Reconciliations

Reconciliation is the process of comparing the transactions from a Bank Statement to the transactions in accounting and confirming that the transaction in your Bank Statement are in accounting with the correct amount. Then, by marking the transaction as Reconciled, the transaction is locked and unable to be changed to ensure that your Bank Statement reconciliation can't be changed and mess up the account balance in the future.

Reconciliation Process

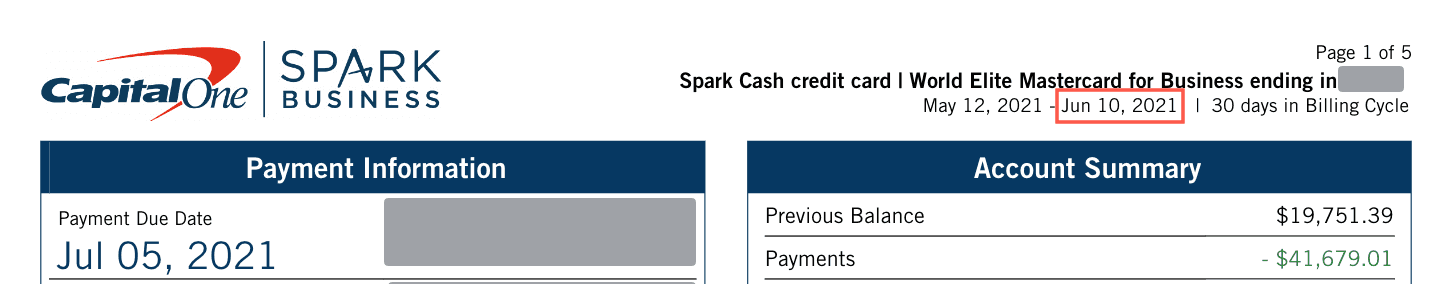

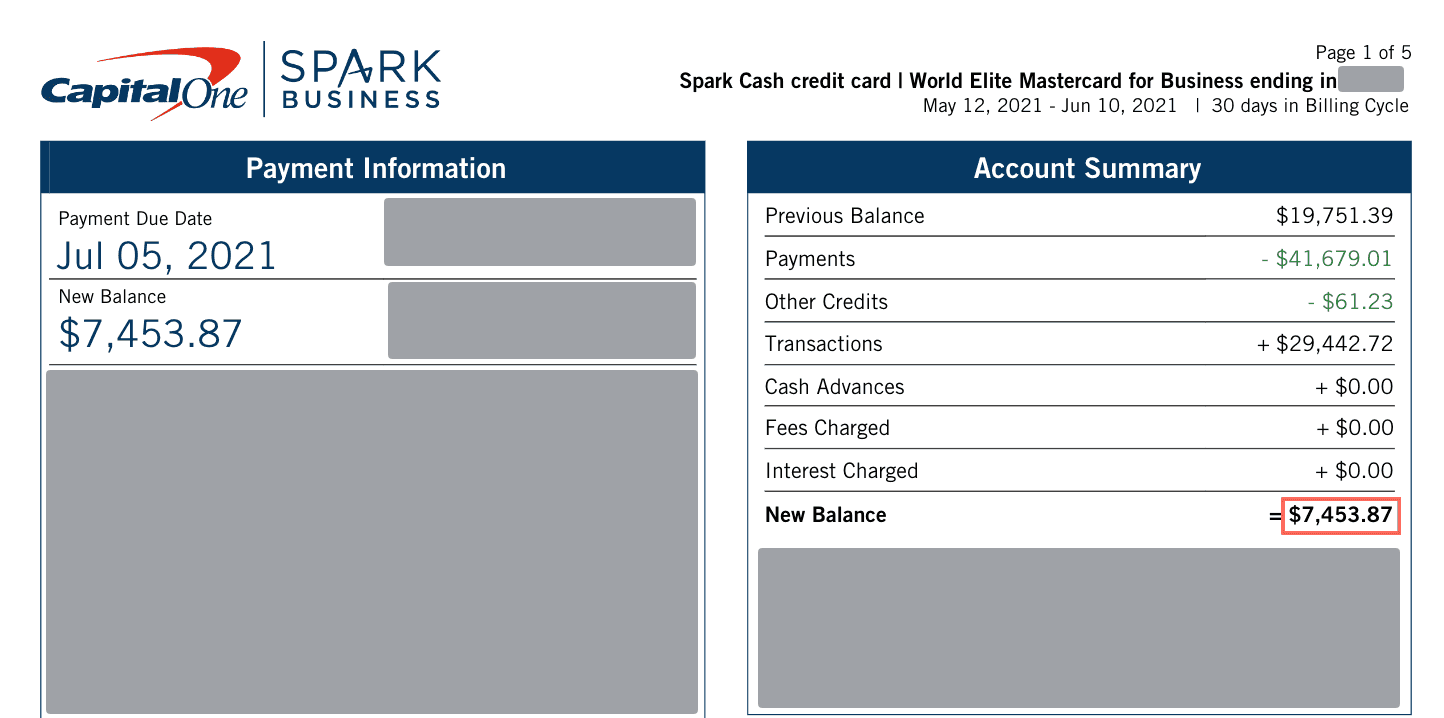

