Deposits

Deposits are about making sure that money you received, like from a Receivable, actually makes it into the bank.

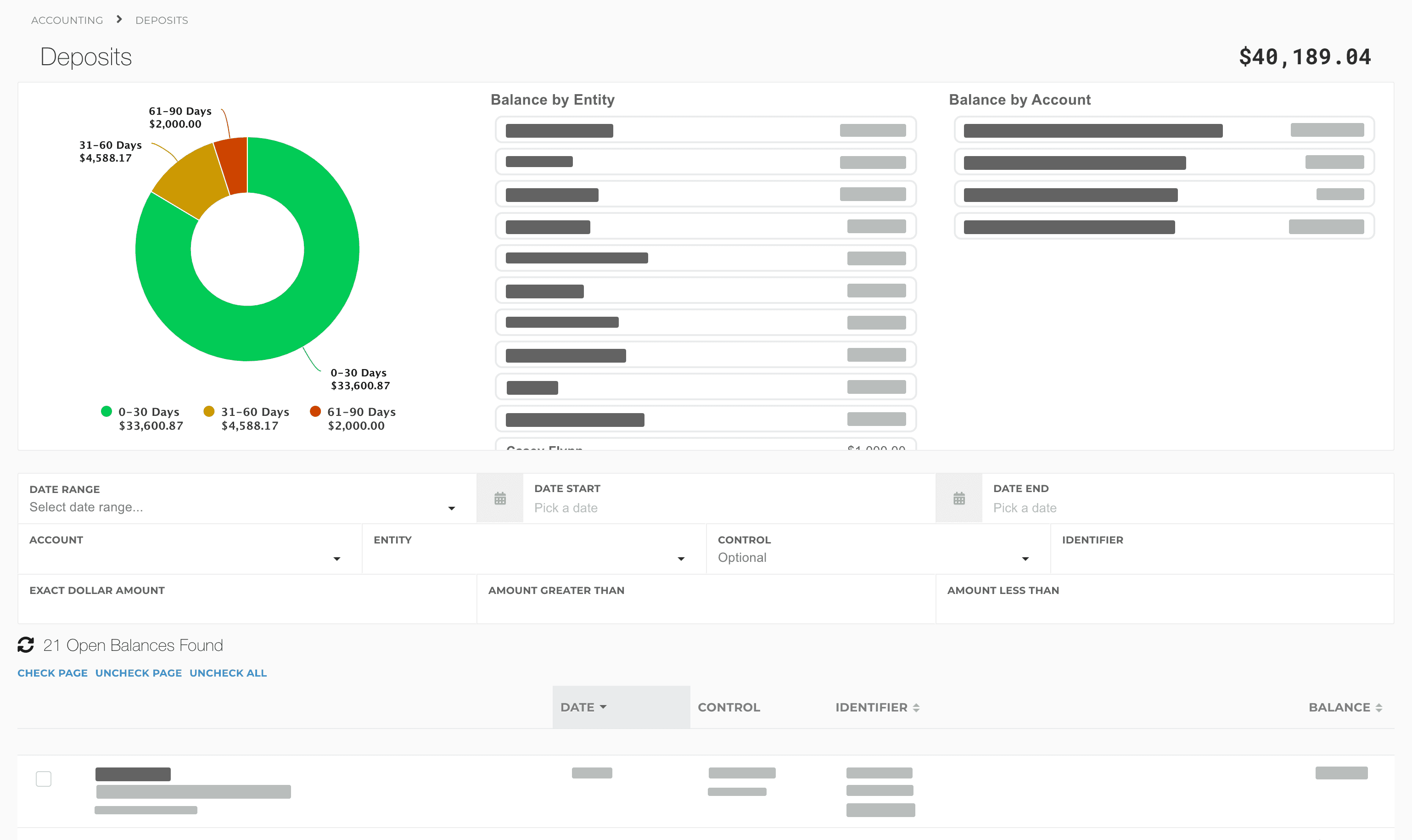

Dashboard

The Dashboard gives you a quick view of what is in Undeposited Funds and allows you to deposit them quickly.

