reconcile accounts, and generate financials for your dealership. We like to break down the fundamentals into what we call the Four Pillars: Payables, Receivables, Deposits, and Banking.

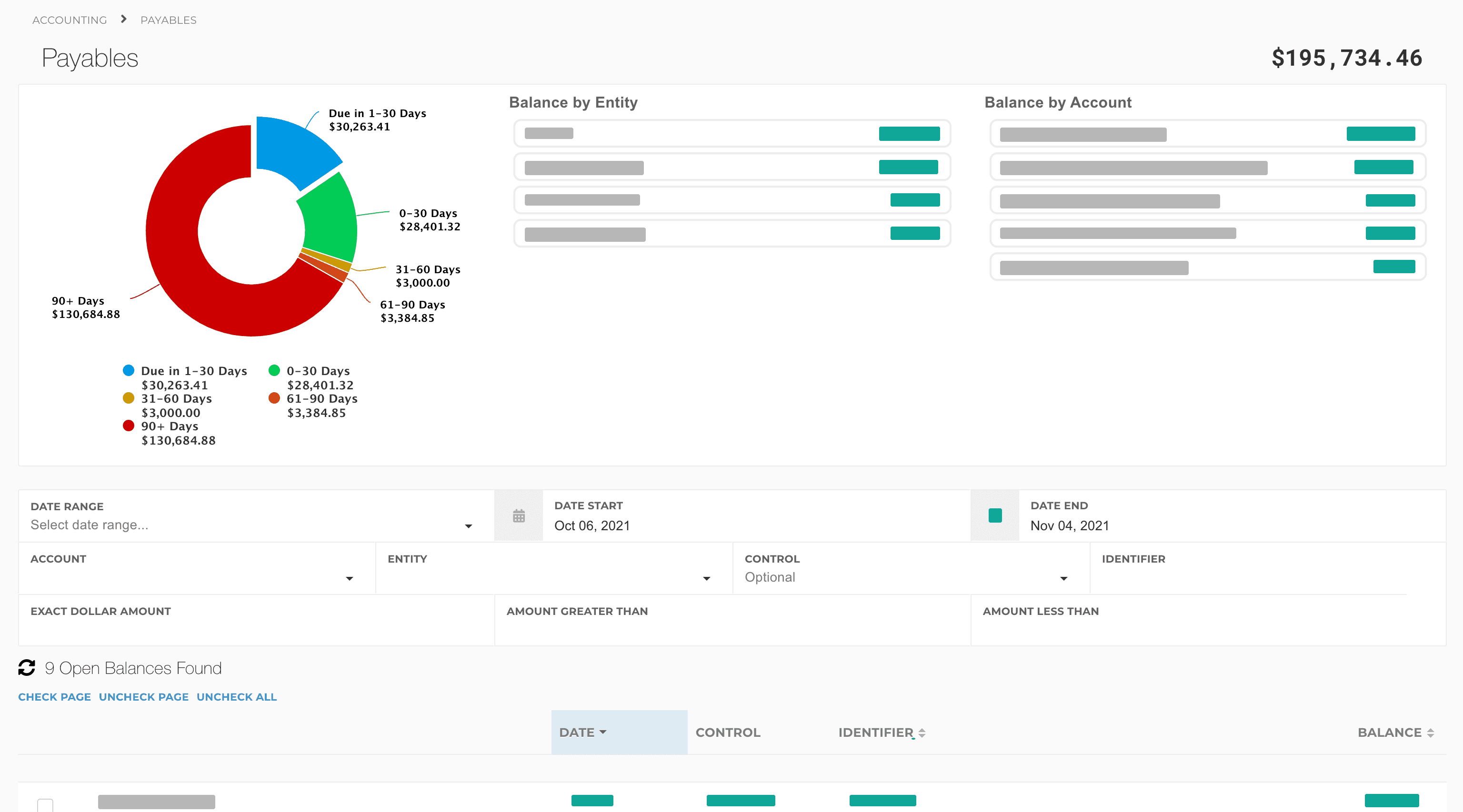

Payables

Payables involve all operations related to paying bills:

-

Costs - Inventory purchase, recon, detail, etc.

-

Expenses - Insurance, building lease, office equipment, restaurants, etc.