First, get a statement from your bank or credit card company. It's important to have an actual statement rather than just looking at your bank transactions because the transactions on the bank statement are final and won't change.

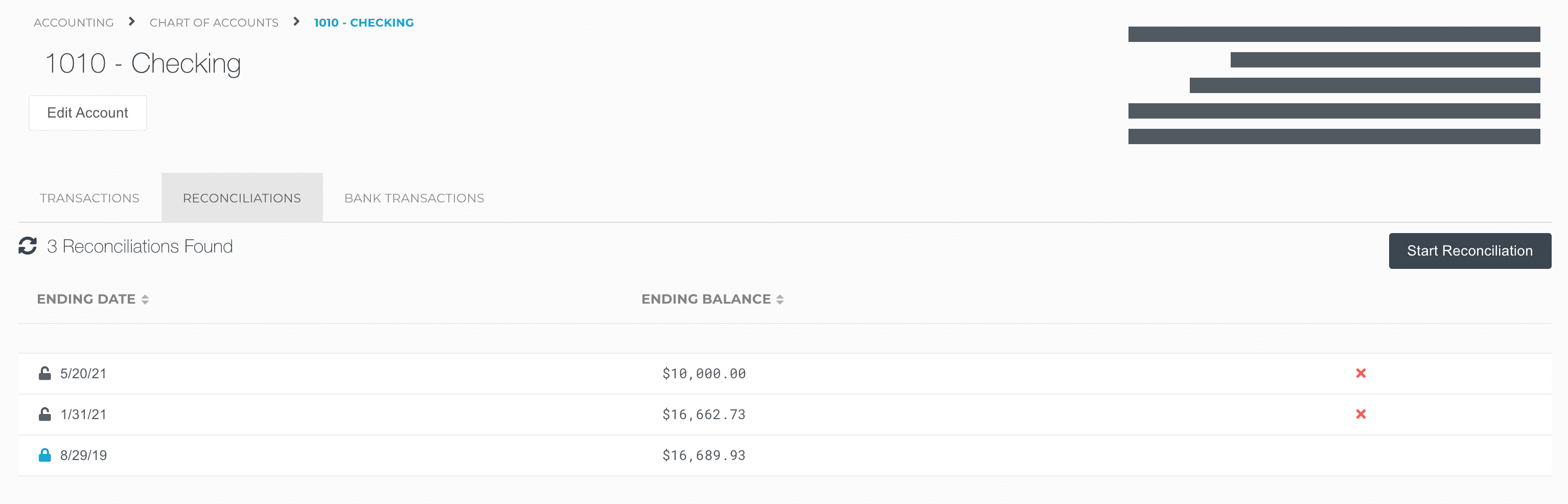

Then, open up the reconciliation in accounting by going to Chart of Accounts, open the account, and click to the Reconciliations tab.

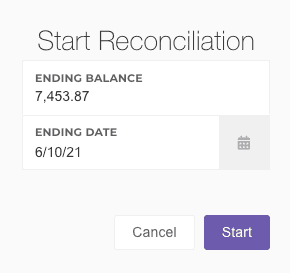

Start Reconciliation

Click Start Reconciliation, and enter the ending period date from your statement. It's important to get the end date of the period to enter in your reconciliation balance.

You also need to enter the ending balance in the account, which you can also find on your statement.