Filtering

- Balance by Age - The pie chart shows the aging of your Undeposited Funds amounts, and you can click on each slice to filter down to just those Undeposited Funds.

- Balance by Entity - The entity column shows you who you've received money from that hasn't been deposited, and clicking an entity quickly filters to just their Undeposited Funds.

- Balance by Account - The account column shows Undeposited Funds balances in each of your accounts, and clicking an account will show you all Undeposited Funds in that category.

All of your Undeposited Funds should be deposited within 1-2 weeks of receiving them. If done properly, this means that you should never have red/old undeposited funds in your pie chart.

Depositing from Accounting

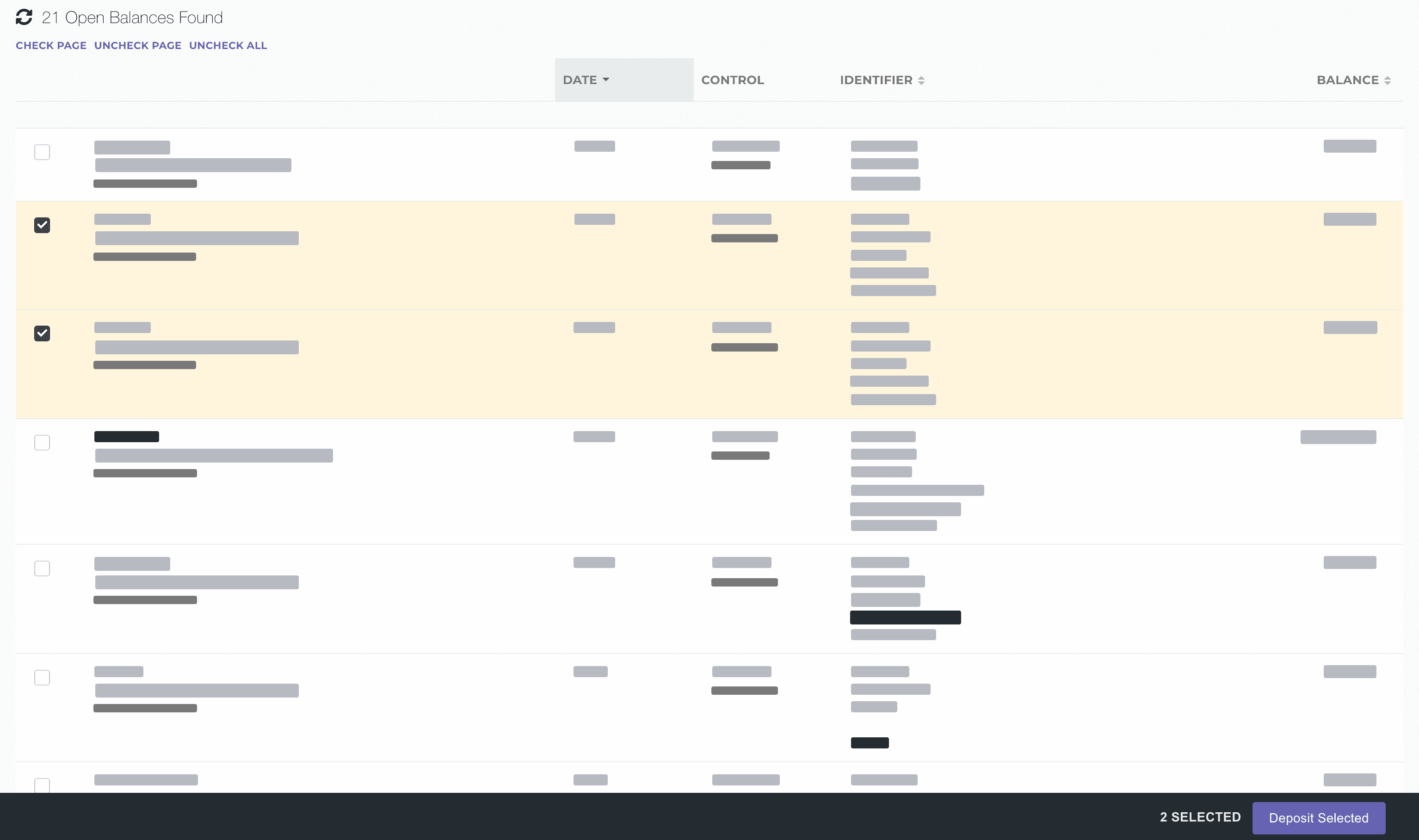

From the Dashboard

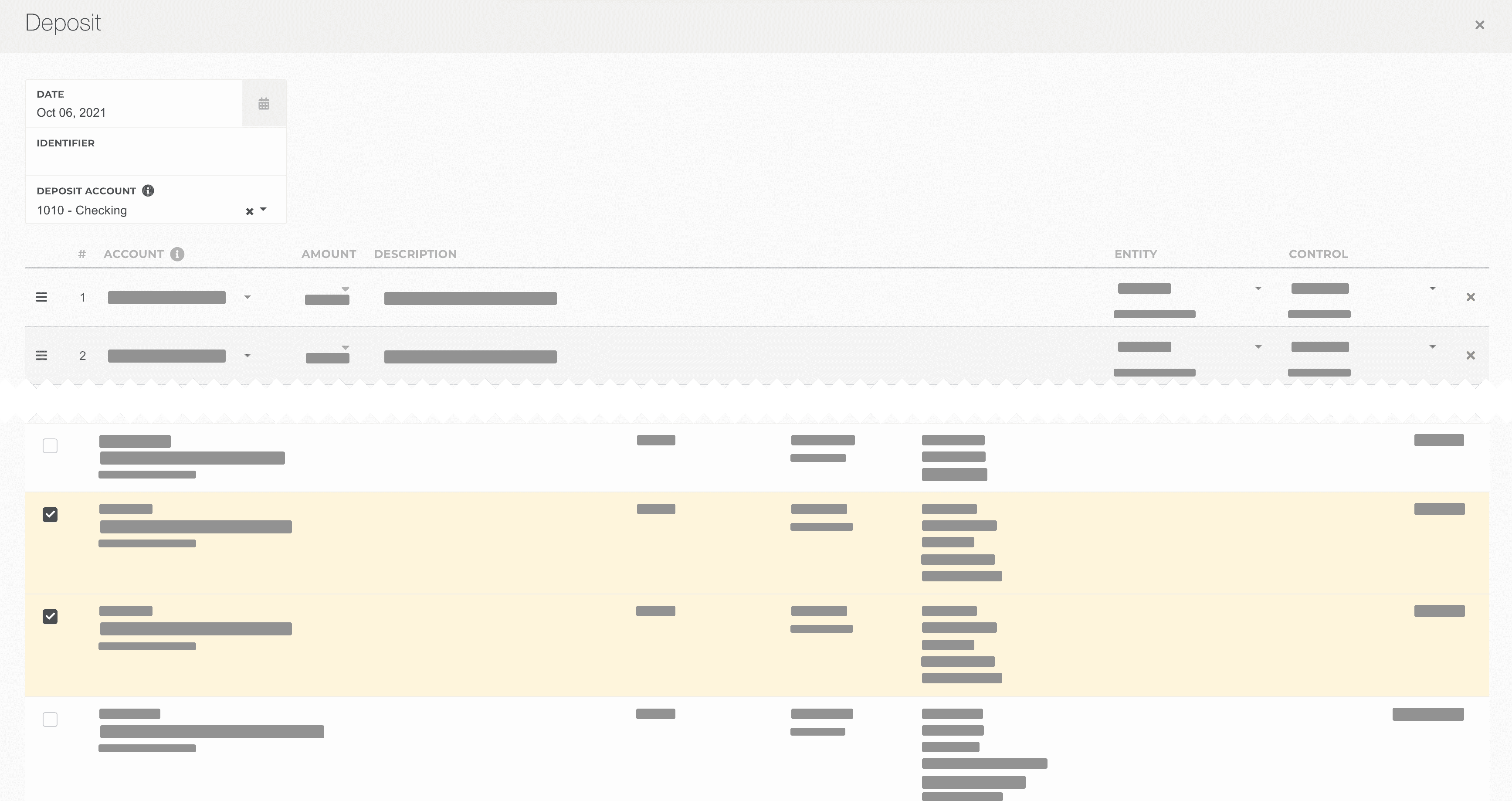