-

Paying in Items - Deals, Tickets, Inventory

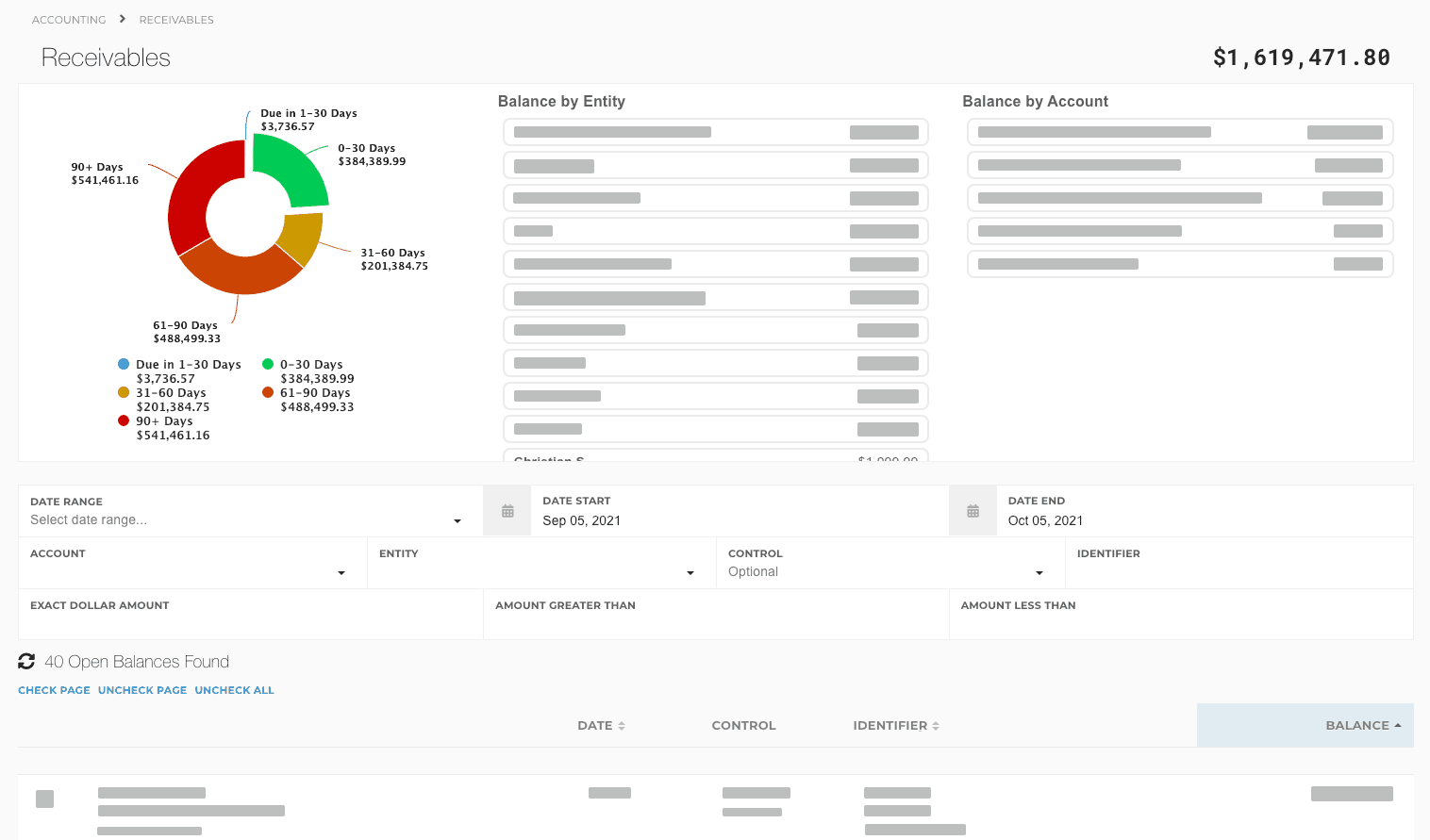

Receivables

Receivables involve all operations related to receiving money, primarily that of Payments and receiving money on tickets, deals, and loans.