Reconciling

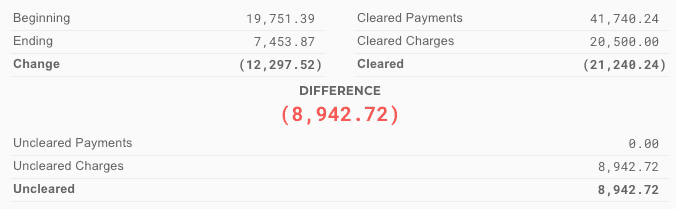

The objective for the reconciliation is to get the Difference to go to $0.00.

A few useful things to know:

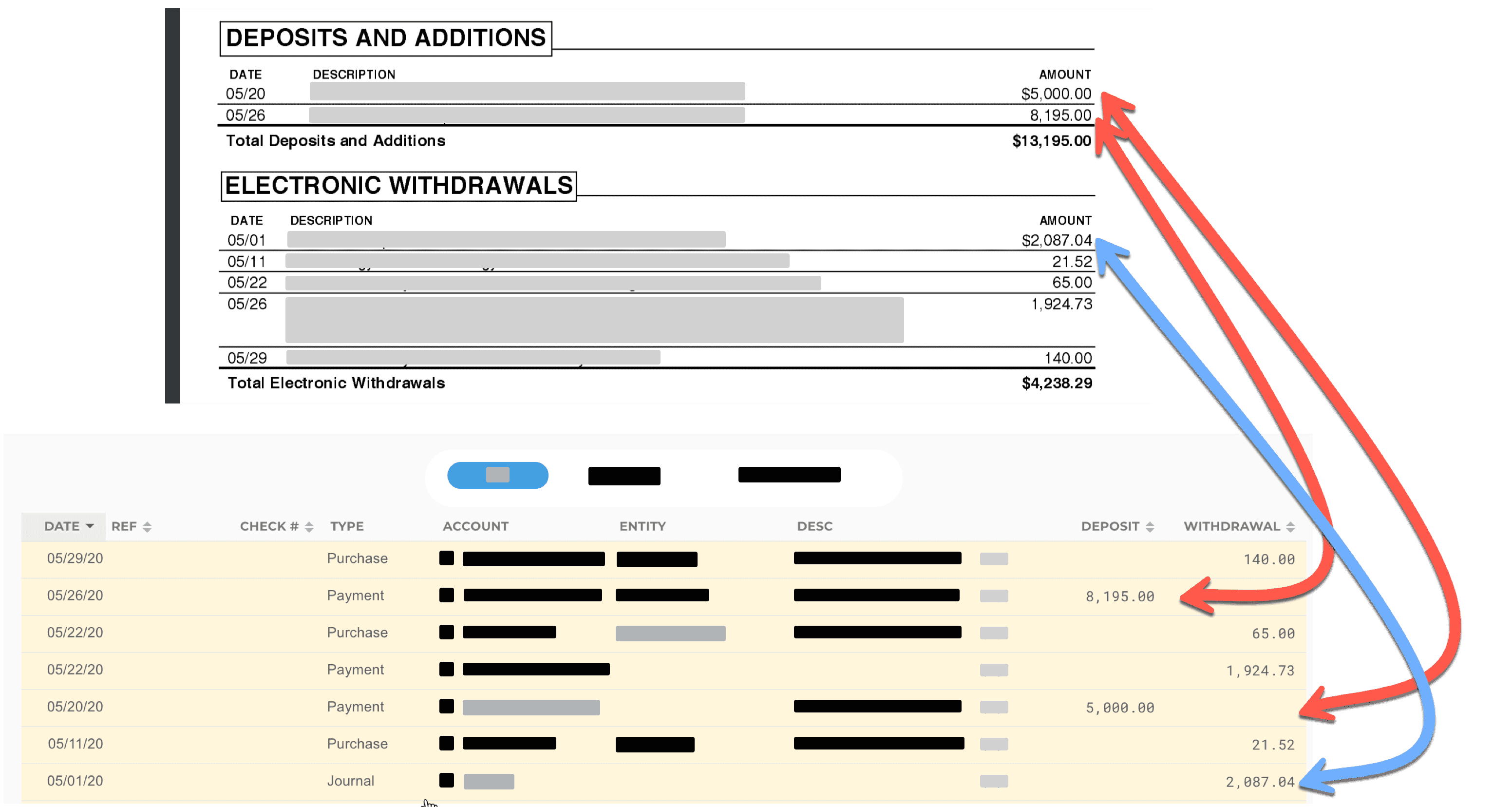

- Your Cleared Payments and Cleared Charges should be equal to the amounts as your bank statement when you're done (see above screenshot for "Payments/Other Credits" and "Transactions"). This is also useful to identify which category you're having problems in. For example, if your Cleared Payments are the same and the Cleared Charges are different, then you know to look at Charges for the difference issue.

