Payables

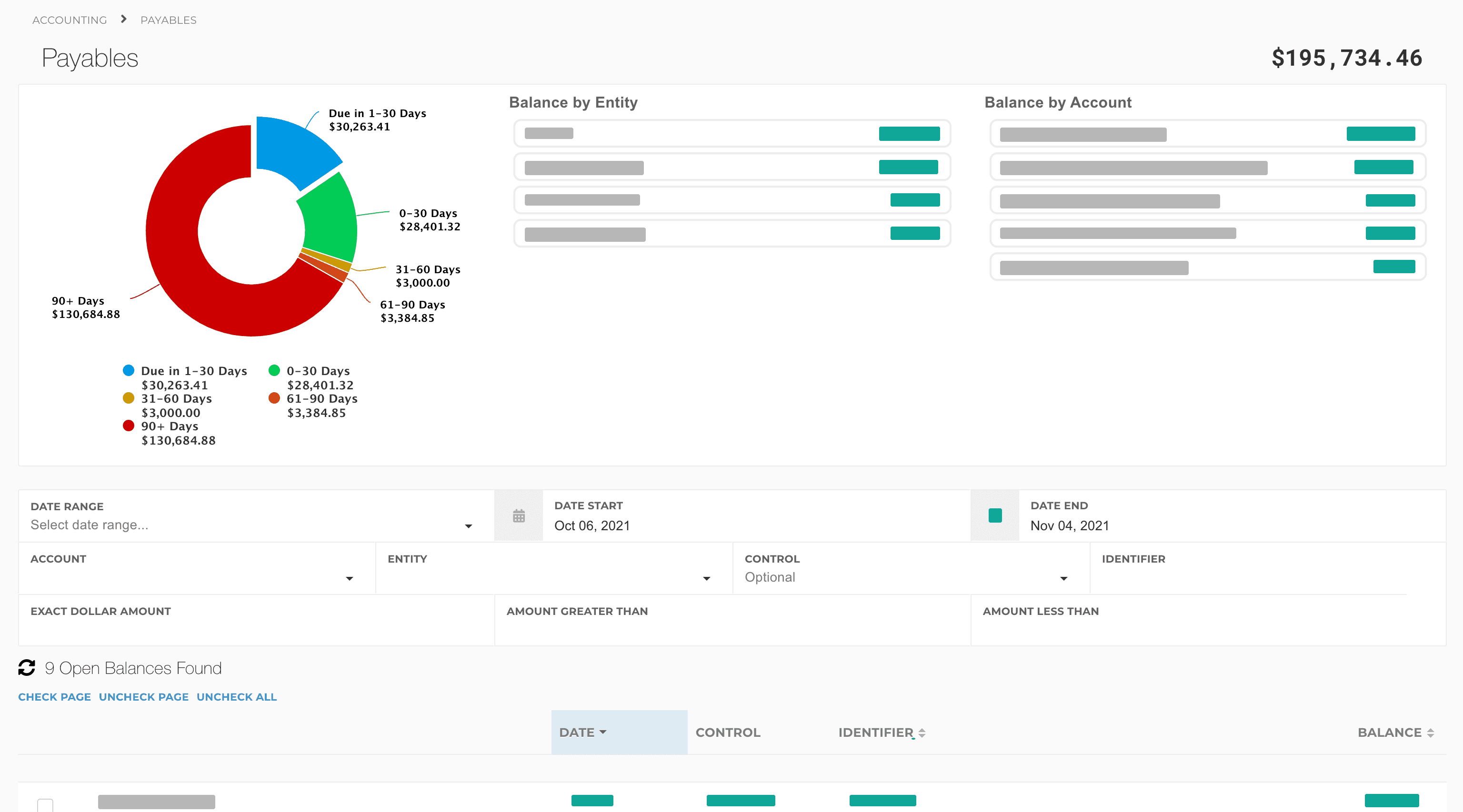

Dashboard

The Dashboard gives you a quick view of whom you owe money to, and allows you to identify and filter by older bills quickly and efficiently.