- Receivables Dashboard

- Receiving in Accounting

- Receiving in Items - Deals, Tickets, Loans

- Receivables Reports

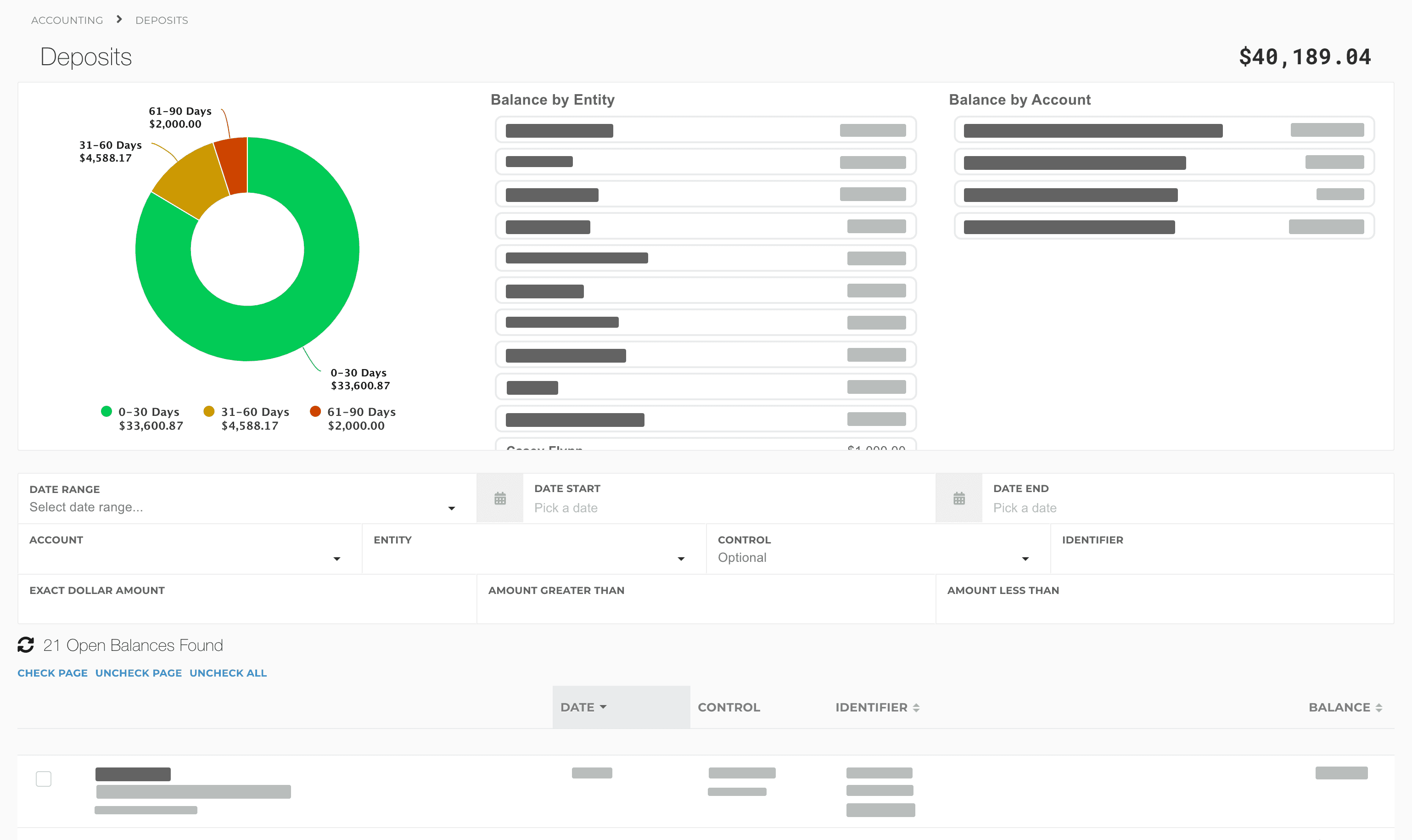

Deposits

Deposits record that money received on a Receivable actually makes it into your bank. This is an essential step that involves Undeposited Funds and ensures that money was actually deposited.

- Deposits Dashboard

- Depositing in Accounting

- Depositing In Items - Deals, Tickets, Loans

- Undeposited Funds

Banking

Banking relates to the banking feed and reconciliation process. It helps ensure that all transactions from your bank or credit card get recorded in accounting.

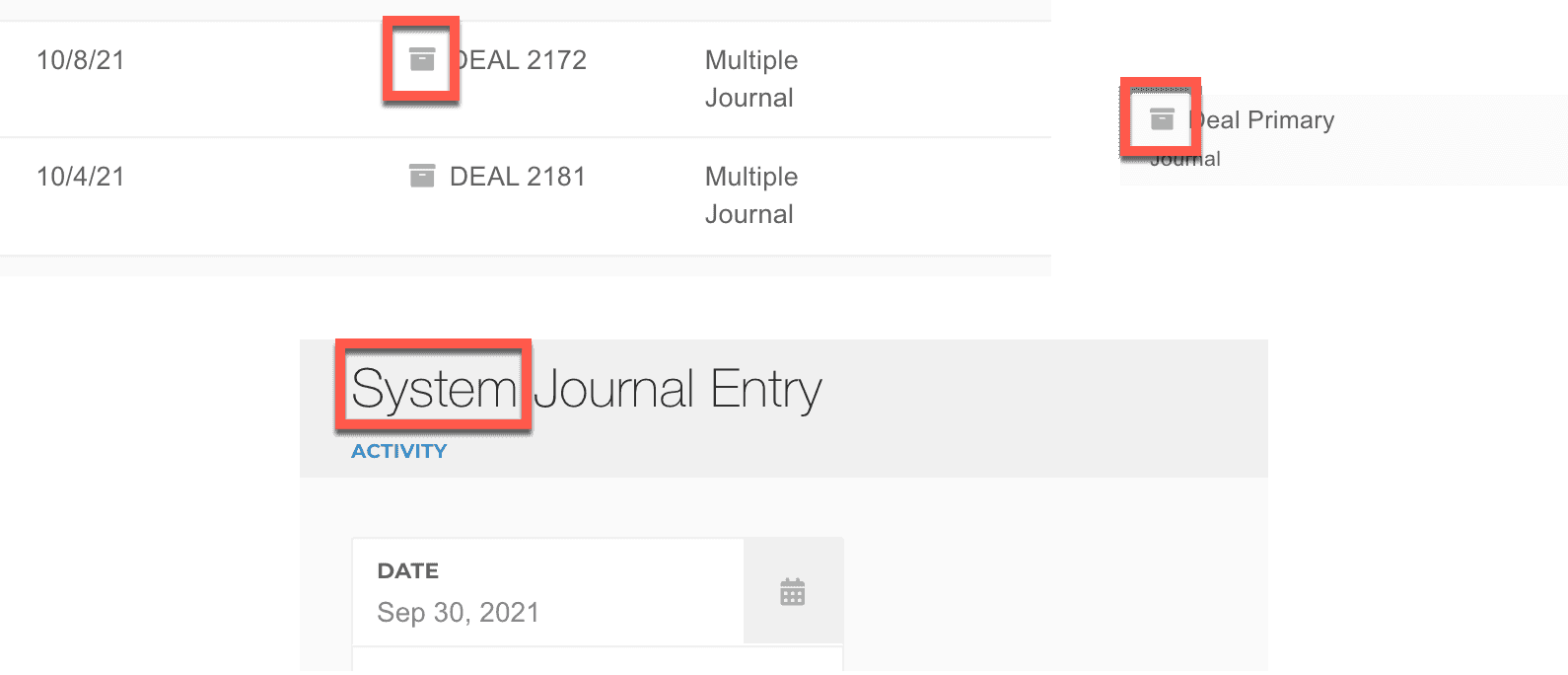

System Transactions

System Transactions are accounting transactions that are automatically created because of a financial operation somewhere else in the system. The following are examples of operations that will create system transactions:

- Adding a cost

- Processing a deal as sold

- Receivable from customer and bank

- Payable to service contract or GAP companies

- Receiving a payment

System transactions can be identified by looking for a gray box, or the transaction title containing System.

System Transactions cannot be modified manually. You must modify the original Item that created the transaction in order to modify it.

For example, if you added a cost for 5,000 and wanted to change the created payable to be 4,500, you'd have to modify the 5,000 cost. You can't modify the transaction directly to 4,500.