- The Change on the left should be equal to the Cleared on the right. This is what the Difference is calculated from.

- The Uncleared amounts on the bottom will not show up on your statement. These are transactions in accounting that haven't hit your bank yet.

Steps to reconcile

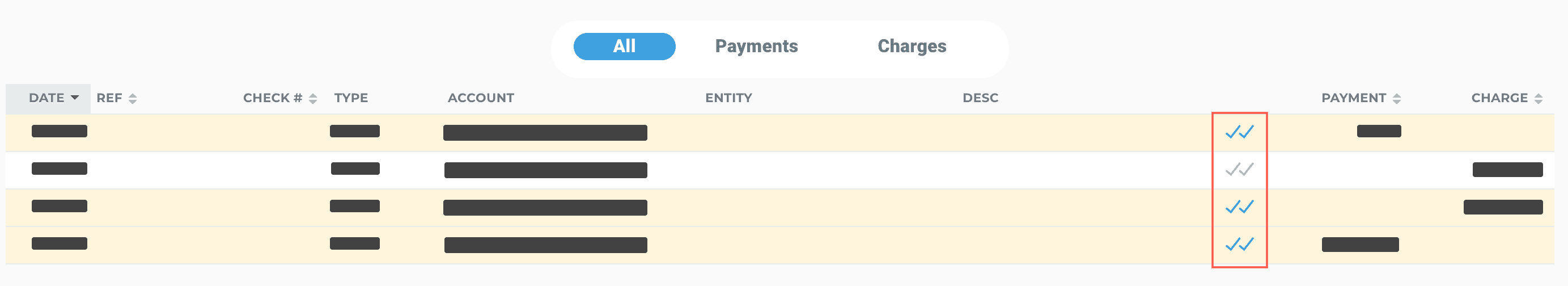

On your bank statement, go through each transaction one-by-one and find the transaction in the reconciliation list. Once you've found it, click the checkboxes to reconcile it.

If there's a transaction on your bank statement that's not in accounting, you need to go add the transaction into accounting, then come back and reconcile it.

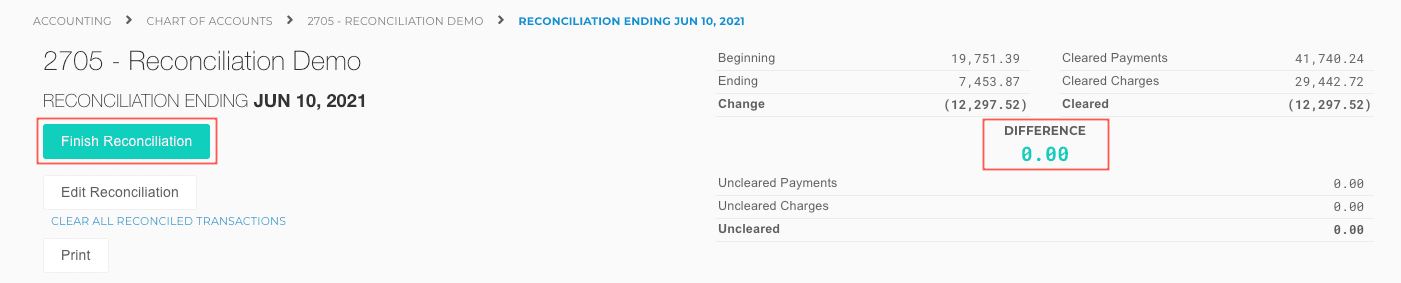

Finishing Reconciliation

Once you're done reconciling and your Difference is $0.00, you can finish the reconciliation and lock it.

Your first reconciliation will include an opening balance that has to be reconciled. This is because there was no previous reconciliation for previous periods, so it's essential that you reconcile that opening balance.

The beginning balance on the reconciliation summary will also be $0.00 for the first reconciliation for the same reasons.