Filtering

- Balance by Age - The pie chart shows aging of your payable amounts, and you can click on each slice to filter down to just those bills.

- Balance by Entity - The entity column shows you who you owe the most money to, and clicking an entity quickly filters to just their bills.

- Balance by Account - The account column shows payable balances in each of your accounts, and clicking an account will show you all bills in that category.

Paying from Accounting

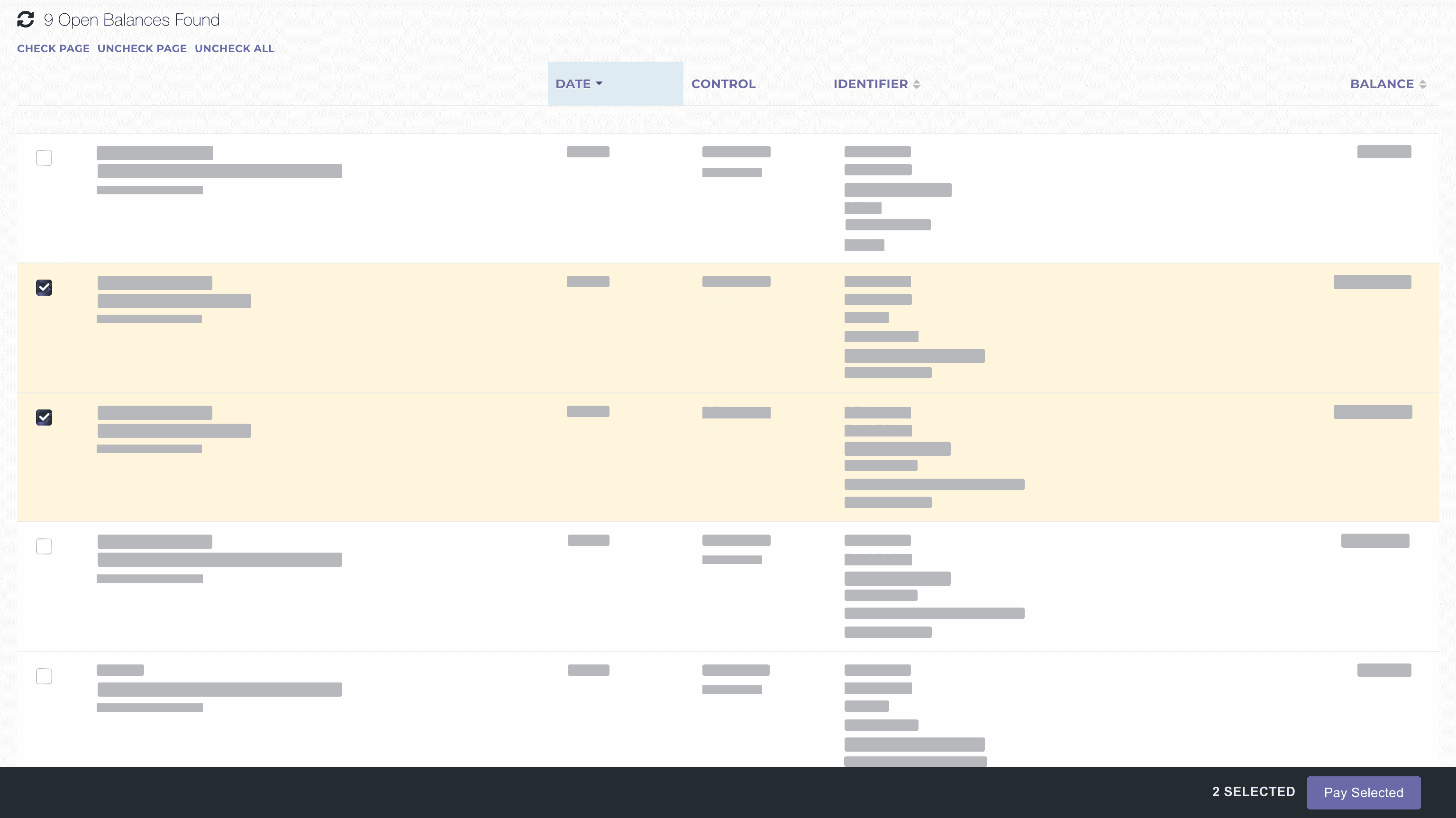

From the Dashboard

You can make payments via the Dashboard by checking off the items on the left-hand side you want to pay, and then clicking Pay Selected.

