Banking

Banking generically refers to ensuring that all the transactions from your bank are in dealr.cloud and vice versa. The operations used to support this are Bank Feeds and Reconciliations.

Reconciliation

Reconciliations are an essential part of the Banking process with accounting. It verifies that all the transactions in your bank also reflect in your accounting system in order to ensure that your balance sheet and profit & loss are accurate.

Bank Feed

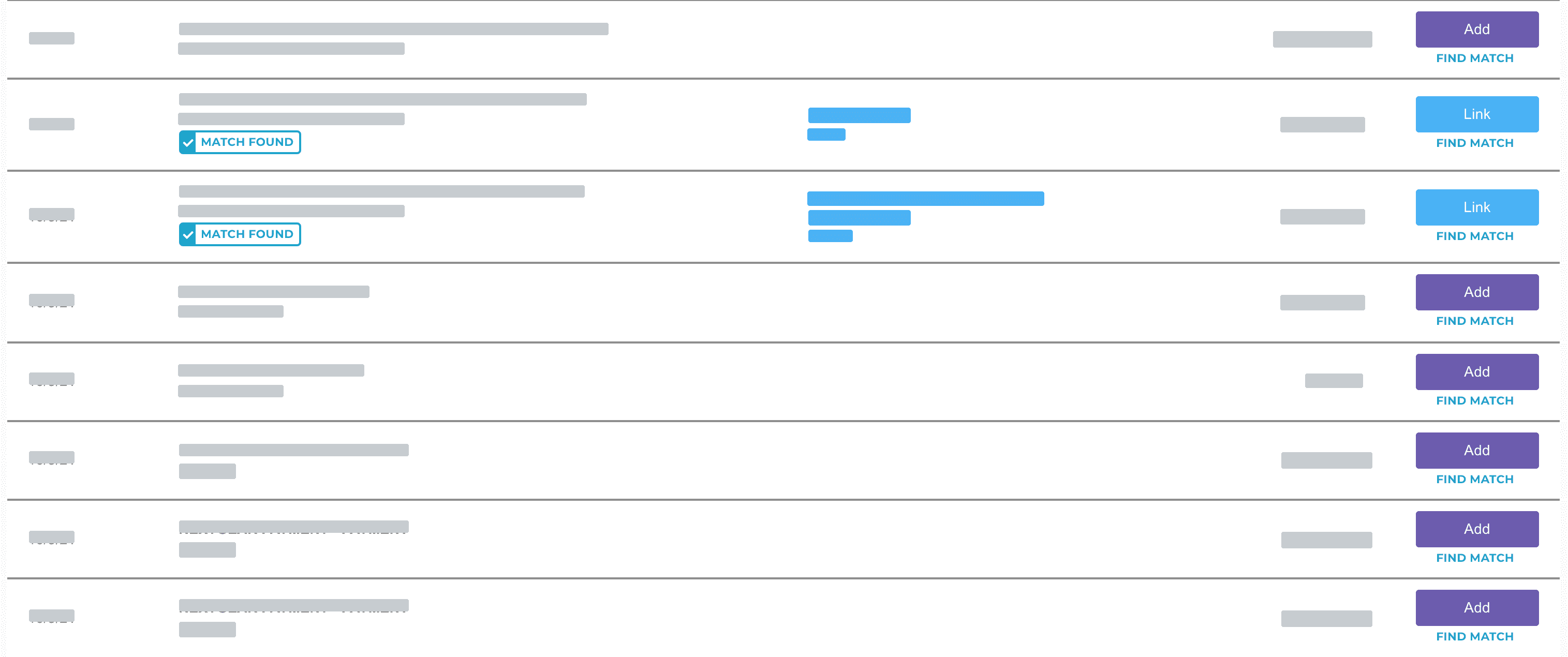

The Bank Feed provides an interface for you to look at a list of transactions retrieved from your bank and compare it to the transactions in accounting. Then, the accounting system automatically detects transactions with similar dates and amounts and allows you to quickly categorize all the bank transactions.

The bank feed provides 5 options to get transactions into the system:

- Link

- Pay

- Receive

- Deposit

- Add

Link

The Link functionality searches for transactions with the same amount and a similar date in the same account you're working in. This is useful for transactions you've already recorded against your accounting system, like a deposit you made or a check you've printed, as we're essentially "confirming" that the transaction is in dealr.cloud and in my bank. This confirmation process is known as "Linking." This option doesn't actually change any accounting system information; it simply links it.

Link options will be found under the following conditions:

- Amounts are equal (down to the penny).

- Accounting Transaction date is within 28 days before or 7 days after the Bank Transaction date.

Example

| Bank Transaction | Accounting Transaction | Button |

|---|---|---|

| 10/15/21 Check for $1,503.21 1010 - Checking | 10/5/21 Withdrawal of $1,503.21 1010 - Checking | Link |

| 11/15/21 Check for $605.00 1010 - Checking | 10/5/21 Withdrawal of $605.00 1010 - Checking | Add |

Pay, Receive, Deposit

The Pay, Receive, and Deposit functionalities searches for open balances with the same amount and a similar date in their respective account types. This is useful for transactions you haven't yet recorded payments or deposits for in your accounting system. This functionality will actually create a transaction in the accounting system, clear the open balance, and also link to the new transaction.

Link options will be found under the following conditions:

- Amounts are equal (down to the penny)

- Specifically referencing the open balance; previous payments or deposits on the transaction will change the open balance and the bank feed will match against the open balance.

- Accounting Transaction date is within 28 days before or 7 days after the Bank Transaction date.

- Accounting Balance is in a Payable, Receivable, or Undeposited Funds account.

| Bank Transaction | Accounting Transaction | Button |

|---|---|---|

| 10/15/21 Check for $25,650.00 1010 - Checking | 10/5/21 Vehicle Purchase for $25,650.00 2000 - Vehicle Inventory Payable | Pay |

| 10/11/21 Deposit of $11,500.00 1010 - Checking | 10/10/21 Financed Amount for $11,500.00 1105 - Finance Contracts Receivable | Receive |

| 10/15/21 Deposit of $1,000.00 1010 - Checking | 10/11/21 Cash Down for $1,000.00 1050 - Undeposited Funds - Vehicle Sales | Deposit |

Add

The Add functionality is used when an option for Linking, Paying, Receiving, or Depositing is unavailable. You can also override the suggested choice to Link, Pay, Receive, or Deposit if the suggested match is incorrect.

This option is useful if the transaction from the bank feed is not in your accounting system yet. This happens quite regularly for transactions which aren't recorded against a deal or inventory, and which you may not have added into accounting yet. For example:

- Rent

- Gas

- Restaurants

- Monthly subscriptions

The Adding button makes it easy to get these transactions into the system and categorized quickly! If you're unsure where to categorize a transaction, check out this page for suggestions.

It's very important that you don't Add any transactions that will later be put into the system elsewhere. For example, don't Add a cost on a vehicle and then go to create the cost on the inventory. This will cause duplicates in the system.

The safe rule of thumb here:

If a transaction is not associated with a specific ticket, vehicle, customer, deal, or loan then you can click the purple Add button. Otherwise, go into the specific ticket, vehicle, customer, deal, or loan to record the transaction first and come back to Link it.

Find Match

The last way to use the bank feed is the Find Match feature, which allows you to find transactions outside the normal search parameters for Link, Pay, Receive, and Deposit.

This presents you with a dialog similar to if you were Paying Bills or Receiving.

Bank Transaction Groups

The Bank Transaction Groups section will search for groups of transactions that match the amount from the bank feed. It also extends the timeframe for Linking, Paying, Receiving, and Depositing matches:

- Accounting Transaction date is within 180 days before or 90 days after the Bank Transaction date.

Let's say you bought 3 vehicles from an auction and added a cost for each to the inventory, but the auction performed an ACH for the total of all three transactions. So long as the Payables match the date parameters above, and the sum of the three amounts is exactly equal to the bank transaction amount, then a group should be shown for you to Pay all three of them simultaneously.

| Bank Transaction | Accounting Transaction | Button |

|---|---|---|

| 10/7/21 ACH Withdrawal for $75,650.00 1010 - Checking | 10/5/21 Vehicle Purchase for $15,300.00 2000 - Vehicle Inventory Payable 10/5/21 Vehicle Purchase for $35,000.00 2000 - Vehicle Inventory Payable 10/5/21 Vehicle Purchase for $25,350.00 2000 - Vehicle Inventory Payable | Pay |

The Bank Transaction Groups list will only find up to 10 groups, and only a maximum of 4 items can be found in each group. That means that if you had purchased 5 vehicles, you'd have to select the 5 payables manually as described in the Open Balances section below.

It's also work noting that some found groups may not make any sense at all with combinations of completely unrelated transactions to match the bank transaction amount. This is expected, as the coin matching algorithm we use doesn't look at the contents of the transactions, only the totals.

Open Balances

Similarly to when you Pay Bills or Receive payments, you can go to the Open Transactions section of the Find Match dialog and manually select multiple balances that should be paid/received/deposited using the bank transaction amount.