You can make deposits via the Dashboard by checking off the items on the left-hand side you want to deposit and then clicking Deposit Selected.

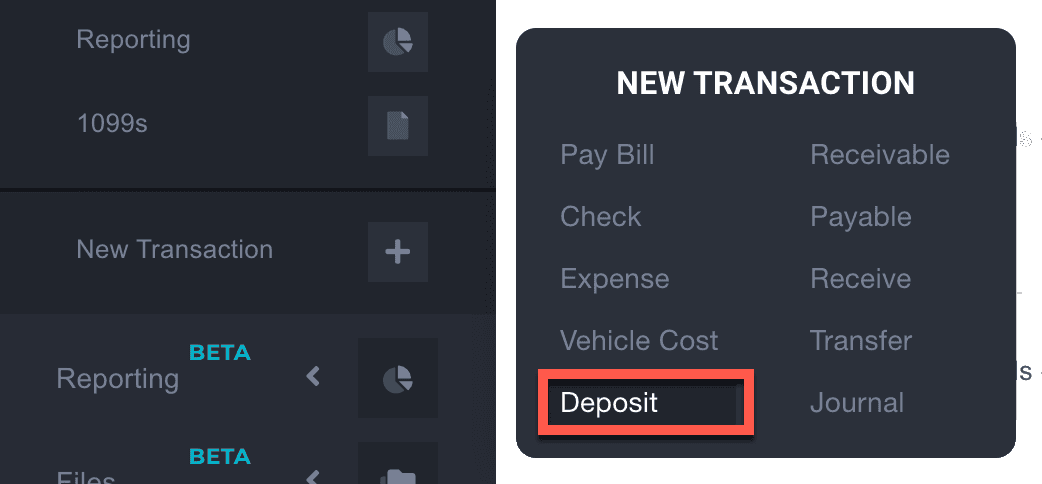

New Transaction

If you go to New Transaction > Deposit you can check the items you want to deposit in the open transactions section.

Depositing from Items

Deposits are usually recorded from the Dashboard because you often have multiple payments needing to be deposited together; however, you can also deposit from an Item's Accounting Panel if you only have one payment to deposit.

Undeposited Funds

Undeposited Funds refers to money (funds) that haven't been deposited yet. Money stays in this account until the physical hand-off to the bank to ensure that all the money makes it to the bank.

Example

Let's say you receive a physical check from a customer. At this point, the customer doesn't actually owe you money because they already paid it. You'd record a payment from that customer for the amount of the check. But, that check isn't actually in my bank yet. Right now, it's sitting on my desk waiting for me to take it to the bank. This is considered Undeposited Funds.

By auditing Undeposited Funds on a regular basis, we can ensure that we're not losing money by not getting it deposited. It's a safeguard.

It also has the benefit of allowing you to combine payments from multiple parties into one deposit, which is what your bank might do when depositing money. If you receive 2 checks, each from a different customer, and deposit them together, then the total deposit amount will be the amount of the two checks. In order to record this, we'd need to record the deposit of both of them together.

Bypassing Undeposited Funds

There are a couple of instances in which you might want to skip undeposited funds:

- Wire Transfer

- ACH Payments

- Funding from a bank

In this case, you have two ways to record a deposit directly into your bank.

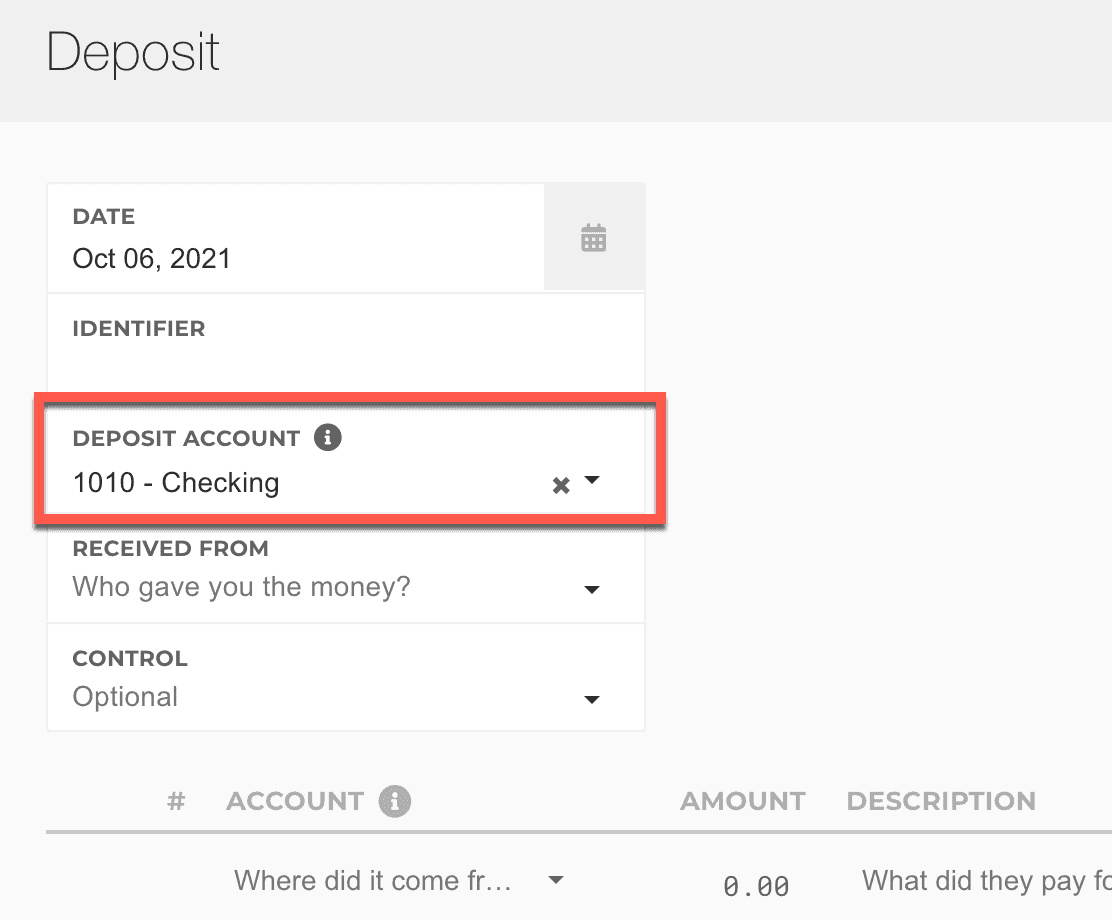

From Accounting Deposit

When recording a deposit in accounting, either from the Dashboard or the New Transaction option, you can change the Deposit Account dropdown and select the account you want to deposit directly into, such as your checking account.

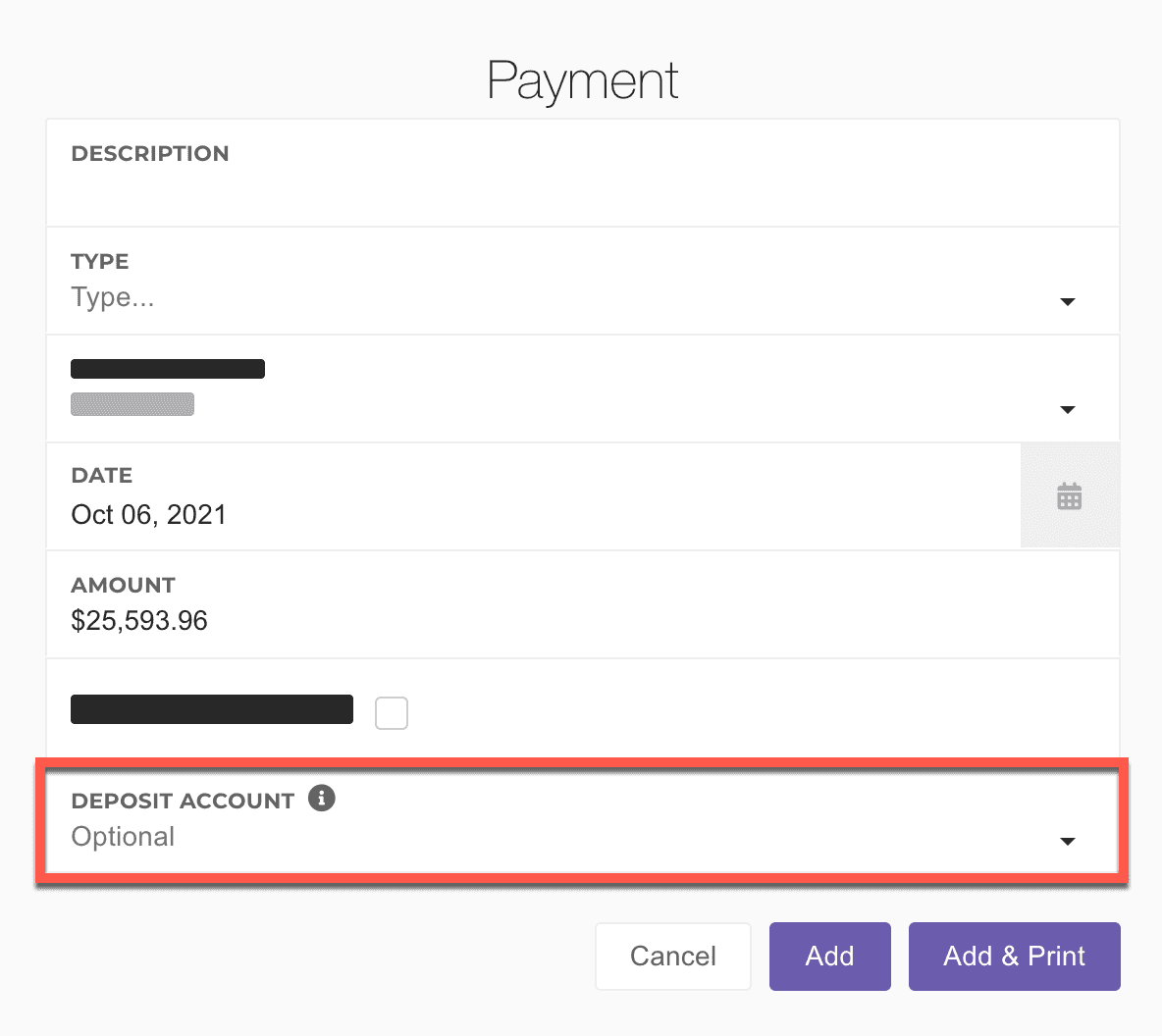

From the Item Payment

When adding a payment on a deal, service ticket, or loan, you can modify the Deposit Account near the bottom of the dialog and select the account you want to deposit directly into, such as your checking account.