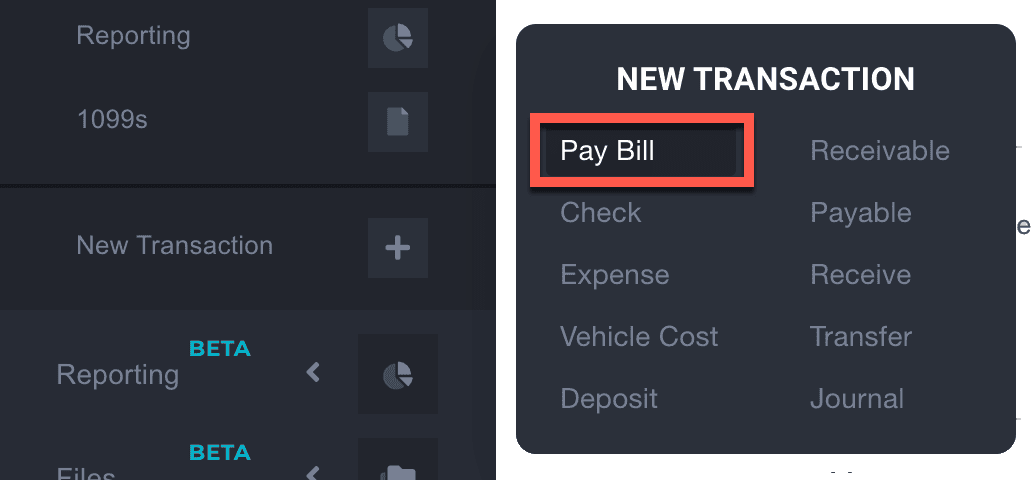

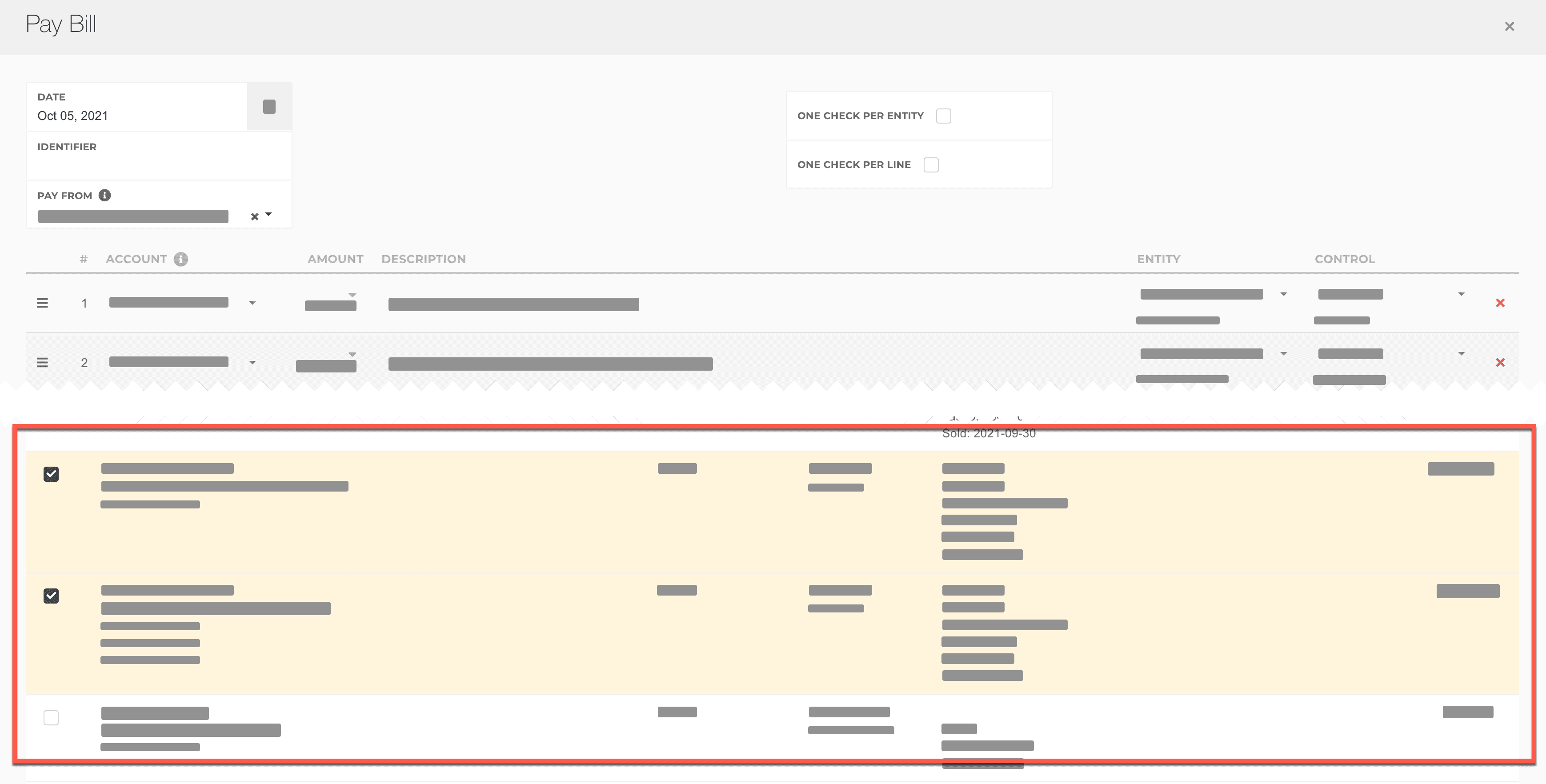

New Transaction

If you go to New Transaction > Pay Bills you can check the items you want to pay in the open transactions section.

Paying from Items

Unlike receivables, anytime you want to record a payment for something you'll have to interact directly with accounting in the payables screen, the Accounting Panel, or the New Transaction pop out.

Inventory costs and floorplan payments are two exceptions to the above rule:

- Inventory Costs - Change the Payment Account dropdown to reflect how you're paying for the cost. Normally this would be a credit card or floorplan account, or a checking account for ACH purchases.

- Floorplan Payments - Change the Payment Account dropdown to reflect how you're making the payment. Since floorplan payments are often paid via ACH, this would normally be your checking account.

You can also use the Accounting Panel in each of these items to receive money.