Split Transactions

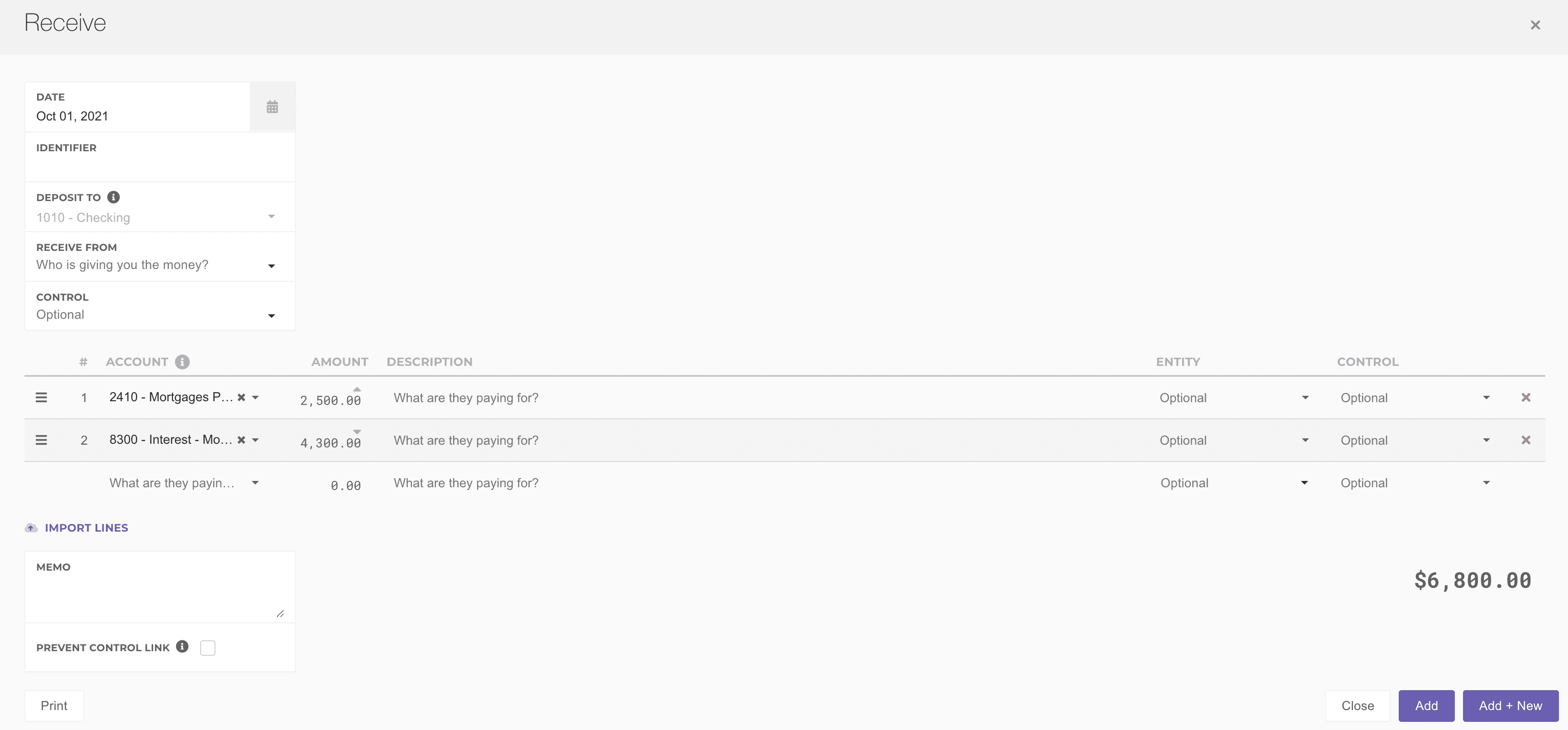

You can also use Find Match to split transactions between accounts.

For example, let's say you have a mortgage payment that is $6,800. $2,500 is principal and $4,300 is interest. We need to split this transaction into two accounts (one expense account, one long term liability account), but the bank transaction is for a single amount. When we click Find Match, we can add two lines and create a new transaction that splits the amounts out over multiple accounts!

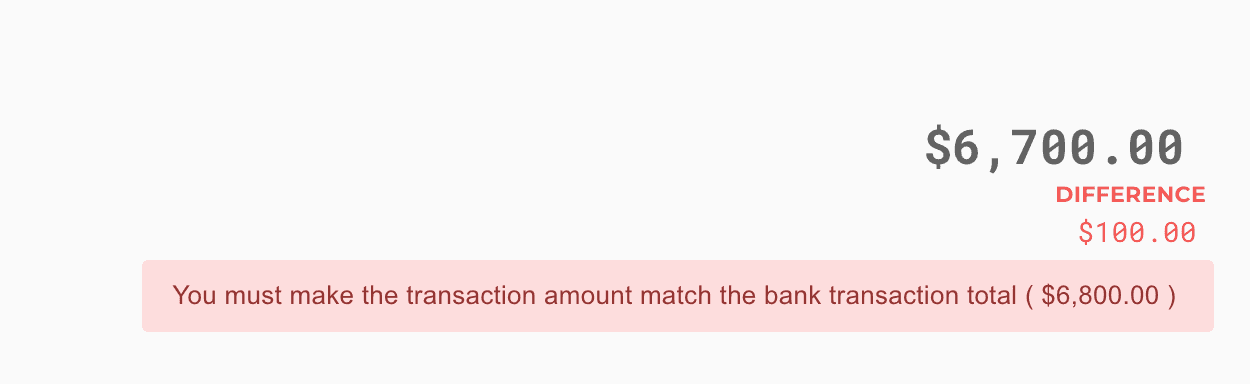

If your added lines don't equal the exact amount from the bank feed, a warning will be shown, and you'll need to make the amounts match before being allowed to Add the transaction.