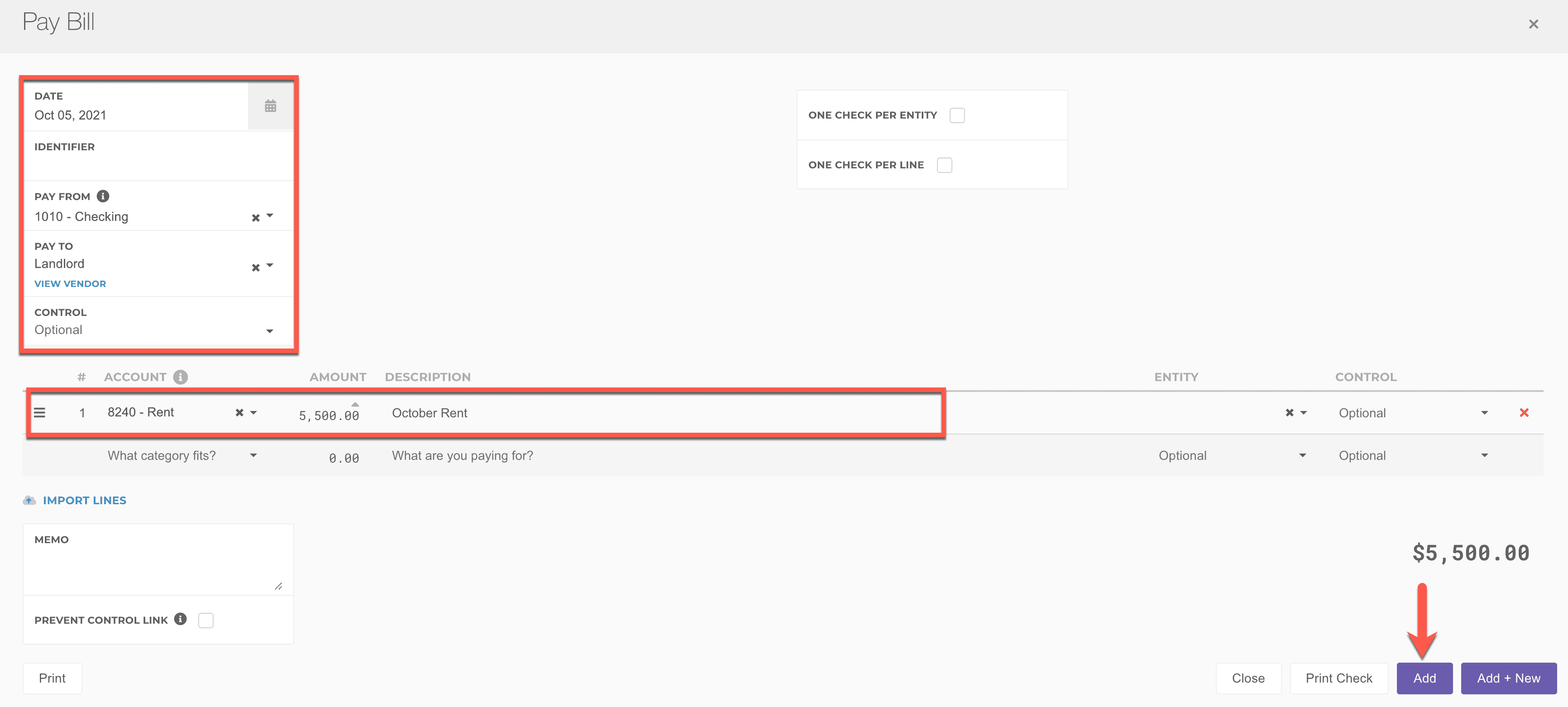

Expenses

Creating expenses is a simple process!

- Click New Transaction > Expense on the sidebar.

- Select your date, who you're paying, and how you're paying.

- Select a category (account) appropriate to your expense, add the amount, and add a description.

- Click Add! Or, print a check if you need to.

Picking a Category

If you're new to accounting, understanding which account/category to select for an expense can be challenging. To make it a bit easier, we've created a table below that should help you get started with the most common expense types!

| Account/Category | Examples |

|---|---|

| Business cards, Facebook Ads, paid listings (CarGurus, Cars.com, AutoTrader, etc.), or other marketing related expenses. | |

| Office supplies (pens, paper, toner), software (dealr.cloud, email service, domain registration), and small equipment purchases (computers, phones, printers). | |

| Yard maintenance, contractor repairs (plumbers, electricians), or janitorial services. | |

| This account should be used when you're writing off something, like a receivable that's never going to get paid, or undeposited funds that were lost. | |

| This is where you should put all the fees you're charged by your merchant or credit card processor. | |

| Business meals, coffee for customers, etc. | |

| Anytime you're sending something in the mail! UPS, FedEx, USPS (certified letters), and similar expenses. | |

| Accounting services, lawyer fees, consulting costs, etc. | |

| Monthly service fees, overdraft charges, etc. | |

| Liability insurance, garage protection, worker's compensation, etc. | |

| Payment for your monthly lease or rent bill. | |

| Water, electricity, natural gas, etc. |

There are a lot of other accounts that get created out of the box, and you're welcome to look through them and use those as well. If you don't see a category that fits, just create a new account! Accounts can have tax implications, so you should check with your accountant as well.

Printing Checks

Here is how you can print checks from the system.

Reports

The easiest way to understand your open payables and aging is through the Dashboard, but if you need a printed report, the below options can help: